New York State Department of Taxation and Finance it 2104 Form

What is the New York State Department Of Taxation And Finance IT 2104

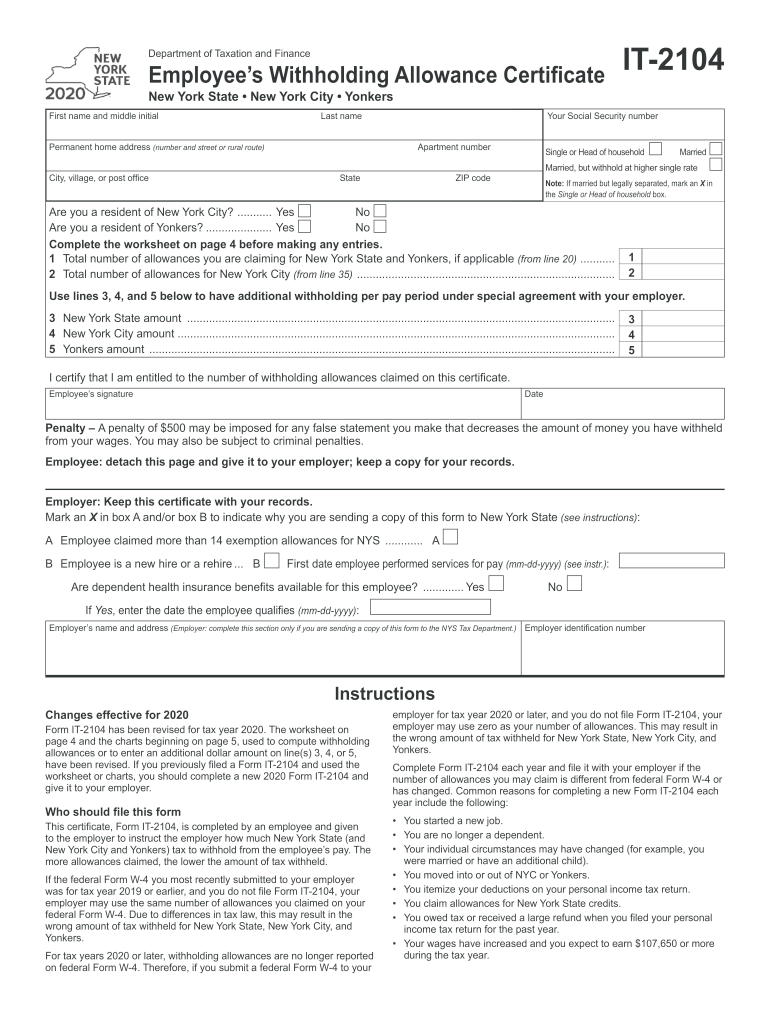

The New York State Department Of Taxation And Finance IT 2104 form is a crucial document used for reporting and claiming certain tax credits in New York State. This form is typically associated with the New York State personal income tax and is designed to help taxpayers accurately calculate their eligibility for various tax benefits. The IT 2104 form is essential for ensuring compliance with state tax regulations and for maximizing potential tax refunds or credits.

How to use the New York State Department Of Taxation And Finance IT 2104

Using the IT 2104 form involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents, including income statements and previous tax returns. Once the required information is collected, individuals can fill out the form, providing details such as income, deductions, and any applicable credits. After completing the form, it can be submitted either electronically or via mail, depending on the taxpayer's preference and the specific instructions provided by the New York State Department of Taxation and Finance.

Steps to complete the New York State Department Of Taxation And Finance IT 2104

Completing the IT 2104 form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the IT 2104 form from the New York State Department of Taxation and Finance website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income and any deductions you are eligible for.

- Calculate the tax credits you wish to claim on the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail as per the guidelines provided.

Legal use of the New York State Department Of Taxation And Finance IT 2104

The IT 2104 form must be filled out and submitted according to New York State tax laws to be legally valid. This includes adhering to deadlines and ensuring that the information provided is truthful and accurate. Electronic signatures are accepted, provided they comply with the legal standards set forth by the ESIGN Act and other relevant regulations. Using a secure eSignature platform can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the IT 2104 form are critical for taxpayers to avoid penalties. Typically, the form must be submitted by the same deadline as the personal income tax return. It is essential to check the New York State Department of Taxation and Finance website for specific dates each tax year, as they may vary. Marking these dates on a calendar can help ensure timely submission.

Required Documents

To complete the IT 2104 form, taxpayers should gather several key documents, including:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of any deductions or credits being claimed.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete new york state department of taxation and finance it 2104

Complete New York State Department Of Taxation And Finance IT 2104 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage New York State Department Of Taxation And Finance IT 2104 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The easiest method to modify and eSign New York State Department Of Taxation And Finance IT 2104 without effort

- Locate New York State Department Of Taxation And Finance IT 2104 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with specific tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or link invitation, or download it to your computer.

Never worry about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks using any device you prefer. Modify and eSign New York State Department Of Taxation And Finance IT 2104 and maintain outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance it 2104

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the New York State Department Of Taxation And Finance IT 2104?

The New York State Department Of Taxation And Finance IT 2104 is a tax form used by individuals to claim certain credits or deductions on their state income tax returns. Understanding this form is crucial for residents who want to optimize their tax filings and entitlements.

-

How can airSlate SignNow help with the New York State Department Of Taxation And Finance IT 2104?

airSlate SignNow streamlines the process of filling out and eSigning documents like the New York State Department Of Taxation And Finance IT 2104. With our platform, users can easily send, sign, and manage their tax documents, ensuring compliance and efficiency.

-

Is airSlate SignNow compliant with New York State Department Of Taxation And Finance regulations?

Yes, airSlate SignNow is fully compliant with New York State Department Of Taxation And Finance regulations. Our platform ensures that all eSigned documents, including the IT 2104, meet the legal standards required by state tax authorities.

-

What features does airSlate SignNow offer for managing the New York State Department Of Taxation And Finance IT 2104?

AirSlate SignNow offers features such as template creation, document storage, and real-time tracking to manage your New York State Department Of Taxation And Finance IT 2104 effortlessly. These tools enhance user experience and simplify the eSigning process.

-

What are the pricing options for using airSlate SignNow to handle tax documents?

AirSlate SignNow offers flexible pricing plans tailored to meet various business needs, starting from a basic plan suitable for individual users to advanced plans for enterprises. This makes it an affordable choice for anyone needing to manage the New York State Department Of Taxation And Finance IT 2104 and other documents.

-

What benefits does airSlate SignNow provide for tax professionals dealing with the IT 2104 form?

Tax professionals benefit from airSlate SignNow's quick document turnaround, secure eSigning, and easy integration with existing workflows. For those handling the New York State Department Of Taxation And Finance IT 2104, our platform enhances accuracy and efficiency, ultimately improving client satisfaction.

-

Can airSlate SignNow integrate with other tools used for tax filing?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, allowing users to manage the New York State Department Of Taxation And Finance IT 2104 alongside their preferred tools. This flexibility enhances productivity and streamlines the entire tax preparation process.

Get more for New York State Department Of Taxation And Finance IT 2104

Find out other New York State Department Of Taxation And Finance IT 2104

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document