Decline Inheritor Initial with airSlate SignNow

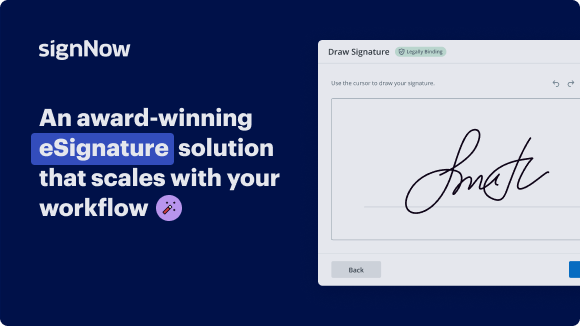

Upgrade your document workflow with airSlate SignNow

Versatile eSignature workflows

Fast visibility into document status

Easy and fast integration set up

Decline inheritor initial on any device

Detailed Audit Trail

Rigorous protection standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — decline inheritor initial

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. decline inheritor initial in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to decline inheritor initial:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to decline inheritor initial. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a solution that brings everything together in one unified enviroment, is what organizations need to keep workflows performing smoothly. The airSlate SignNow REST API enables you to integrate eSignatures into your app, internet site, CRM or cloud storage. Try out airSlate SignNow and enjoy faster, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

Get legally-binding signatures now!

FAQs

-

How do I change my signature on airSlate SignNow?

Close deals in Google Chrome: Once you download the airSlate SignNow add-on, click on the icon in the upper menu. Upload a document you want to eSign. It'll open in the online editor. Select My Signature. Generate a signature and click Done. After you can you change your signature anytime save the executed doc to your device. -

What is airSlate SignNow used for?

airSlate SignNow empowers organizations to speed up document processes, reduce errors, and improve collaboration. Embed eSignatures into your document workflows. Get 250 free signature invites. Build, test, and launch your integrations in minutes instead of weeks. -

How do I cancel my airSlate SignNow subscription on my Iphone?

How do I cancel my iOS subscription? Go to AppStore on your device, and tap on your profile icon. Scroll down and tap Subscriptions. Choose your airSlate SignNow subscription. ... Tap Cancel subscription and follow the instructions to confirm the cancellation. Confirm the subscription cancellation. -

How do you delete airSlate SignNow?

Click on your profile photo in the top right corner and select My Account from the dropdown menu. Go to the Settings section and click delete your account. Then, you'll be asked to contact support@signnow.com to confirm your account deletion. -

Is airSlate SignNow safe to use?

Are airSlate SignNow eSignatures secure? Absolutely! airSlate SignNow operates ing to SOC 2 Type II certification, which guarantees compliance with industry standards for continuity, protection, availability, and system confidentiality. The electronic signature service is secure, with safe storage and access for all industries. -

Is airSlate SignNow legally binding?

airSlate SignNow documents are also legally binding and exceed the security and authentication requirement of ESIGN. Our eSignature solution is safe and dependable for any industry, and we promise that your documents will be kept safe and secure.

What active users are saying — decline inheritor initial

Related searches to decline inheritor initial with airSlate SignNow

Decline inheritor initial

hi everyone today i want to talk to you about whether or not you can refuse an inheritance so why would anyone want to refuse an inheritance you might be thinking although it's surprising to many there's several circumstances when declining an inheritance can be beneficial the law does permit you to refuse an inheritance if you comply with certain strict requirements the legal term for a refusal of an inheritance is a disclaimer which is defined as an irrevocable and unqualified refusal to accept an interest in the property let's talk about when disclaiming an inheritance may be beneficial the first reason would be to avoid or reduce the estate or gift or income taxes in 2020 the federal estate tax exclusion was over 11 million dollars for an individual in over 22 million for a married couple this means that only estates that exceed this amount would be subject to that estate tax but most people do don't have such a sizable estate so using a disclaimer to avoid federal estate taxes is less common now than it was in the past and who knows if that those numbers will change as they do change frequently and they're set to come back down again however in some states like in massachusetts there's an estate tax that has a left much lower value and that's if an estate goes over a million dollars so if your estate will be subject to those taxes disclaiming an inheritance may make sense if the next beneficiary in line as named in the will or under state law is taxed at a lower rate than you in addition a disclaimer provides a way for you to provide a gift to the next beneficiary in line without having to worry about the gift tax if you decide to disclaim an inheritance for tax purposes it is considered to have never belonged to you obviously you could not make a gift of something that was never yours as a result it does not count towards your annual gift tax exclusion of over fifteen thousand dollars for an individual or thirty thousand for a married couple or your lifetime exclusion amount of eleven over eleven million dollars for an individual if your inheritance is an asset that produces income such as an ira it will likely shift you into a higher tax bracket a disclaimer may be beneficial if you don't need that extra income of course the next beneficiary in line will also benefit especially if that person is in a lower tax bracket another example of where disclaiming an inheritance may be beneficial is about refers to the eligibility for certain benefit programs if you're trying to qualify for certain government benefits at some point in the future and the inheritance would jeopardize your eligibility disclaiming the inheritance may enable you to become eligible now there's a little bit of a warning here for some benefit programs an effective disclaimer must occur several years...

Show more