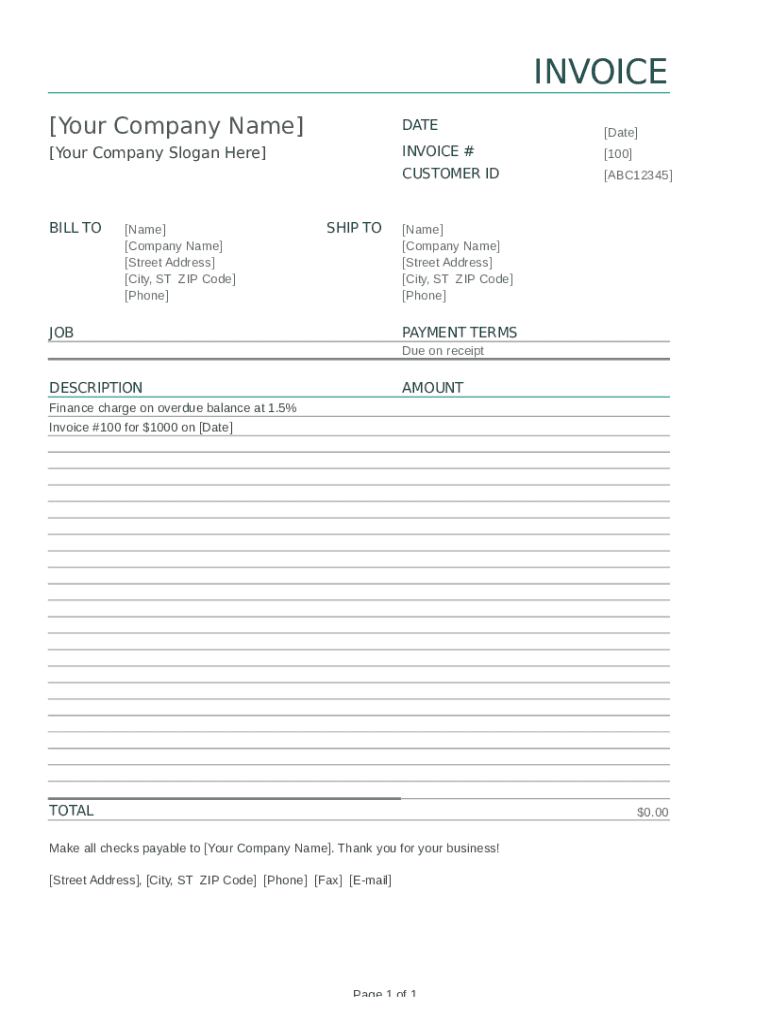

Finance Invoice Editing Template Form

What is the PCC PCI Checklist?

The PCC PCI checklist is a vital tool designed to help organizations assess their compliance with the Payment Card Industry Data Security Standards (PCI DSS). This checklist outlines the necessary steps and requirements for businesses that handle credit card transactions, ensuring that they protect sensitive cardholder data. By following the checklist, businesses can identify gaps in their security measures and implement necessary changes to safeguard against data breaches and fraud.

Key Elements of the PCC PCI Checklist

Understanding the key elements of the PCC PCI checklist is essential for effective compliance. The checklist typically includes the following components:

- Network Security: Ensuring that firewalls and security protocols are in place to protect cardholder data.

- Data Protection: Implementing encryption methods to secure sensitive information during transmission and storage.

- Access Control: Limiting access to cardholder data to only those employees who need it for their job functions.

- Regular Testing: Conducting vulnerability scans and penetration tests to identify and address security weaknesses.

- Monitoring and Logging: Keeping detailed logs of access and activity related to cardholder data to detect and respond to potential security incidents.

Steps to Complete the PCC PCI Checklist

Completing the PCC PCI checklist involves several systematic steps that guide organizations toward compliance:

- Identify Scope: Determine which systems and processes handle cardholder data.

- Assess Current Security Measures: Review existing security protocols and identify areas for improvement.

- Implement Required Changes: Make necessary adjustments to meet PCI DSS requirements based on the checklist.

- Document Compliance: Maintain records of compliance efforts and any changes made to security measures.

- Conduct Regular Reviews: Schedule periodic assessments to ensure ongoing compliance with PCI DSS standards.

Legal Use of the PCC PCI Checklist

Using the PCC PCI checklist is not only a best practice but also a legal requirement for businesses that handle credit card transactions. Compliance with PCI DSS helps organizations avoid legal penalties and reputational damage associated with data breaches. By adhering to the checklist, businesses demonstrate their commitment to protecting customer data and maintaining trust in their operations.

Who Issues the PCC PCI Checklist?

The PCC PCI checklist is developed and maintained by the Payment Card Industry Security Standards Council (PCI SSC). This organization was founded by major credit card companies, including Visa, MasterCard, American Express, Discover, and JCB, to enhance payment card security standards globally. Businesses can access the checklist and other compliance resources through the PCI SSC’s official website.

Penalties for Non-Compliance

Failure to comply with the PCC PCI checklist and the associated PCI DSS can result in significant penalties for businesses. These may include:

- Fines: Organizations may face fines from credit card companies for non-compliance.

- Increased Transaction Fees: Non-compliant businesses may incur higher fees for processing credit card transactions.

- Legal Consequences: Data breaches can lead to lawsuits and liability for damages incurred by affected customers.

- Loss of Reputation: A breach can severely damage a company's reputation, leading to loss of customer trust and business.

Quick guide on how to complete finance invoice editing template

Complete Finance Invoice Editing Template effortlessly on any device

Web-based document management has become favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any setbacks. Handle Finance Invoice Editing Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest way to modify and eSign Finance Invoice Editing Template with ease

- Find Finance Invoice Editing Template and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Finance Invoice Editing Template and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the finance invoice editing template

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the PCC PCI checklist and why is it important?

The PCC PCI checklist is a set of standards designed to enhance security in handling payment card information. Following this checklist is crucial for businesses to minimize data bsignNowes and comply with PCI DSS requirements, ensuring customer trust and financial safety.

-

How can airSlate SignNow help me with the PCC PCI checklist?

airSlate SignNow streamlines the eSigning process while maintaining compliance with the PCC PCI checklist. Our platform ensures that your documents are secure and that sensitive information is handled following industry standards.

-

Is there a cost associated with using airSlate SignNow for PCC PCI compliance?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Investing in our solution provides you with the tools necessary to effectively comply with the PCC PCI checklist, which can save you from costly security bsignNowes.

-

What features does airSlate SignNow offer to support PCC PCI compliance?

Our platform includes features like secure document storage, user authentication, and detailed audit trails, all designed to help you adhere to the PCC PCI checklist. These features ensure your documents are not only legally binding but also protected from unauthorized access.

-

Can airSlate SignNow be integrated with other software for better PCC PCI compliance?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow while ensuring compliance with the PCC PCI checklist. This integration allows for a more cohesive approach to managing sensitive customer data securely.

-

What benefits do businesses gain from following the PCC PCI checklist using airSlate SignNow?

By following the PCC PCI checklist with airSlate SignNow, businesses gain enhanced security, improved customer trust, and streamlined operations. This adherence not only protects your data but also enhances your business reputation in a competitive marketplace.

-

How does airSlate SignNow ensure data security in relation to the PCC PCI checklist?

airSlate SignNow employs advanced encryption methods and complies with industry-standard security practices to ensure data security as per the PCC PCI checklist. This commitment helps protect sensitive information and maintains the integrity of your eSigned documents.

Get more for Finance Invoice Editing Template

Find out other Finance Invoice Editing Template

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement