PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications

What is the PA Schedule NRH?

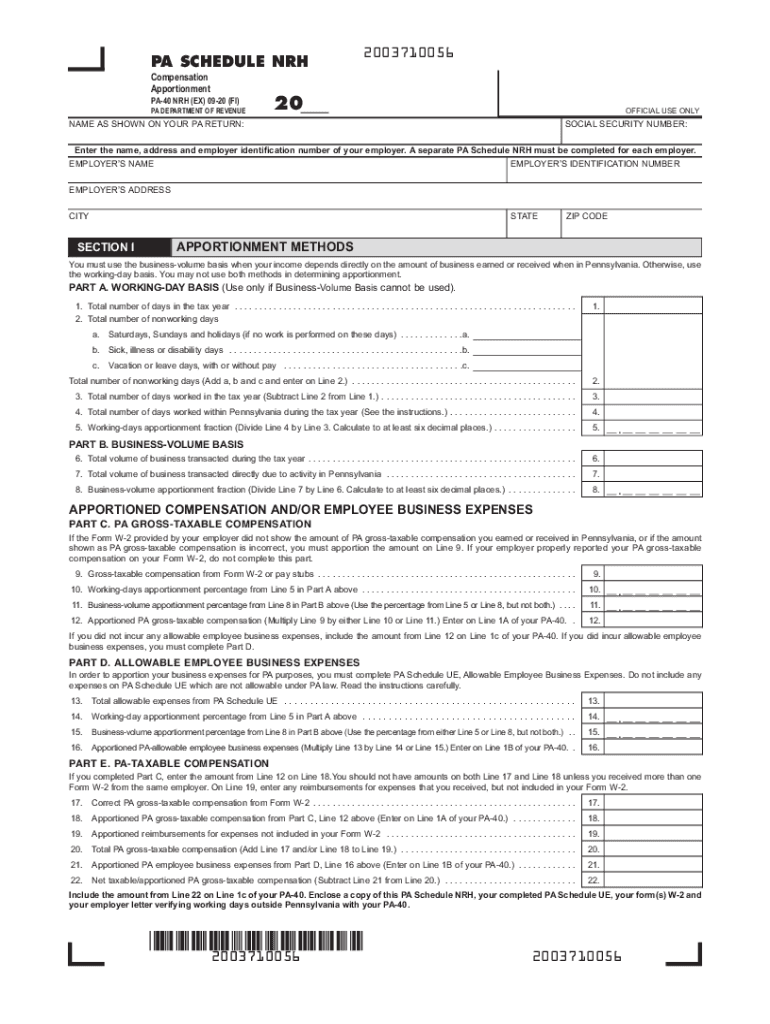

The PA Schedule NRH is a form used for reporting compensation apportionment in Pennsylvania. This form is essential for individuals and businesses that need to allocate their income properly across different jurisdictions. The PA Schedule NRH allows taxpayers to report income earned in Pennsylvania while also claiming credits for taxes paid to other states. Understanding this form is crucial for ensuring compliance with state tax regulations and for optimizing tax liabilities.

Steps to Complete the PA Schedule NRH

Completing the PA Schedule NRH involves several steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including income statements and records of taxes paid to other states. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income earned in Pennsylvania.

- Detail any income earned in other states and the taxes paid on that income.

- Calculate the apportionment percentage based on the income earned in Pennsylvania versus total income.

- Complete any additional sections as required, including credits for taxes paid to other states.

Finally, review the completed form for accuracy before submission.

Legal Use of the PA Schedule NRH

The PA Schedule NRH must be completed in accordance with Pennsylvania tax laws to ensure its legal validity. This form is recognized by the Pennsylvania Department of Revenue and must be filed alongside your PA-40 tax return. Accurate completion of the schedule is necessary to avoid penalties and ensure that your tax obligations are met. It is advisable to consult with a tax professional if you have questions about the legal implications of the information you report.

Filing Deadlines for the PA Schedule NRH

Timely filing of the PA Schedule NRH is crucial for compliance. The deadline for submitting the PA-40 tax return, along with the Schedule NRH, typically falls on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid late fees and penalties.

Required Documents for the PA Schedule NRH

To accurately complete the PA Schedule NRH, you will need several key documents, including:

- Your federal tax return, as it provides a basis for your state filing.

- W-2 forms from employers that show your income.

- 1099 forms for any additional income sources.

- Records of taxes paid to other states, if applicable.

- Any supporting documentation for deductions or credits claimed.

Having these documents ready will streamline the process of completing the form and ensure that all information is accurate.

Examples of Using the PA Schedule NRH

Understanding practical scenarios can help clarify how to effectively use the PA Schedule NRH. For example, if a Pennsylvania resident works in New Jersey and pays state income tax there, they can use the PA Schedule NRH to report their income earned in New Jersey while claiming a credit for the taxes paid. This ensures they do not face double taxation on the same income. Another scenario could involve a business that operates in multiple states, where the schedule helps allocate income appropriately based on where the business activities occur.

Quick guide on how to complete pa schedule nrh compensation apportionment pa 40 nrh formspublications

Effortlessly Prepare PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and electronically sign your documents without any issues. Manage PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications on any platform using airSlate SignNow's Android or iOS apps and enhance any document-based operation today.

How to Modify and eSign PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications with Ease

- Find PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate issues related to lost or misplaced documents, frustrating form searches, or errors that require reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule nrh compensation apportionment pa 40 nrh formspublications

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the pa schedule nrh?

The pa schedule nrh is a specific feature within airSlate SignNow that streamlines the process of managing document signatures and approvals. This tool allows users to effortlessly track and manage their scheduling needs, making it easier to organize workflows efficiently.

-

How does airSlate SignNow's pa schedule nrh improve my business operations?

By utilizing the pa schedule nrh, businesses can enhance their operational efficiency through automated document signing and scheduling. This feature reduces the time spent on manual processes, allowing teams to focus on more critical tasks while ensuring all documents are signed in a timely manner.

-

Is there a cost associated with using the pa schedule nrh feature?

AirSlate SignNow offers flexible pricing plans that include access to the pa schedule nrh feature. Depending on your organization's needs, you can choose a plan that provides appropriate features and benefits, ensuring that your investment aligns with your business goals.

-

Can the pa schedule nrh integrate with other software I use?

Yes, the pa schedule nrh feature supports integrations with various third-party applications and services. This capability allows you to connect your existing workflows and signNowly enhance your document management processes across all the tools you utilize in your business.

-

What types of documents can I manage with the pa schedule nrh?

The pa schedule nrh in airSlate SignNow can handle a wide range of documents, including contracts, agreements, and forms. Whether you're dealing with internal documents or client-facing agreements, this feature provides a streamlined approach to document management and eSigning.

-

How secure is the pa schedule nrh feature with airSlate SignNow?

Security is a top priority for airSlate SignNow, and the pa schedule nrh feature is designed with robust security measures. Your documents are encrypted and stored securely, ensuring that sensitive information remains protected throughout the signing process.

-

Can I track the status of documents signed through pa schedule nrh?

Absolutely! The pa schedule nrh feature includes tracking capabilities that allow you to see the status of each document in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you greater control over your document workflows.

Get more for PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications

- Ohio secretary of state agent notification form for unincorporated nonprofit associations

- Form 522 download printable pdf statement of continued

- Renew indiana timber license form

- Cdr exemption form city of indianapolis indy

- Application for indiana timber buyers license form

- Micro wine wholesaler indiana form

- Business card printing request state of indiana in form

- Printing request form this area for print shop use only

Find out other PA Schedule NRH Compensation Apportionment PA 40 NRH FormsPublications

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple