About Schedule F Form 1040, Profit or Loss from Farming Navigating a Schedule F Farm Tax ReturnSmall Farm Reviewing and Calculat

Understanding the Schedule F Form 1040

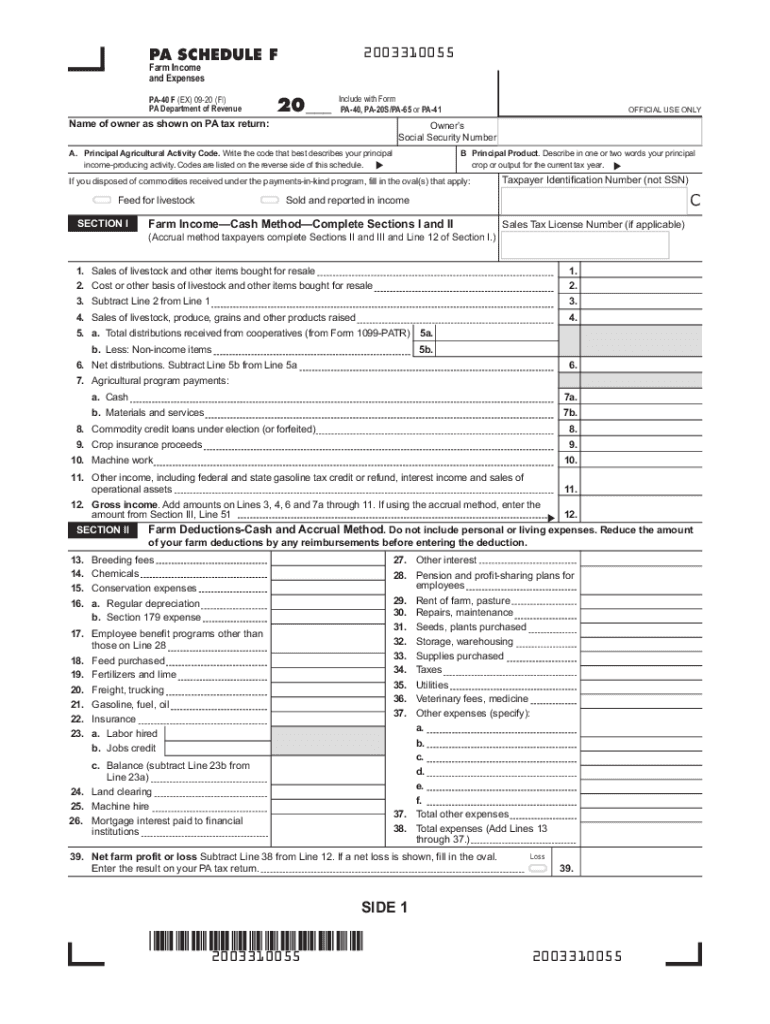

The Schedule F form, officially known as the Profit or Loss From Farming, is a crucial document for farmers and agricultural businesses in the United States. It allows individuals to report income and expenses related to their farming operations. This form is typically filed alongside Form 1040, the individual income tax return. Understanding the details of the Schedule F form is essential for accurate reporting and compliance with IRS regulations.

Steps to Complete the Schedule F Form 1040

Completing the Schedule F form involves several steps to ensure accurate reporting of farming income and expenses. Start by gathering all necessary financial records, including income from sales of livestock, crops, and other farm-related activities. Next, document all expenses, such as feed, fertilizer, equipment, and maintenance costs. Each section of the form must be filled out carefully, detailing both income and expenses. After completing the form, review it for accuracy before submitting it with your Form 1040.

Key Elements of the Schedule F Form 1040

The Schedule F form consists of several key sections that require specific information. These include:

- Income Section: Report all income generated from farming activities.

- Expenses Section: List all allowable expenses incurred in the farming process.

- Net Profit or Loss: Calculate the net profit or loss by subtracting total expenses from total income.

Each section must be completed with accurate figures to ensure compliance with IRS guidelines.

IRS Guidelines for Filing Schedule F

The IRS provides specific guidelines for filing the Schedule F form. It is important to adhere to these guidelines to avoid penalties. Ensure that all income and expenses are documented and that the form is submitted by the tax deadline. The IRS also recommends maintaining records for at least three years in case of an audit. Familiarizing yourself with these guidelines can help ensure a smooth filing process.

Filing Deadlines for Schedule F

Filing deadlines for the Schedule F form align with the general tax filing deadlines for individuals. Typically, the deadline to file Form 1040, including Schedule F, is April 15. However, if you need additional time, you may file for an extension, which allows for an additional six months. It is important to be aware of these deadlines to avoid late filing penalties.

Legal Use of the Schedule F Form

The Schedule F form is legally binding and must be filled out accurately to reflect true income and expenses from farming operations. Misrepresentation of information can lead to penalties, including fines and potential audits. Therefore, it is essential to ensure that all information reported on the form is truthful and substantiated by proper documentation.

Quick guide on how to complete about schedule f form 1040 profit or loss from farming navigating a schedule f farm tax returnsmall farm reviewing and

Complete About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest method to modify and eSign About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat with ease

- Locate About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about schedule f form 1040 profit or loss from farming navigating a schedule f farm tax returnsmall farm reviewing and

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the pa 40f feature in airSlate SignNow?

The pa 40f feature in airSlate SignNow allows users to streamline their document signing process efficiently. With this feature, you can effortlessly eSign documents and manage workflows, ensuring a hassle-free experience. It's designed to save time and boost productivity for businesses of all sizes.

-

How much does airSlate SignNow cost for the pa 40f plan?

The pricing for airSlate SignNow's pa 40f plan is competitively structured to offer great value for businesses. Depending on your needs and the size of your organization, you can choose from various subscription options. This flexibility ensures that you only pay for what you truly require.

-

What are the key benefits of using pa 40f with airSlate SignNow?

Using the pa 40f feature with airSlate SignNow provides several benefits, including improved document turnaround times and enhanced collaboration among team members. This allows users to focus more on core business functions instead of getting bogged down in paperwork. Overall, it contributes to operational efficiency.

-

Can I integrate airSlate SignNow's pa 40f feature with other applications?

Yes, the pa 40f feature of airSlate SignNow supports seamless integration with various applications and platforms. This includes tools for project management, CRM systems, and more, ensuring you can utilize your existing workflows effectively. Integration helps maintain consistency and enhances overall productivity.

-

Is the pa 40f feature secure for sensitive documents?

Absolutely, the pa 40f feature in airSlate SignNow is designed with advanced security protocols to protect your sensitive documents. Encryption and authentication features ensure that only authorized users can access important files. You can trust that your data is safeguarded throughout the eSigning process.

-

How can I get support for using the pa 40f feature?

For support regarding the pa 40f feature, airSlate SignNow offers comprehensive resources including tutorials, FAQs, and customer service assistance. You can easily access these resources on their website or contact their support team for personalized help. This ensures you can maximize the benefits of the pa 40f feature.

-

What types of documents can I eSign using the pa 40f feature?

The pa 40f feature in airSlate SignNow allows you to eSign a variety of document types, including contracts, agreements, and forms. This versatility makes it suitable for different industries and use cases, enabling businesses to handle their documentation needs effectively. You can upload, sign, and send any document type.

Get more for About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat

- Maine byob permit form

- How to stock a pond in maine form

- Application for a byob permit 1000 per day check form

- Certificate confirmation kindle on sweetagsfertk form

- Enter form

- Annual hazardous waste generation fee determination form g fds

- Application for withdrawl of certificate form

- Cedar city business license form

Find out other About Schedule F Form 1040, Profit Or Loss From Farming Navigating A Schedule F Farm Tax ReturnSmall Farm Reviewing And Calculat

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now