Kentucky Estimated Tax Voucher Form

What is the Kentucky Estimated Tax Voucher

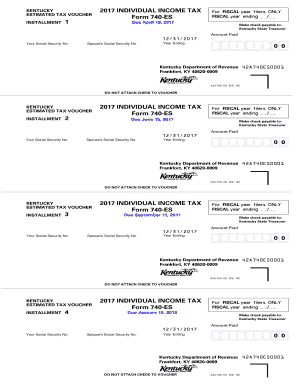

The Kentucky Estimated Tax Voucher is a form used by taxpayers to report and pay estimated income taxes throughout the tax year. This voucher is essential for individuals and businesses that expect to owe tax of $500 or more when filing their annual return. By submitting this form, taxpayers can avoid underpayment penalties and ensure that they are meeting their tax obligations in a timely manner.

How to use the Kentucky Estimated Tax Voucher

Using the Kentucky Estimated Tax Voucher involves several steps. First, taxpayers need to calculate their estimated tax liability for the year based on their expected income. Once the amount is determined, the taxpayer fills out the voucher, indicating the payment amount and the due date. The completed voucher can then be submitted along with the payment to the Kentucky Department of Revenue. It is important to keep a copy of the voucher for personal records.

Steps to complete the Kentucky Estimated Tax Voucher

Completing the Kentucky Estimated Tax Voucher requires careful attention to detail. Follow these steps:

- Determine your estimated income for the year.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the voucher with your personal information, including your name, address, and Social Security number.

- Enter the calculated estimated tax amount and the payment due date.

- Review the form for accuracy and sign it.

Legal use of the Kentucky Estimated Tax Voucher

The Kentucky Estimated Tax Voucher is legally binding when completed correctly. To ensure its validity, taxpayers must adhere to state regulations regarding estimated tax payments. This includes submitting the voucher by the due dates and paying the correct amounts. Failure to comply with these regulations may result in penalties or interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Estimated Tax Voucher are crucial for avoiding penalties. Typically, vouchers are due on the 15th day of April, June, September, and January for the respective quarters. Taxpayers should mark these dates on their calendars to ensure timely submission and avoid any late fees associated with missed payments.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky Estimated Tax Voucher can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Kentucky Department of Revenue's website.

- Mailing the completed voucher to the designated address provided on the form.

- In-person submission at local revenue offices for those who prefer direct interaction.

Penalties for Non-Compliance

Non-compliance with the Kentucky Estimated Tax Voucher requirements can lead to significant penalties. Taxpayers who fail to make estimated payments may face underpayment penalties, which can accumulate over time. Additionally, interest may be charged on any unpaid tax amounts, further increasing the financial burden. It is essential to stay informed about payment obligations to avoid these consequences.

Quick guide on how to complete kentucky estimated tax voucher 2017

Prepare Kentucky Estimated Tax Voucher effortlessly on any device

Digital document management has become popular among organizations and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Kentucky Estimated Tax Voucher on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Kentucky Estimated Tax Voucher with ease

- Access Kentucky Estimated Tax Voucher and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Kentucky Estimated Tax Voucher and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kentucky estimated tax voucher 2017?

The Kentucky estimated tax voucher 2017 is a form used by taxpayers to calculate and remit their estimated tax payments for the state. This voucher helps ensure that individuals and businesses stay compliant with Kentucky tax regulations while minimizing any penalties for underpayment. Using the voucher simplifies the process of making quarterly tax payments.

-

How do I obtain the Kentucky estimated tax voucher 2017?

You can obtain the Kentucky estimated tax voucher 2017 by visiting the Kentucky Department of Revenue's website or through tax preparation software. Many online resources and platforms provide easy access to the required forms, making them easily downloadable for your convenience. Ensure you are using the correct form for the 2017 tax year.

-

What are the pricing options for using airSlate SignNow for the Kentucky estimated tax voucher 2017?

AirSlate SignNow offers various pricing plans designed to fit different business needs, whether you need to electronically sign documents or manage tax forms like the Kentucky estimated tax voucher 2017. Pricing varies from monthly subscriptions to annual plans, providing flexibility based on usage. You can review the pricing structure on the airSlate SignNow website.

-

Can I use airSlate SignNow to eSign the Kentucky estimated tax voucher 2017?

Yes, you can use airSlate SignNow to easily eSign the Kentucky estimated tax voucher 2017. Our platform allows users to electronically sign and send tax documents securely, ensuring a straightforward process. This feature helps speed up the submission of your tax forms while maintaining compliance with legal standards.

-

Does airSlate SignNow offer integrations with accounting software for the Kentucky estimated tax voucher 2017?

AirSlate SignNow integrates seamlessly with several accounting software solutions, which can assist in managing the Kentucky estimated tax voucher 2017. This integration helps streamline workflows by allowing you to collect signatures and access necessary forms directly within your accounting applications. You can check our integrations page for a complete list of compatible software.

-

What are the benefits of using airSlate SignNow for tax forms like the Kentucky estimated tax voucher 2017?

Using airSlate SignNow for tax forms, such as the Kentucky estimated tax voucher 2017, provides multiple benefits including efficiency, ease of use, and improved compliance. Our platform minimizes paperwork, reduces the risk of errors, and allows for real-time tracking of documents. This results in faster submissions and overall time savings.

-

Is airSlate SignNow secure for submitting the Kentucky estimated tax voucher 2017?

Absolutely! AirSlate SignNow places a high priority on security, making it safe for submitting the Kentucky estimated tax voucher 2017. We utilize advanced encryption and authentication measures to protect your sensitive tax information, ensuring that your documents are securely transmitted and stored.

Get more for Kentucky Estimated Tax Voucher

- Transport malta form

- Inz 1178 partnership support form for residence

- Snap reauthorization application for stores reginfo form

- Pptc 040 e adult abroad general passport application for canadians 16 years of age or over applying outside of canada and the form

- Employer name or dba please print form

- Dws ark 237 updated form

- Request for decision on unpaid hp 1 medical bills form

- C4 form fill online printable fillable blankpdffiller

Find out other Kentucky Estimated Tax Voucher

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy