IRS library

Individual forms

1040 forms

All versions of annual tax return forms and necessary schedules filed by US citizens or residents

Learn more

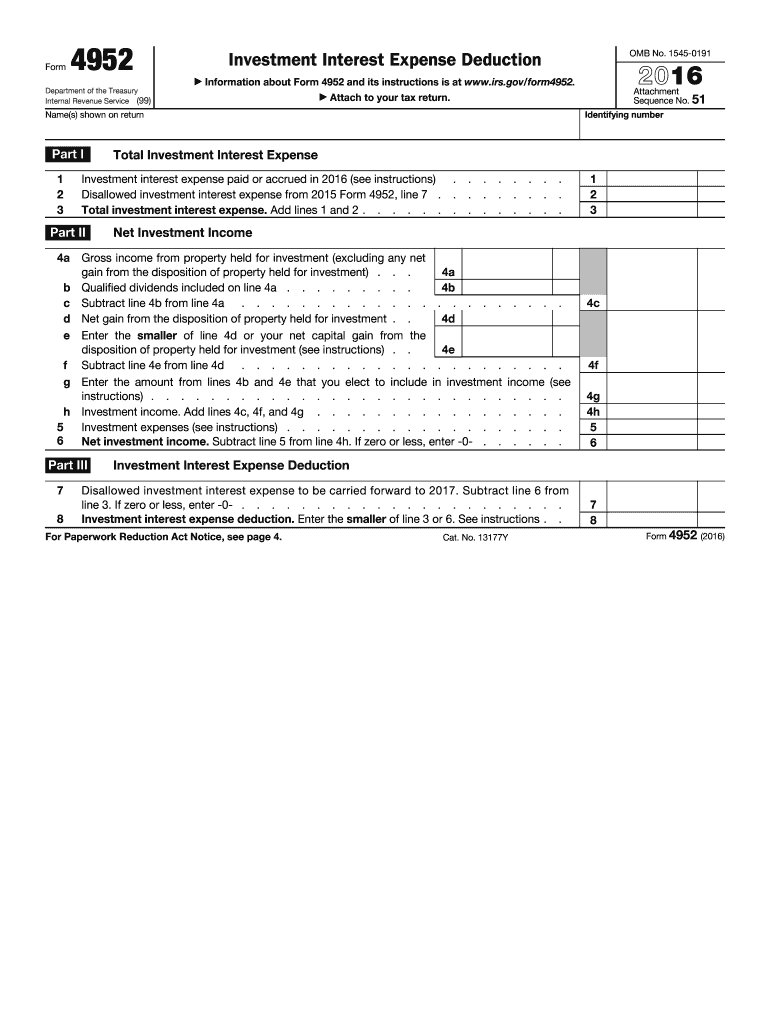

4952 form

The Investment Interest Expense Deduction is used to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years.

Learn more

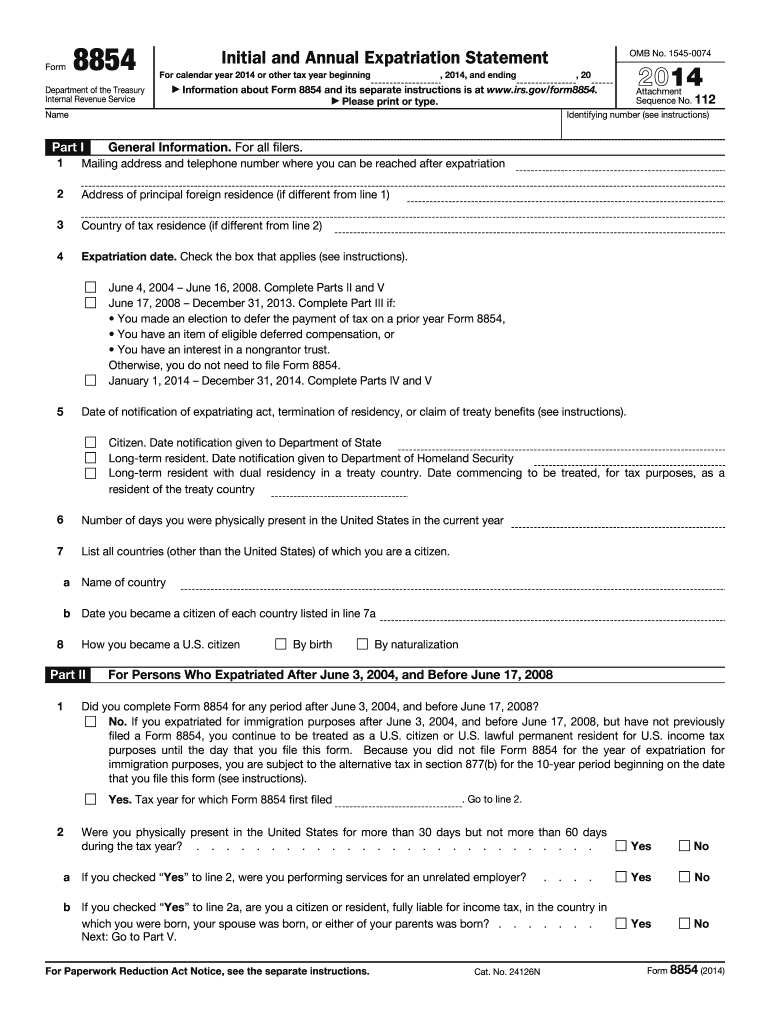

8854 form

Initial and Annual Expatriation Statement is used by individuals who have expatriated on or after June 4, 2004.

Learn more

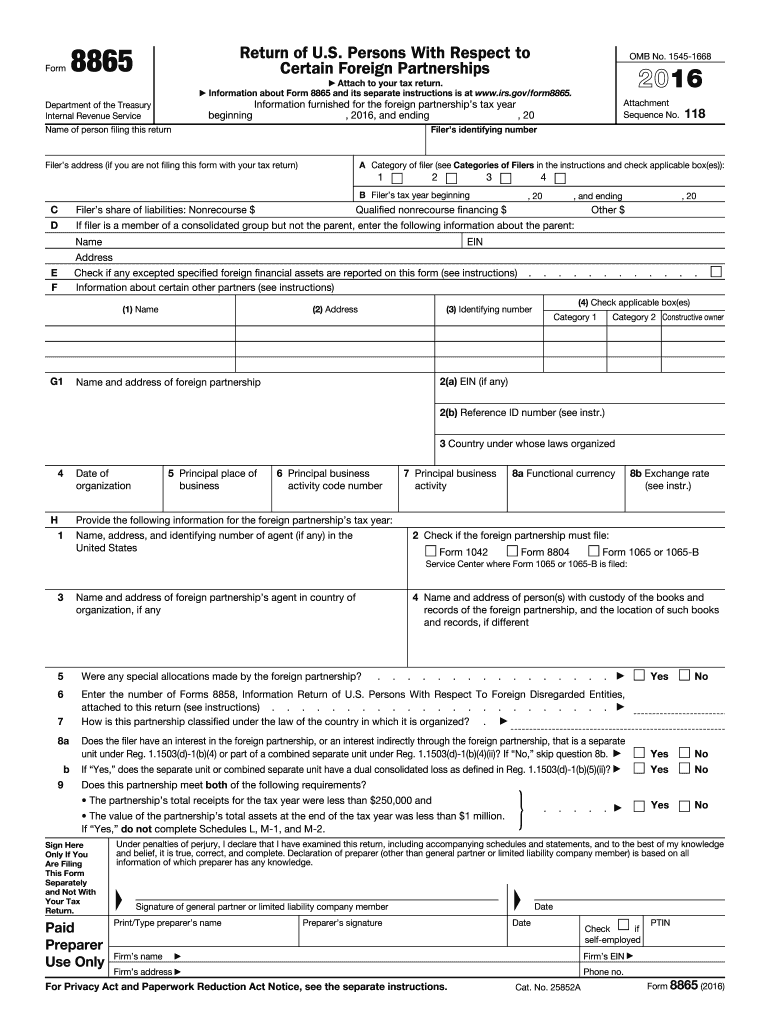

8865 form

Return of U.S. Persons With Respect to Certain Foreign Partnerships should be attached to the individual's tax return.

Learn more

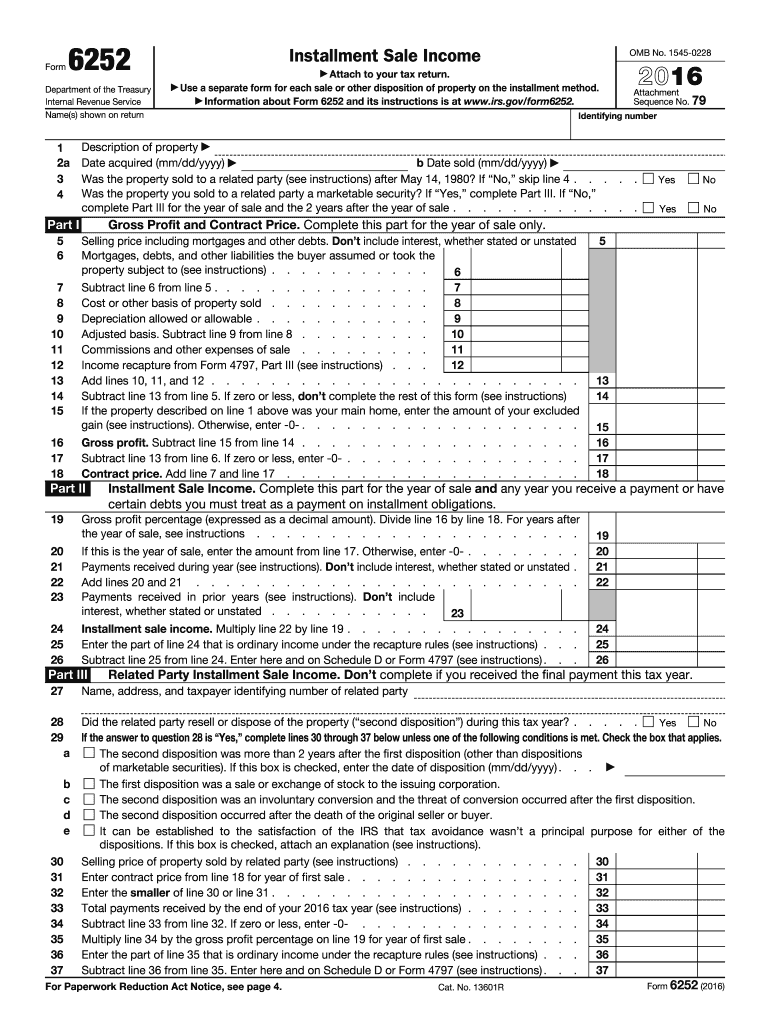

6252 form

Use this form to report income from an installment sale on the installment method.

Learn more

-

1

- 2