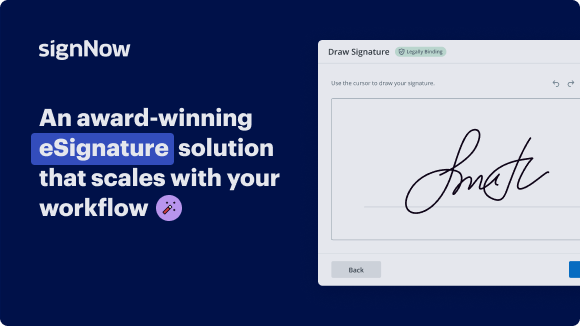

Add Cosigner Signed with airSlate SignNow

Improve your document workflow with airSlate SignNow

Versatile eSignature workflows

Fast visibility into document status

Simple and fast integration set up

Add cosigner signed on any device

Detailed Audit Trail

Rigorous protection requirements

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — add cosigner signed

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. add cosigner signed in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to add cosigner signed:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to add cosigner signed. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a solution that brings everything together in one unified enviroment, is what enterprises need to keep workflows functioning smoothly. The airSlate SignNow REST API allows you to integrate eSignatures into your application, website, CRM or cloud storage. Check out airSlate SignNow and get faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

Get legally-binding signatures now!

What active users are saying — add cosigner signed

Related searches to add cosigner signed with airSlate SignNow

Add initials cosigner

[Music] hey guys thank you so much for watching this video please give us a call if you guys are looking to improve your credit score lower your car payment buy a car trade in a car if you're looking to purchase your first home if you're looking to purchase of rental property we can help you give us a call today eight seven seven two zero five seven seven seven one talk to you guys soon and thanks again hello everyone this is Calvin Russell CEO and founder a 50 club credit consultation hope everyone's doing well today today we're gonna talk about should you or should you not co-sign for your kids to have a credit card alright so for those who don't know Oh President Obama well former President Obama put together this was the credit card Act of 2009 and the whole purpose of the credit card Act of 2009 was to keep people from ages of 18 to 21 pretty much of you were underage well now of course underage at that at that point in time it wasn't a big deal up until the credit card Act of 2009 you could get a credit card between ages 18 and 21 without a job without income without a cosigner like that's just how it was you were 18 you instantly got a credit card okay and if you ask me the I would say that the I would say that the restrictions are still not extremely tough but again at that time we were coming out of a right after a recession and of course they felt like a good percentage of that debt was by you know young people who couldn't pay it back it wasn't likely that lost their homes and stuff like that because they lost their job these were people who had access to lines of credit and of course the bank's just easily gave it to him and this was and I was actually a part of that group at the time that the Act came out and 2009 after I just made by 21 and 20 something like that and long story short I had a credit card I remember that I remember when the banks when you would go to a college campus the banks would already have tables set up and all they basically give you t-shirts you know if you get a credit card now they don't do that anymore you know because again because their new act I say that to say now if your child wants a credit card without having a job they must get a cosigner so this is my take on I'm gonna give you the pros and cons number one the pros are gonna be if you allow your child to have a credit card of course if you cosign form you have to co-sign for them to get a credit card if they don't have some form of income okay now there is a that's where a great area is because a person can easily say that they got a job but then of course if the bank doesn't verify whose fault is that right the bank knows what they're doing when they're not verifying they would rather not know okay so either way I say that to say if you do find yourself in a situation where you put know the truth on the application and then you find out they need a cosigner would you cosign for them here's the deal they don't really need to have a cosigner per se because if you add them on your account as an authorized user when they're 18 the nikah it's easier for them to build credit that way that way you know that you can still teach them about credit they have access to your account and you show them how to you know how to use the card and you know things that sort the only difference is they wouldn't get the bill okay so at some point I do think as parents we must be responsible and show our kids how credit works because they're going to want things that that you're not going to pay cash for don't get me wrong I know this for the cash people come out and always say well you know what if you don't have the cash boys you know you shouldn't you probably shouldn't buy it well yeah I mean that's neat that's if that's your personal opinion but my point is is that you're gonna get your child is most definitely to get credit card offers you can't stop credit card offers I mean well technically you can but that's only for like five to seven years and before it starts back up again so my point is is that it's okay for children to learn not children for teenagers and at this point young adults to learn about credit they need to learn about it right away because these banks are most definitely know jump in and it's only so long before I mean how long even expect these kids are be inside the nest you gotta let them grow and it's up to you as a parent to teach them that so if you want to avoid co-signing for them and the motors authorized use when they're 18 show them about credit help them build it show them how to use it showing how they know do certain things I would go ahead and let them get their own credit card I will cosign for that sure that way I can make sure that they're trained and know and then know how to actually use that but again my son will have income coming in he's not just I'm not gonna go into that but again I work through college I didn't finish college but again how to work through college wasn't a big deal you know so I say that's the same if it's just a matter of having proof of income or source income it's not gonna be that big of a deal so but if you if you want to co-sign for them go right ahead just make sure that you teach them how to use it if you don't co-sign for them and say you know what I'm just let them be on their own that's what you don't want to do because they're gonna get offers they're gonna want to buy a better car they're gonna want to buy a home and here's the thing especially if you're setting them off to college you're already starting them off with 50 to 100 thousand on so it's to loan that they need to have a plan and if they don't have credit and they got dead it's gonna even be worse and they're gonna blame you as a parent okay so you don't wanna do that you got okay we got to step up we have to be responsible about this I'm telling you there are a lot of people that understand this and they teach their kids right away you've got to be on top of it because you're either gonna pay now or you're going to pay later all right if you like this video like it if you want to share it share it and as always be sure to subscribe as we got more like a lot more content on the way and we're gonna talk about more stuff about anytime you have to deal with like you know family credit and stuff like things I think is a very touchy situations they lap you don't necessary want to talk about but we gotta talk about it we gotta address it okay you [Music]

Show more