Blank 254 Form

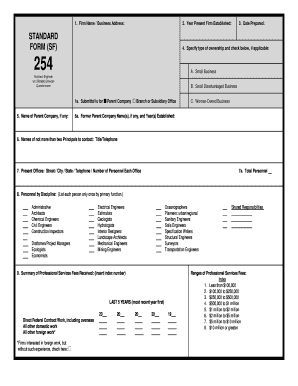

What is the Blank 254 Form

The Blank 254 Form is a document used primarily for reporting purposes in various business and tax-related contexts. It is essential for individuals and entities that need to disclose specific financial information to the Internal Revenue Service (IRS) or other regulatory bodies. This form is often associated with compliance requirements, ensuring that the information submitted is accurate and complete. Understanding its purpose is crucial for anyone involved in financial reporting or tax obligations.

Steps to complete the Blank 254 Form

Completing the Blank 254 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details, financial data, and any relevant supporting documents. Next, carefully fill out each section of the form, making sure to follow the instructions provided. Double-check all entries for accuracy to avoid any errors that could lead to penalties. Finally, review the completed form to ensure that it meets all requirements before submission.

Legal use of the Blank 254 Form

The legal use of the Blank 254 Form is paramount for ensuring compliance with federal regulations. To be considered legally binding, the form must be completed accurately and submitted within the designated timelines. Additionally, using a reliable digital signature solution can enhance the form's validity, providing an added layer of security and authenticity. It is important to be aware of the legal implications of submitting this form, as inaccuracies or omissions can result in penalties or legal repercussions.

How to obtain the Blank 254 Form

The Blank 254 Form can typically be obtained through official IRS channels or relevant state agencies. It is essential to ensure that you are using the most current version of the form, as updates may occur. For convenience, many users opt to download the form directly from the IRS website, where it is available in a printable format. Additionally, some tax preparation software may include the form, allowing for easy access and completion.

Filing Deadlines / Important Dates

Filing deadlines for the Blank 254 Form can vary depending on the specific circumstances and the entity submitting the form. Generally, it is crucial to be aware of the annual deadlines set by the IRS to avoid late penalties. Keeping track of important dates, such as the end of the tax year and submission deadlines, helps ensure timely compliance. It is advisable to consult the IRS guidelines or a tax professional for the most accurate and relevant deadlines related to this form.

Examples of using the Blank 254 Form

The Blank 254 Form is commonly used in various scenarios, such as by self-employed individuals reporting income, businesses disclosing financial information, or entities applying for tax-exempt status. For instance, a freelancer might use the form to report earnings to the IRS, while a non-profit organization may need it to demonstrate compliance with tax laws. Understanding these examples can help clarify the form's application in real-world situations.

Quick guide on how to complete blank 254 form

Execute Blank 254 Form effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly and without interruptions. Manage Blank 254 Form on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Steps to modify and electronically sign Blank 254 Form with ease

- Obtain Blank 254 Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Blank 254 Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank 254 form

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is a Blank 254 Form?

The Blank 254 Form is a document used in various fields to collect and present specific information. It serves as a customizable template to facilitate data entry and organization. By utilizing airSlate SignNow, users can easily create, send, and eSign a Blank 254 Form, streamlining the process and ensuring compliance.

-

How can airSlate SignNow help me manage my Blank 254 Form?

airSlate SignNow provides an intuitive platform to manage your Blank 254 Form efficiently. You can customize templates, easily send them for signatures, and track the document’s status in real-time. This not only saves time but enhances the overall efficiency of your documentation process.

-

Is there a cost associated with using the Blank 254 Form feature?

Yes, while airSlate SignNow offers several pricing plans, the cost will depend on the features you select. All plans provide access to create and use a Blank 254 Form among other document types. Review our pricing page to find the best plan that fits your business needs.

-

Can I integrate airSlate SignNow with other applications when using the Blank 254 Form?

Absolutely! airSlate SignNow offers a wide range of integrations with popular applications, allowing you to streamline your workflows. You can connect tools such as Google Drive, Dropbox, and more while managing your Blank 254 Form, enhancing collaborative efforts across your team.

-

What are the key benefits of using the Blank 254 Form with airSlate SignNow?

Using the Blank 254 Form with airSlate SignNow provides numerous benefits, including improved accuracy, reduced processing time, and enhanced data security. The eSigning feature ensures quick turnaround on document approval, leading to faster business transactions. Efficient management of your forms can signNowly enhance productivity.

-

Is the Blank 254 Form customizable in airSlate SignNow?

Yes, the Blank 254 Form is fully customizable within airSlate SignNow. You can add fields, modify layouts, and tailor the form according to your specific needs. Customization ensures that the form captures all necessary information relevant to your business processes.

-

How does airSlate SignNow ensure the security of my Blank 254 Form?

airSlate SignNow prioritizes your document security with bank-level encryption and advanced authentication methods. Every Blank 254 Form is protected against unauthorized access, ensuring that sensitive information remains confidential. Trust that your documents are safe while using our platform.

Get more for Blank 254 Form

Find out other Blank 254 Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later