Cigna Beneficiary Designation Form

What is the Cigna Beneficiary Designation Form

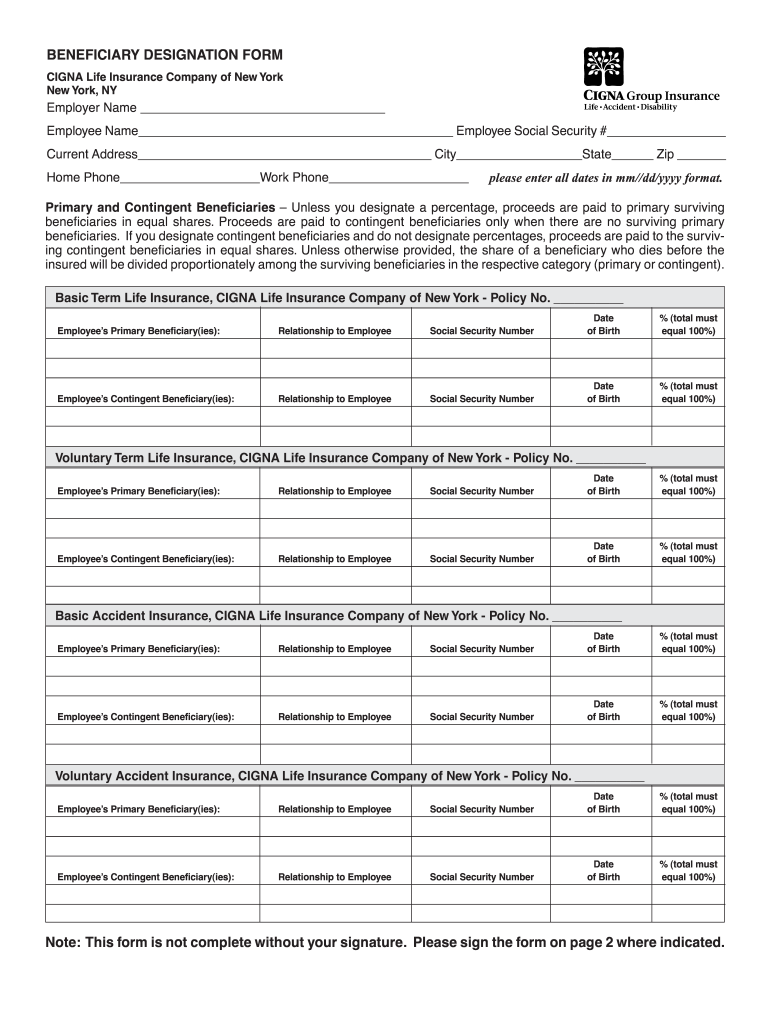

The Cigna Beneficiary Designation Form is a critical document used to specify individuals or entities that will receive benefits from a Cigna insurance policy upon the policyholder's death. This form ensures that the policyholder's wishes are honored regarding the distribution of benefits. It is essential for creating a clear record of beneficiaries, which can help avoid potential disputes among family members or other parties after the policyholder's passing.

How to use the Cigna Beneficiary Designation Form

Using the Cigna Beneficiary Designation Form involves several straightforward steps. First, obtain the form from the Cigna website or customer service. Next, fill out the required information, including the names, addresses, and relationships of the beneficiaries. Once completed, review the form for accuracy and ensure all necessary signatures are included. Finally, submit the form according to Cigna's guidelines, either online or via mail, to ensure it is processed correctly.

Steps to complete the Cigna Beneficiary Designation Form

Completing the Cigna Beneficiary Designation Form requires careful attention to detail. Follow these steps:

- Download the form from the Cigna website or request a physical copy.

- Provide your personal information, including your policy number.

- List the beneficiaries, ensuring to include their full names, addresses, and relationship to you.

- Specify the percentage of benefits each beneficiary will receive.

- Sign and date the form to validate it.

- Submit the form as directed by Cigna, either electronically or by mail.

Legal use of the Cigna Beneficiary Designation Form

The Cigna Beneficiary Designation Form is legally binding once completed and submitted according to Cigna's requirements. It is essential to ensure that the form complies with state laws regarding beneficiary designations. This includes understanding any specific regulations that may apply to your state, as these can affect the validity of the form and the distribution of benefits. Consulting with a legal professional can provide additional assurance that the form meets all necessary legal standards.

Key elements of the Cigna Beneficiary Designation Form

Several key elements must be included in the Cigna Beneficiary Designation Form to ensure its effectiveness:

- Policyholder Information: Full name, address, and policy number.

- Beneficiary Details: Names, addresses, and relationships of all beneficiaries.

- Distribution Percentages: Clear percentages indicating how benefits will be divided among beneficiaries.

- Signatures: Required signatures from the policyholder and, if applicable, witnesses.

Who Issues the Form

The Cigna Beneficiary Designation Form is issued by Cigna, a leading health insurance provider in the United States. Policyholders can obtain the form directly from Cigna's official website or by contacting their customer service department. It is essential to use the most current version of the form to ensure compliance with Cigna's policies and state regulations.

Quick guide on how to complete cigna group life insurance beneficiary form

Explore the simpler method to handle your Cigna Beneficiary Designation Form

The traditional approaches to filling out and approving documents consume an excessive amount of time in comparison to contemporary document management systems. You previously had to search for appropriate paper forms, print them, fill in all the information, and mail them. Now, you can locate, complete, and sign your Cigna Beneficiary Designation Form within a single internet browser tab using airSlate SignNow. Preparing your Cigna Beneficiary Designation Form has never been easier.

Steps to fill out your Cigna Beneficiary Designation Form with airSlate SignNow

- Access the category page you need and find your state-specific Cigna Beneficiary Designation Form. Alternatively, utilize the search bar.

- Confirm that the version of the form is accurate by previewing it.

- Press Get form and enter editing mode.

- Fill in your document with the necessary information using the editing tools.

- Review the added information and click the Sign tool to validate your form.

- Choose the most suitable method to create your signature: generate it, draw your signature, or upload a photo of it.

- Press DONE to save your modifications.

- Download the document to your device or proceed to Sharing settings to send it digitally.

Effective online tools like airSlate SignNow simplify filling out and submitting your forms. Use it to discover just how much time document management and approval processes are actually meant to take. You’ll conserve a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

If an insured parent dies without filling out a beneficiary form and the will is silent on the insurance proceeds, to whom do the benefits go to? Does the situation need go to probate court?

A policy in the United States cannot and should not be issued without a beneficiary. It is a legal requirement that 1) impedes speculation in human life and 2) reduces the likelihood/incidence of Stranger Originated Life Insurance (a.k.a Stoli).So, what is the real situation here? Are you saying a company actually issued coverage leaving that crucial part of the form blank?If so, depending on the size of the policy and the litigation costs that will ensue to straighten up the mess, you might consider legal action against the insurance company and/or the agent for dereliction of duty.One of the strengths of life insurance is its rapid provision of liquidity, which it accomplishes by paying proceeds according to contract as opposed to by Will or Trust. It's as simple as verifying the death, submitting the claim, and then a check gets cut from the insurance company to the beneficiary. Nothing needs to go through probate or the estate settlement process, which can take months.If this valuable convenience was lost due to a failure of the agent and/or the insurance company, I think legal action should be considered.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How long did it take a beneficiary to collect the $10,000 life insurance policy taken out on WWII soldiers?

If the policy remains in force (premiums are paid), the policy will pay $10,000. to the beneficiary upon the death of the insured.If the WWII soldier is still alive beyond age 95, the policy will cut a check to the insured for $10,000. and the policy will cease to exist.So, if you know a WWII soldier who had the $10,000 policy and died at age 97, the policy has already been paid to the soldier.

-

Do I have to fill out the form of Railway Group D and Loco pilot separately?

Yes, you have to apply separately for both the posts!You can apply here for Railway Group D: RRB Group D Recruitment 2018: Exam Date, Apply Online, Vacancy, SyllabusYou can apply here for Loco Pilot: - Railway Recritment BoardGood Luck!

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

How much time and money does it take for a new startup (<50 employees) to fill out the paperwork to become a group for the purpose of negotiating for health insurance for their founders and employees?

I'm not sure if this is a purely exploratory question or if you're inferring that you're planning on navigating the group health insurance market without the assistance of a broker. If the latter, I'd caution against it for several reasons (which I'll omit for now for the sake of brevity).To get a group quote, generally all that's needed is an employee census. Some states apply a modifier to the rate depending on the overall health of the group members (for a very accurate quote, employees may need to fill out general health statements).Obtaining rates themselves can take a few minutes (for states like CA which don't have a signNow health modifier) to several days.I suspect your cor question is the time/effort required once you've determined the most appropriate plan design for your company. This is variable depending on how cohesive your employee base is.Best case scenario - if all employees are in one location and available at the same time, I could bring an enrollment team and get all the paperwork done in the course of 1-3 hours depending on the size of your group. In the vast majority of cases, the employer's paperwork is typically around 6 pages of information, and the employee applications about 4-8 pages. Individually none of them take more than several minutes to complete.Feel free to contact me directly if you have specific questions or concerns.

-

How do I find out if the executor of my father's will changed the life insurance policy to name her and not the estates beneficiary?

First, only the owner of a life insurance policy may change anything on the insurance policy. If you contact the carrier they will ONLY talk with the owner. Step 1: Find the policy number of the insurance policy. Step 2: Call the insurance company and go as far as they will allow you by asking about the policy/owner. If you’re not the owner this will be your dead end on the phone. Step 3: Ask the executor what has been done. If this is not an option then know that the owner/beneficiary must prove insurable interest to become beneficiary on a policy. Hope this helps.UPVOTE, comment, go to my website Kent Sawyers and subscribe to my Youtube channel Financial Advice-Kent Sawyers.Regards,Kent

Create this form in 5 minutes!

How to create an eSignature for the cigna group life insurance beneficiary form

How to create an eSignature for the Cigna Group Life Insurance Beneficiary Form in the online mode

How to generate an eSignature for your Cigna Group Life Insurance Beneficiary Form in Chrome

How to make an electronic signature for putting it on the Cigna Group Life Insurance Beneficiary Form in Gmail

How to generate an eSignature for the Cigna Group Life Insurance Beneficiary Form from your smart phone

How to generate an electronic signature for the Cigna Group Life Insurance Beneficiary Form on iOS

How to generate an eSignature for the Cigna Group Life Insurance Beneficiary Form on Android devices

People also ask

-

What is the role of a beneficiary in Cigna insurance policies?

In Cigna insurance policies, a beneficiary is the person or entity designated to receive benefits upon the insured individual's death. Understanding how a beneficiary Cigna is defined is crucial for policyholders to ensure their loved ones receive the intended financial support.

-

How do I add or change my beneficiary with Cigna?

To add or change a beneficiary Cigna, policyholders typically need to log into their Cigna account or contact customer service. It’s important to keep your beneficiary information up-to-date to avoid complications during claims processing.

-

What are the benefits of having a designated beneficiary for my Cigna policy?

Having a designated beneficiary Cigna allows for a smooth transfer of funds to your loved ones, reducing delays and complexities after your passing. It also ensures that your financial support signNowes the intended recipients, providing peace of mind.

-

What happens if I don't designate a beneficiary for my Cigna policy?

If you do not designate a beneficiary Cigna, the insurance benefits may be paid to your estate, possibly leading to delays and additional probate costs. It's advisable to designate a beneficiary to streamline the claims process and avoid unnecessary complications.

-

Are there any fees associated with changing a beneficiary on my Cigna policy?

Changing a beneficiary Cigna is typically a free process. However, it's essential to check your specific policy details or signNow out to Cigna customer service for clarification about potential fees that might apply in certain situations.

-

Can I designate multiple beneficiaries on my Cigna insurance policy?

Yes, policyholders can designate multiple beneficiaries Cigna. This allows you to allocate a percentage of the benefits to each beneficiary, ensuring that your wishes are clearly specified and understood.

-

What information do I need to provide when designating a beneficiary with Cigna?

When designating a beneficiary Cigna, you typically need to provide the full name, relationship to you, and contact information of the beneficiary. This ensures that Cigna can easily signNow out to the designated recipient when the time comes.

Get more for Cigna Beneficiary Designation Form

Find out other Cigna Beneficiary Designation Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word