Dor Gtc Form

What is the Dor Gtc

The Dor Gtc, or Georgia Department of Revenue's Georgia Tax Center, is an online platform designed to facilitate tax management for individuals and businesses in Georgia. It serves as a centralized hub for accessing various tax-related services, including filing returns, making payments, and checking the status of tax accounts. The platform simplifies the process of managing state tax obligations, offering users a streamlined approach to compliance.

How to use the Dor Gtc

To use the Dor Gtc effectively, users must first create an account on the Georgia Tax Center website. This involves providing personal information, such as a Social Security number or business identification number, to establish a secure profile. Once registered, users can log in to access a variety of services, including filing state taxes, making payments, and viewing tax history. The user-friendly interface guides individuals through each step, ensuring that all necessary information is submitted accurately.

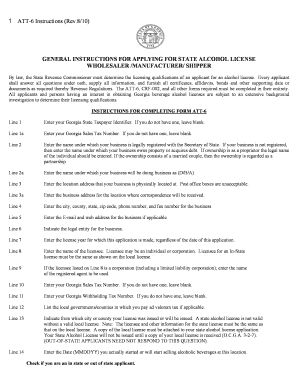

Steps to complete the Dor Gtc

Completing tasks on the Dor Gtc involves several key steps:

- Create an account by entering required personal or business information.

- Log in to the platform using your credentials.

- Select the specific tax service you need, such as filing a return or making a payment.

- Follow the prompts to enter the necessary information, ensuring all fields are completed accurately.

- Review your entries for accuracy before submitting.

- Submit your request and save any confirmation or reference numbers provided.

Required Documents

When using the Dor Gtc, certain documents may be necessary depending on the type of transaction. Commonly required documents include:

- W-2 forms for employees.

- 1099 forms for independent contractors.

- Previous year’s tax returns for reference.

- Business registration documents for businesses.

Having these documents ready can streamline the process and ensure compliance with state regulations.

Legal use of the Dor Gtc

The Dor Gtc is legally recognized as a valid platform for managing state tax obligations. Users must ensure that all information provided is accurate and complete to avoid potential penalties. The platform complies with state regulations governing electronic tax submissions, making it a secure option for fulfilling tax responsibilities. Utilizing the Dor Gtc helps individuals and businesses stay compliant with Georgia tax laws.

Penalties for Non-Compliance

Failure to comply with Georgia tax regulations can result in various penalties. Common consequences include:

- Fines for late filing or payment.

- Interest accrued on unpaid taxes.

- Possible legal action for severe non-compliance.

Staying informed and utilizing the Dor Gtc can help mitigate these risks and ensure timely compliance with tax obligations.

Quick guide on how to complete dor gtc

Effortlessly Prepare Dor Gtc on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Dor Gtc on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Dor Gtc with ease

- Locate Dor Gtc and click on Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose your preferred method for sharing the form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from your chosen device. Modify and eSign Dor Gtc and guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dor gtc

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What are Georgia forms T 22C?

Georgia forms T 22C are specific tax forms required for certain transactions in the state of Georgia. These forms help ensure compliance with state regulations related to tax reporting. Using airSlate SignNow, you can easily fill and eSign Georgia forms T 22C, making the process more efficient.

-

How does airSlate SignNow simplify the completion of Georgia forms T 22C?

airSlate SignNow streamlines the process of completing Georgia forms T 22C by providing an intuitive interface for inputting information. You can quickly upload, edit, and sign documents without the hassle of printing and scanning. This saves time and reduces the chances of errors associated with manual entry.

-

Is there a cost associated with using airSlate SignNow for Georgia forms T 22C?

Yes, airSlate SignNow operates on a subscription model, which is cost-effective for businesses that regularly handle Georgia forms T 22C. The pricing varies based on the features you need, and many users find that the service pays for itself by increasing productivity and reducing paper costs.

-

Can I integrate airSlate SignNow with other software for handling Georgia forms T 22C?

Absolutely! airSlate SignNow offers numerous integrations with popular software tools that enhance document management and eSigning. These integrations facilitate smoother workflows when dealing with Georgia forms T 22C and help maintain a comprehensive digital invoicing and filing system.

-

What security measures does airSlate SignNow use for Georgia forms T 22C?

airSlate SignNow prioritizes the security of documents, including Georgia forms T 22C, by employing advanced encryption protocols and secure cloud storage. This ensures that your sensitive tax information remains confidential and protected from unauthorized access.

-

Can I access Georgia forms T 22C on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully accessible via mobile devices, allowing you to manage Georgia forms T 22C on the go. The mobile app provides all the essential features, enabling you to fill out, sign, and send documents from anywhere with an internet connection.

-

What are the benefits of using airSlate SignNow for Georgia forms T 22C?

Using airSlate SignNow for Georgia forms T 22C offers many benefits, including increased efficiency through easy document management, quicker eSigning processes, and enhanced collaboration. It also reduces the ecological impact of printing and promotes a more organized approach for filing important tax documents.

Get more for Dor Gtc

Find out other Dor Gtc

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now