Vt Renters Rebate Form 2007-2026

What is the Vermont Renters Rebate Form?

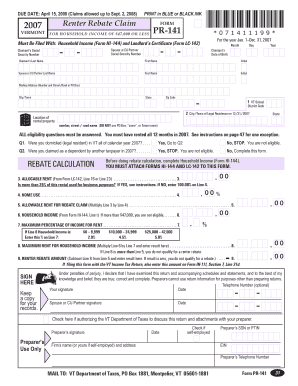

The Vermont Renters Rebate Form is a document designed for eligible renters in Vermont to claim a rebate on their rent payments. This form allows tenants to receive financial assistance based on their rental expenses and income levels. The program aims to alleviate some of the financial burdens faced by renters, particularly those with lower incomes. By filling out this form, renters can potentially receive a refund that helps offset their housing costs.

Eligibility Criteria for the Vermont Renters Rebate

To qualify for the Vermont Renters Rebate, applicants must meet specific criteria. Generally, eligibility is determined by the following factors:

- Residency in Vermont for the entire tax year.

- Rental payments made during the year must exceed a certain threshold.

- Income must fall below a specified limit, which varies based on household size.

It is essential for applicants to review the most current eligibility requirements to ensure they meet all conditions before submitting their forms.

Steps to Complete the Vermont Renters Rebate Form

Completing the Vermont Renters Rebate Form involves several steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary documentation, including proof of income and rental agreements.

- Obtain the Vermont Renters Rebate Form from the official state website or local tax office.

- Fill out the form carefully, providing all required information, such as personal details and rental expenses.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online, by mail, or in person.

Required Documents for the Vermont Renters Rebate Form

When completing the Vermont Renters Rebate Form, applicants must include specific documents to support their claims. Commonly required documents include:

- Proof of rental payments, such as receipts or bank statements.

- Income verification documents, like pay stubs or tax returns.

- Identification, such as a driver's license or state ID.

Having these documents ready can help streamline the application process and ensure that all necessary information is provided.

Form Submission Methods

The Vermont Renters Rebate Form can be submitted through various methods to accommodate different preferences. Renters may choose to:

- Submit the form online through the state’s official website.

- Mail the completed form to the designated tax office.

- Deliver the form in person to a local tax office for immediate processing.

Each submission method has its own timeline for processing, so renters should choose the option that best fits their needs.

Legal Use of the Vermont Renters Rebate Form

The Vermont Renters Rebate Form serves as a legally binding document when completed and submitted according to state regulations. It is important for renters to understand that providing false information on this form can lead to penalties or disqualification from the program. Ensuring compliance with all legal requirements is crucial for a successful application.

Quick guide on how to complete vt renters rebate form

Complete Vt Renters Rebate Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Vt Renters Rebate Form on any device with airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

The simplest way to modify and electronically sign Vt Renters Rebate Form with ease

- Locate Vt Renters Rebate Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Vt Renters Rebate Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vt renters rebate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont renters rebate?

The Vermont renters rebate is a program designed to reimburse qualifying individuals for a portion of their rent payments. This rebate helps lower-income renters manage their housing costs, providing financial relief. To qualify, applicants must meet specific income criteria and provide necessary documentation of their rental expenses.

-

How do I apply for the Vermont renters rebate?

To apply for the Vermont renters rebate, you need to complete the necessary application forms, which can typically be obtained from the Vermont Department of Taxes website. Ensure you have your rental agreements and income statements ready to support your application. Submitting your application before the deadline is crucial to securing your rebate.

-

What are the eligibility requirements for the Vermont renters rebate?

Eligibility for the Vermont renters rebate generally requires that you are a renter in Vermont and meet certain income thresholds. Additionally, you must have paid rent during the year for which you are applying. It’s vital to review the specific guidelines provided by the Vermont Department of Taxes to ensure you qualify.

-

How much can I expect to receive from the Vermont renters rebate?

The amount of the Vermont renters rebate varies based on your income and the amount of rent you paid. Typically, renters can receive refunds ranging from a few hundred dollars to over a thousand dollars. For an accurate estimate, consult the Vermont Department of Taxes' guidelines regarding the rebate calculations.

-

When will I receive my Vermont renters rebate?

Once your application for the Vermont renters rebate is processed, you can expect to receive your rebate within a few weeks to a couple of months. The speed of processing depends on the volume of applications and the accuracy of your submission. Always check your application status on the Vermont Department of Taxes website for updates.

-

Can I receive the Vermont renters rebate if I'm on a fixed income?

Yes, individuals on a fixed income can qualify for the Vermont renters rebate, provided they meet the income eligibility criteria set by the state. This rebate is particularly beneficial for seniors and disabled renters who may be managing a limited income. It’s important to supply accurate financial documentation when applying.

-

What documents do I need to apply for the Vermont renters rebate?

When applying for the Vermont renters rebate, you'll need to gather various documents, including proof of income, rental agreements, and any receipts or statements indicating the rent you've paid. Ensure your documentation aligns with the requirements specified by the Vermont Department of Taxes to avoid processing delays.

Get more for Vt Renters Rebate Form

- 6250 ridgewood road st cloud mn 56303 dear gettington com gettington ion edgekey form

- Account closing request form legends bank

- Tdmh fiscal services form

- Orthodontic new patient intake sample script solutions for the form

- Wire transfer instructions template form

- Christian character reference seuedu form

- Daas 101 long form

- Form ad 1052

Find out other Vt Renters Rebate Form

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself