Declaration for Electronic Filing PTE This Form is Used to Authenticate the Electronic Portion of the Return, Authorize the ERO

What is the Declaration For Electronic Filing PTE?

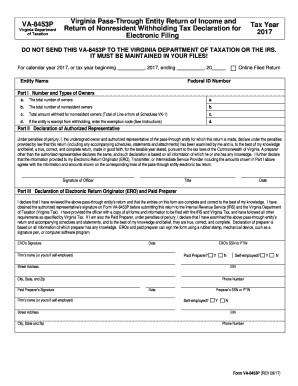

The Declaration For Electronic Filing PTE is a crucial form used in the electronic filing process of tax returns. This form serves multiple purposes: it authenticates the electronic portion of the return, authorizes the Electronic Return Originator (ERO) to transmit the return via a third-party transmitter, and grants permission for the Income Service Provider (ISP) to transmit the return through a third-party transmitter if necessary. Understanding this form is essential for ensuring compliance and facilitating a smooth electronic filing experience.

How to Use the Declaration For Electronic Filing PTE

Using the Declaration For Electronic Filing PTE involves several key steps. First, ensure that you have all necessary information ready, including your personal details and tax information. Next, fill out the form accurately, providing any required signatures or initials. Once completed, the form must be submitted electronically alongside your tax return. This process helps confirm your identity and authorizes the ERO and ISP to handle your return securely.

Steps to Complete the Declaration For Electronic Filing PTE

Completing the Declaration For Electronic Filing PTE involves a series of straightforward steps:

- Gather all relevant tax documents and personal information.

- Access the form through your tax preparation software or online platform.

- Fill in the required fields, ensuring accuracy in your entries.

- Provide your electronic signature, which may involve typing your name or using a digital signature tool.

- Review the completed form for any errors before submission.

- Submit the form electronically as part of your tax return filing process.

Key Elements of the Declaration For Electronic Filing PTE

Several key elements are essential to the Declaration For Electronic Filing PTE. These include:

- Authentication: Confirms the identity of the taxpayer and the accuracy of the electronic return.

- Authorization: Grants permission to the ERO and ISP to transmit the return on behalf of the taxpayer.

- Compliance: Ensures adherence to IRS regulations regarding electronic filing.

- Signature Requirements: Details the necessary signatures to validate the form.

Legal Use of the Declaration For Electronic Filing PTE

The Declaration For Electronic Filing PTE has significant legal implications. It is recognized as a legally binding document when completed correctly. The form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, as well as the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and records are valid and enforceable, providing legal protection for both the taxpayer and the ERO.

IRS Guidelines on the Declaration For Electronic Filing PTE

The IRS provides specific guidelines regarding the use of the Declaration For Electronic Filing PTE. Taxpayers must ensure that the form is filled out accurately and submitted in conjunction with their electronic tax return. The IRS emphasizes the importance of maintaining compliance with all filing requirements and deadlines to avoid penalties. Familiarizing yourself with these guidelines is crucial for a successful electronic filing experience.

Quick guide on how to complete declaration for electronic filing pte this form is used to authenticate the electronic portion of the return authorize the ero

Effortlessly Prepare Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO on Any Device

Digital document management has become increasingly favored by enterprises and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO effortlessly

- Locate Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration for electronic filing pte this form is used to authenticate the electronic portion of the return authorize the ero

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the Declaration For Electronic Filing PTE and why is it necessary?

The Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing is essential for ensuring compliance when filing electronically. It validates the return and secures authorization for electronic transmission, allowing for a smooth filing process.

-

How can I complete the Declaration For Electronic Filing PTE using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing by accessing our user-friendly template. Our platform streamlines the completion and signing process, making it efficient for users.

-

What are the benefits of using airSlate SignNow for electronic filings?

airSlate SignNow offers various benefits for electronic filings, including compliance assurance and time-saving features. The Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing enhances your filing experience by providing a secure, easy-to-use platform for document management and eSigning.

-

Are there any additional costs associated with using the Declaration For Electronic Filing PTE through airSlate SignNow?

While airSlate SignNow offers competitive pricing, specific costs associated with electronic filing processes, including the use of the Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing, may vary based on the subscription plan you choose. It's advisable to review our pricing page for detailed information.

-

What integrations does airSlate SignNow offer for electronic filing?

airSlate SignNow integrates seamlessly with a variety of applications to enhance your electronic filing experience. This includes tools that facilitate accessing the Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing, thereby allowing for a cohesive workflow and improved efficiency.

-

Can I track the status of my documents submitted through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documents. After submitting the Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing, you can easily see when it has been viewed or signed by all parties involved.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. The platform utilizes advanced encryption methods and complies with data protection regulations, ensuring that the Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO To Transmit Via 3rd Party Transmitter, And Authorize The ISP To Transmit Via 3rd Party Transmitter If Filing and other sensitive data remain protected throughout the electronic filing process.

Get more for Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO

Find out other Declaration For Electronic Filing PTE This Form Is Used To Authenticate The Electronic Portion Of The Return, Authorize The ERO

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe