Gift CardCertificate Reporting Form DFA Cornell

What is the gift card reporting form?

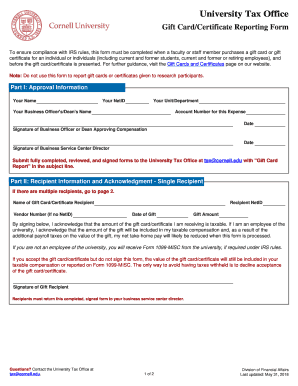

The gift card reporting form is a document used primarily for tracking and reporting the distribution and usage of gift cards within an organization. This form is essential for maintaining accurate records, ensuring compliance with financial regulations, and facilitating proper accounting practices. It typically includes details such as the recipient's information, the value of the gift card, and the date of issuance. Organizations may use this form to monitor gift card expenditures and to comply with IRS guidelines regarding reporting income and expenses.

How to use the gift card reporting form

Using the gift card reporting form involves several straightforward steps. First, gather all necessary information about the gift cards being reported, including the recipient's name, the gift card amount, and the date of distribution. Next, accurately fill out the form, ensuring that all details are correct and complete. Once completed, the form may need to be submitted to the appropriate department within the organization or to an external regulatory body, depending on the specific requirements. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the gift card reporting form

Completing the gift card reporting form requires careful attention to detail. Follow these steps:

- Collect all relevant information about the gift cards, including recipient details and card values.

- Access the gift card reporting form, which can typically be found on your organization’s internal resources or financial department.

- Fill in the required fields, ensuring accuracy in names, amounts, and dates.

- Review the completed form for any errors or omissions.

- Submit the form according to your organization’s guidelines, whether electronically or via mail.

Legal use of the gift card reporting form

The legal use of the gift card reporting form is crucial for compliance with federal and state regulations. Organizations must ensure that they are reporting gift card distributions accurately to avoid potential penalties. This form can serve as a legal document in case of audits or financial reviews. To maintain compliance, it is important to adhere to IRS guidelines and any other applicable laws regarding gift card reporting, including maintaining proper records and ensuring that all issued cards are accounted for in financial statements.

Required documents

When completing the gift card reporting form, certain documents may be required to support the information provided. These documents can include:

- Proof of purchase for the gift cards.

- Receipts or invoices related to the distribution of the gift cards.

- Any internal policies regarding gift card issuance and reporting.

Having these documents on hand can facilitate the completion of the form and ensure that all necessary information is accurately reported.

Form submission methods

The gift card reporting form can typically be submitted through various methods, depending on organizational preferences. Common submission methods include:

- Online submission via an internal portal or electronic document management system.

- Mailing a physical copy to the appropriate department.

- In-person submission at designated locations within the organization.

It is important to confirm the preferred submission method with your organization to ensure compliance and proper processing of the form.

Quick guide on how to complete gift cardcertificate reporting form dfa cornell

Prepare Gift CardCertificate Reporting Form DFA Cornell effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Gift CardCertificate Reporting Form DFA Cornell on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Gift CardCertificate Reporting Form DFA Cornell with ease

- Obtain Gift CardCertificate Reporting Form DFA Cornell and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Gift CardCertificate Reporting Form DFA Cornell and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift cardcertificate reporting form dfa cornell

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the gift card reporting form?

The gift card reporting form is a tool that allows businesses to track and manage their gift card transactions more efficiently. With this form, you can easily compile and analyze data related to gift card sales and redemptions. This streamlines the reporting process and enhances financial transparency.

-

How can I access the gift card reporting form?

You can access the gift card reporting form through your airSlate SignNow account. Once logged in, navigate to the reporting tools section where you will find the option to generate or fill out the form. This user-friendly interface makes it easy to get started with minimal training.

-

Is there a cost associated with using the gift card reporting form?

The gift card reporting form is included in the airSlate SignNow subscription plans. Depending on your selected plan, you may have access to additional features that enhance your reporting capabilities. For detailed pricing information, please refer to our pricing page.

-

What are the benefits of using the gift card reporting form?

Using the gift card reporting form provides signNow advantages, including improved tracking of gift card usage and better financial insights. It helps businesses minimize fraud and discrepancies by maintaining accurate records. This form ultimately aids in making data-driven decisions related to gift card promotions and budgeting.

-

Can the gift card reporting form integrate with other systems?

Yes, the gift card reporting form can be integrated with various accounting and financial management systems. This seamless integration allows for better data synchronization and reduces the manual effort of transferring information. Ensure that your preferred systems are compatible with airSlate SignNow to maximize efficiency.

-

What features are included in the gift card reporting form?

The gift card reporting form includes features such as customizable templates, real-time data tracking, and automated reporting functionalities. These features help streamline data entry, reduce errors, and facilitate quicker access to essential information. This results in better overall management of your gift card programs.

-

How does the gift card reporting form help with compliance?

The gift card reporting form aids in compliance by ensuring that all gift card transactions are accurately recorded and reported. Proper documentation of sales and redemptions helps businesses adhere to regulations and tax laws. This level of transparency can protect your business from potential legal issues.

Get more for Gift CardCertificate Reporting Form DFA Cornell

- California proof service 2011 form

- Fillable california court forms

- P gina 1 fl 281 s california courts courts ca form

- Fl 290 en espa ol california courts courts ca form

- Fl 355 fillable 2012 form

- Fl 355 fillable 2006 form

- Jv 123 sv2100206xyzofm california courts courts ca form

- S lo para informaci n no entregue a la corte california courts courts ca 6967956

Find out other Gift CardCertificate Reporting Form DFA Cornell

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast