Mn Prorate Application Form

What is the Mn Prorate Application

The Mn prorate application is a form used by individuals and businesses in Minnesota to request a prorated property tax refund. This application is particularly relevant for those who have experienced changes in their property ownership status during the tax year. It allows taxpayers to adjust their property tax obligations based on the time they owned the property, ensuring that they only pay for the portion of the year they were responsible for the property taxes.

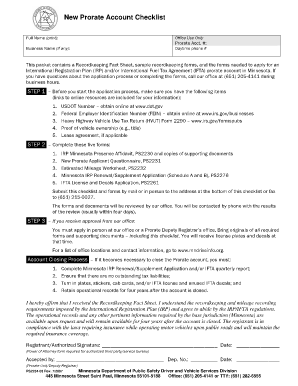

Steps to complete the Mn Prorate Application

Completing the Mn prorate application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as your property details, ownership dates, and tax identification numbers. Next, fill out the application form, ensuring all sections are completed accurately. Review the form for any errors or omissions before submission. Finally, submit the application through the designated method, whether online, by mail, or in person, and keep a copy for your records.

Legal use of the Mn Prorate Application

The legal validity of the Mn prorate application hinges on compliance with state laws governing property taxes. To be considered legally binding, the application must be filled out completely and submitted within the specified deadlines. Additionally, it is essential to provide accurate information to avoid penalties or delays in processing. Utilizing a reliable electronic signature tool can enhance the security and legality of the submission process.

Required Documents

When applying for a prorated property tax refund using the Mn prorate application, certain documents are typically required. These may include proof of property ownership, such as a deed or title, tax statements, and any relevant documentation that supports the claim for a prorated refund. Having these documents ready can facilitate a smoother application process and ensure that all necessary information is provided.

Eligibility Criteria

Eligibility for the Mn prorate application generally includes criteria related to property ownership and tax status. Applicants must have owned the property for part of the tax year and must be able to demonstrate the change in ownership. Additionally, the property must be located within Minnesota, and the application must be submitted within the designated timeframe to qualify for a refund.

Form Submission Methods

The Mn prorate application can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online through the official state portal, which often allows for quicker processing. Alternatively, the application can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its advantages, so selecting the one that best fits your needs is important.

Quick guide on how to complete mn prorate application

Manage Mn Prorate Application seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Access Mn Prorate Application on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and electronically sign Mn Prorate Application effortlessly

- Locate Mn Prorate Application and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which requires only seconds and holds the same legal validity as a standard handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mn Prorate Application to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mn prorate application

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is an MN prorate account?

An MN prorate account refers to a billing method used in Minnesota that allows businesses to bill clients for services based on the actual usage during the billing period. This assists in budgeting and provides flexibility for companies utilizing airSlate SignNow's services, ensuring they only pay for what they use.

-

How does the pricing for the MN prorate account work?

The pricing for the MN prorate account is based on the volume of documents eSigned and features utilized during the billing cycle. This ensures that your costs are aligned with your actual business needs, making airSlate SignNow a cost-effective choice for managing electronic signatures.

-

What features are included in the MN prorate account?

The MN prorate account includes a variety of features such as unlimited eSigning, document templates, team collaboration tools, and integration with various third-party applications. This set of features is designed to enhance workflow efficiency and streamline the signing process.

-

What are the benefits of using an MN prorate account?

Using an MN prorate account allows for greater budgeting flexibility and ensures that you only pay for services as needed. This model is particularly beneficial for businesses that may have fluctuating document signing demands throughout the year, making airSlate SignNow's service even more attractive.

-

Can the MN prorate account integrate with other business tools?

Yes, the MN prorate account can seamlessly integrate with various business tools such as Salesforce, Google Drive, and Zapier. This integration capability allows for enhanced productivity and helps in centralizing your document management process within airSlate SignNow.

-

Is the MN prorate account suitable for small businesses?

Absolutely! The MN prorate account is particularly well-suited for small businesses that may need a flexible pricing model without the burden of fixed monthly fees. With airSlate SignNow, small businesses can effectively manage their document signing needs without overspending.

-

How can I set up an MN prorate account with airSlate SignNow?

Setting up an MN prorate account is simple with airSlate SignNow. Just visit our website, select the MN prorate account option during the sign-up process, and follow the prompts to set up your account to start managing your electronic signing needs effectively.

Get more for Mn Prorate Application

Find out other Mn Prorate Application

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract