What Form Do I File to Get an Extension of Time for Filing an

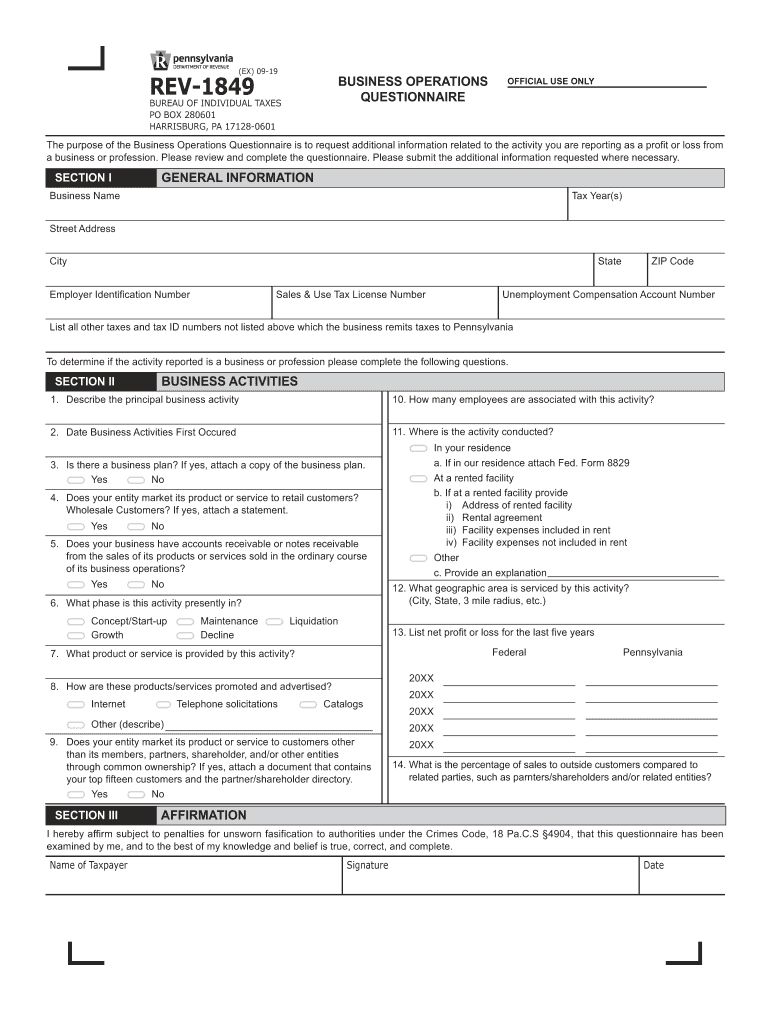

What is the PA 1849 Form?

The PA 1849 form is a document used in Pennsylvania for requesting an extension of time to file certain tax returns. This form is essential for taxpayers who need additional time to prepare their returns without incurring penalties. It is particularly relevant for individuals and businesses that may face challenges in meeting the standard filing deadlines. Understanding the purpose and function of the PA 1849 form is crucial for ensuring compliance with state tax regulations.

How to Use the PA 1849 Form

Using the PA 1849 form involves several straightforward steps. First, obtain the form from the Pennsylvania Department of Revenue’s website or through authorized tax preparation software. Next, fill out the required information, including your personal details and the specific tax return for which you are requesting an extension. Ensure that all fields are completed accurately to avoid delays in processing. Once filled out, submit the form either electronically or by mail, depending on your preference and the guidelines provided by the state.

Steps to Complete the PA 1849 Form

Completing the PA 1849 form requires attention to detail. Follow these steps:

- Download the PA 1849 form from the official website.

- Provide your name, address, and Social Security number or Employer Identification Number.

- Indicate the type of tax return for which you are requesting an extension.

- Specify the tax year relevant to your request.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form by the due date to avoid penalties.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines associated with the PA 1849 form. Generally, the request for an extension must be submitted by the original due date of the tax return. For most individuals, this date is April 15. However, if you are a business entity, the due date may vary. Always check the Pennsylvania Department of Revenue's official calendar for any updates or changes to filing deadlines.

Legal Use of the PA 1849 Form

The PA 1849 form is legally recognized as a valid request for an extension of time to file tax returns in Pennsylvania. When completed and submitted according to the guidelines, it provides taxpayers with additional time to prepare their returns without facing immediate penalties. It is crucial to ensure compliance with state laws when using this form to maintain good standing with the Pennsylvania Department of Revenue.

Required Documents

When filing the PA 1849 form, you may need to provide additional documentation depending on your specific situation. This could include:

- Previous tax returns for reference.

- Income documentation, such as W-2s or 1099s.

- Any correspondence from the Pennsylvania Department of Revenue regarding your tax status.

Having these documents ready can facilitate the completion of the form and ensure that all necessary information is accurately reported.

Quick guide on how to complete what form do i file to get an extension of time for filing an

Prepare What Form Do I File To Get An Extension Of Time For Filing An effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the right format and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage What Form Do I File To Get An Extension Of Time For Filing An on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign What Form Do I File To Get An Extension Of Time For Filing An with ease

- Obtain What Form Do I File To Get An Extension Of Time For Filing An and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign What Form Do I File To Get An Extension Of Time For Filing An while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pa 1849 form and how is it used?

The pa 1849 form is a standard document used in various business transactions. It helps streamline processes by allowing users to eSign and send documents securely. With airSlate SignNow, you can easily create, edit, and manage your pa 1849 forms electronically.

-

What features does airSlate SignNow offer for managing pa 1849 documents?

airSlate SignNow provides a wide range of features for managing pa 1849 documents, including customizable templates, automated workflows, and real-time tracking. Users can securely sign and send these documents from any device, making it an efficient solution for businesses.

-

How much does airSlate SignNow cost for handling pa 1849 forms?

airSlate SignNow offers competitive pricing plans to accommodate different business needs. Depending on your requirements, you'll find a suitable plan for managing pa 1849 forms that can signNowly reduce costs compared to traditional paper-based processes.

-

Can I integrate airSlate SignNow with other software for handling pa 1849?

Yes, airSlate SignNow easily integrates with various software tools, allowing you to manage your pa 1849 workflow seamlessly. Popular integrations include CRMs, cloud storage services, and project management applications, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for pa 1849 documents?

Using airSlate SignNow for your pa 1849 documents offers several benefits, such as increased efficiency, reduced turnaround time, and enhanced security. eSigning documents electronically ensures a smoother workflow and allows for quick access to important documents anytime, anywhere.

-

Is airSlate SignNow secure for signing pa 1849 forms?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your pa 1849 forms. You can trust that your sensitive information is safe while eSigning and managing your documents.

-

Can multiple users collaborate on pa 1849 documents with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on pa 1849 documents in real-time. This feature is especially useful for teams working on important agreements, ensuring everyone stays aligned and can contribute to the process.

Get more for What Form Do I File To Get An Extension Of Time For Filing An

- Cash bond form

- Form 5306 authorization and release for license office management new personnel and officers dor mo

- Ne exemption form

- Nebraska sales tax exempt fillable form

- Pa 34 v1 0pdf revenue nh form

- 2020 new jersey election to participate in a composite return form nj 1080e

- Nj 1080e form

- Form it 210262019certificate of income tax withheldit21026

Find out other What Form Do I File To Get An Extension Of Time For Filing An

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form