Transfer Adjust Form

What is the Transfer Adjust?

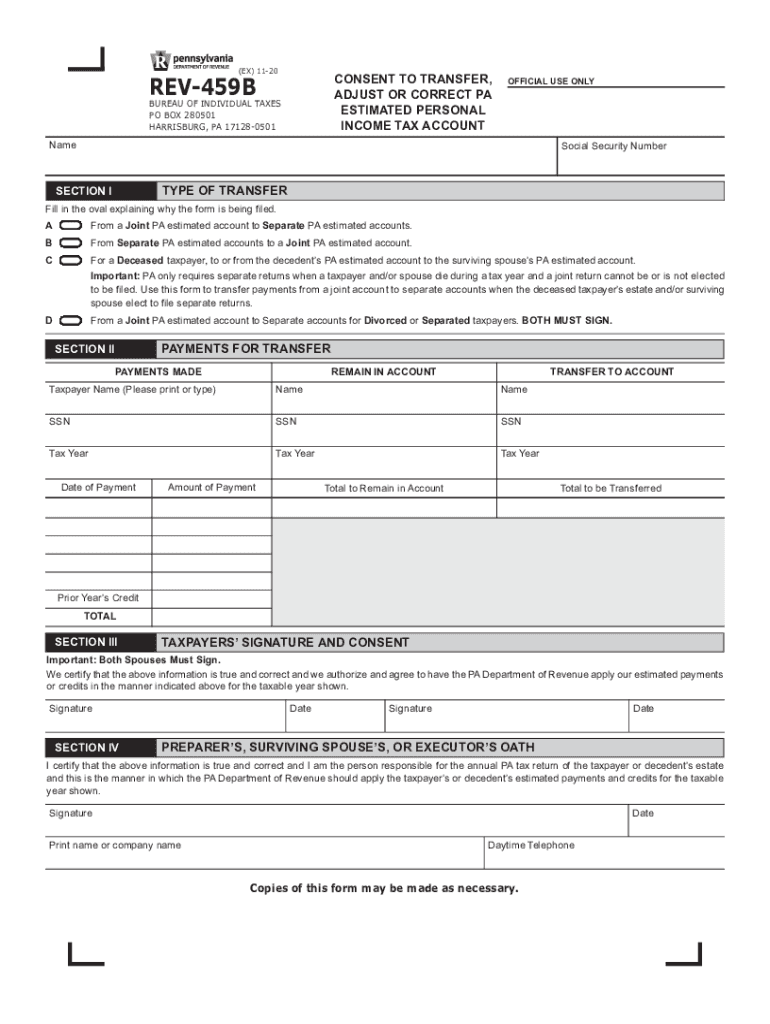

The Transfer Adjust, often referred to in the context of the 459b form, is a crucial component in Pennsylvania tax regulations. This adjustment is designed to facilitate the transfer of income and tax liabilities between individuals or entities, particularly in cases involving changes in residency or ownership. Understanding the Transfer Adjust is essential for ensuring compliance with state tax laws and optimizing tax obligations.

Steps to complete the Transfer Adjust

Completing the Transfer Adjust on the 459b form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents that pertain to the income being transferred. Next, accurately fill out the relevant sections of the 459b form, ensuring that all income figures and personal information are correct. It is important to double-check calculations to avoid errors that could lead to penalties. Once completed, review the form for completeness before submission.

Legal use of the Transfer Adjust

The legal use of the Transfer Adjust is governed by Pennsylvania tax regulations. To be considered valid, the adjustment must be made in accordance with state laws, which outline specific eligibility criteria and documentation requirements. Utilizing the Transfer Adjust legally ensures that taxpayers can effectively manage their tax responsibilities without facing legal repercussions. It is advisable to consult a tax professional if there is any uncertainty regarding the legal aspects of this adjustment.

Required Documents

When completing the 459b form and the associated Transfer Adjust, specific documents are required to substantiate the information provided. These may include proof of income, residency documentation, and any previous tax returns that relate to the income being adjusted. Having these documents readily available can streamline the process and enhance the accuracy of the form submission.

Filing Deadlines / Important Dates

Timely submission of the 459b form is critical to avoid penalties. The filing deadlines for the Transfer Adjust typically align with Pennsylvania's tax filing schedule. It is essential to stay informed about these dates to ensure that the form is submitted on time. Marking important dates on a calendar can help taxpayers manage their filing obligations effectively.

Examples of using the Transfer Adjust

Practical examples of using the Transfer Adjust can clarify its application. For instance, if an individual moves from one county to another within Pennsylvania and has income that needs to be reported in both locations, the Transfer Adjust allows for the proper allocation of tax liabilities. Another example involves business partnerships where income is transferred between partners, necessitating an adjustment to reflect each partner's share accurately.

Quick guide on how to complete transfer adjust

Complete Transfer Adjust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Transfer Adjust on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Transfer Adjust with ease

- Locate Transfer Adjust and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Revise and electronically sign Transfer Adjust and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transfer adjust

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the 459b form, and why do I need it?

The 459b form is a crucial document required for specific transactions or processes in various business scenarios. Understanding its purpose and ensuring it's correctly filled out can save time and prevent delays in your operations. By utilizing airSlate SignNow, you can easily create, manage, and eSign the 459b form, streamlining your workflow effectively.

-

How can airSlate SignNow help me with the 459b form?

airSlate SignNow provides a user-friendly platform for creating and eSigning the 459b form. With our powerful features, you can fill out the form electronically, add necessary signatures, and share it instantly. This not only enhances efficiency but also ensures compliance with any regulations pertaining to the document.

-

Is there a cost associated with using the 459b form template in airSlate SignNow?

While airSlate SignNow offers various pricing plans, access to template features, including the 459b form, is typically included. We provide a free trial, allowing you to explore functionalities first before committing. Our cost-effective solutions ensure that managing documents like the 459b form is within signNow for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications to manage my 459b form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enabling you to process the 459b form alongside your existing tools. Whether you're using CRM software or document management systems, our platform ensures a smooth workflow. This integration helps you keep everything organized and easily accessible.

-

What are the benefits of utilizing airSlate SignNow for the 459b form?

Using airSlate SignNow to manage the 459b form offers numerous advantages such as improved efficiency and reduced paper usage. You can track the status of your document in real-time and ensure timely completion with reminders. The electronic signature capability enhances security and expedites the approval process.

-

How secure is my information when signing the 459b form with airSlate SignNow?

Security is a top priority at airSlate SignNow. When signing the 459b form, your data is protected with advanced encryption and confidentiality measures. We regularly update our security protocols to ensure your information remains safe during the entire eSigning process.

-

Can multiple users collaborate on the 459b form within airSlate SignNow?

Yes, airSlate SignNow allows for collaboration on the 459b form among multiple users. Team members can comment, make edits, and electronically sign the document, making it easy to work together no matter where they are. This collaborative feature signNowly enhances communication and efficiency.

Get more for Transfer Adjust

- Transport operations passenger transport act 1994 tow truck act 1973 support transport qld gov form

- Sa456 form

- Fillable online licensing registered dietitian referral form

- Form 519

- Dealer application for transfer of registration form

- Genetic health queensland form

- Centrelink earnings worksheet form

- Application for additional provider number for allied health professional form

Find out other Transfer Adjust

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format