Kotak Tds Challan 280 Form

What is the Kotak TDS Challan 280?

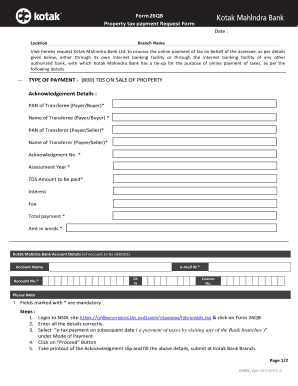

The Kotak TDS Challan 280 is a form used for the payment of tax deducted at source (TDS) to the Indian government. It is specifically designed for taxpayers who need to deposit TDS on income other than salaries. This form is essential for both individuals and businesses that have tax obligations under the Income Tax Act. The Kotak 280 form facilitates the electronic payment of TDS, ensuring compliance with tax regulations while simplifying the process for users.

How to use the Kotak TDS Challan 280

Using the Kotak TDS Challan 280 involves a few straightforward steps. First, access the form online without needing to download it. Fill in the required details, including your PAN, assessment year, and the amount of TDS to be paid. Once completed, submit the form electronically. After submission, you will receive a confirmation receipt, which serves as proof of payment. This process streamlines TDS payments, making it efficient and user-friendly.

Steps to complete the Kotak TDS Challan 280

Completing the Kotak TDS Challan 280 is a simple process. Follow these steps:

- Visit the official Kotak Mahindra Bank website or the designated tax payment portal.

- Select the TDS Challan 280 option.

- Enter your PAN, assessment year, and the relevant details regarding the TDS payment.

- Review the information for accuracy before submitting.

- Submit the form electronically and save the confirmation receipt for your records.

Key elements of the Kotak TDS Challan 280

The Kotak TDS Challan 280 includes several key elements that are crucial for accurate tax payment. These elements consist of:

- PAN: The Permanent Account Number of the taxpayer.

- Assessment Year: The year for which the TDS is being paid.

- Type of Payment: Specifies the nature of income for which TDS is being paid.

- Amount: The total TDS amount to be deposited.

Legal use of the Kotak TDS Challan 280

The Kotak TDS Challan 280 is legally recognized as a valid method for depositing TDS. Compliance with the Income Tax Act is essential, and using this form ensures that taxpayers meet their obligations. The electronic submission of the form provides a secure and efficient way to handle tax payments, while also maintaining a record for future reference. It is important to ensure that all details are accurate to avoid any legal complications.

Form Submission Methods

The Kotak TDS Challan 280 can be submitted electronically, which is the most common method. This online submission process is designed for convenience and efficiency. Users can fill out the form directly on the Kotak Mahindra Bank website or through the official tax payment portal. Alternatively, for those who prefer traditional methods, the form can also be printed and submitted at designated bank branches, although electronic submission is encouraged for its speed and ease.

Quick guide on how to complete kotak tds challan 280

Complete Kotak Tds Challan 280 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Kotak Tds Challan 280 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Kotak Tds Challan 280 with ease

- Find Kotak Tds Challan 280 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Kotak Tds Challan 280 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the kotak mahindra bank challan 280 pdf?

The kotak mahindra bank challan 280 pdf is a standardized form used for making payments to Kotak Mahindra Bank. It includes necessary details like payment amount and account information and can be easily filled and printed for transactions. This PDF format simplifies the payment process for users.

-

How can I download the kotak mahindra bank challan 280 pdf?

You can easily download the kotak mahindra bank challan 280 pdf from the Kotak Mahindra Bank's official website or through specific banking apps. This ensures you have the latest version needed for efficient transactions. Look for the download section related to payment challans.

-

What are the benefits of using the kotak mahindra bank challan 280 pdf?

Using the kotak mahindra bank challan 280 pdf streamlines your payment process by providing a clear format for payments. It also helps in maintaining accurate records and ensures compliance with banking procedures. Additionally, it saves time compared to manual payment methods.

-

Is there a fee for using the kotak mahindra bank challan 280 pdf?

Typically, downloading the kotak mahindra bank challan 280 pdf is free of charge. However, users should confirm with their bank as additional transaction fees might apply depending on the payment method used with the challan. Always check with Kotak Mahindra Bank for any updated fees.

-

Can I fill out the kotak mahindra bank challan 280 pdf online?

Yes, many banking platforms allow users to fill out the kotak mahindra bank challan 280 pdf online before downloading it. This feature ensures you have complete details filled correctly, thus avoiding any errors during the transaction. Check if your banking app supports this functionality.

-

What integrative features does the kotak mahindra bank challan 280 pdf support?

The kotak mahindra bank challan 280 pdf can be integrated with various financial software to simplify payment tracking and record-keeping. This integration makes it easier for businesses to manage payments efficiently. Ensure your software is compatible with the PDF format for seamless use.

-

Are there any specific requirements to use the kotak mahindra bank challan 280 pdf?

To use the kotak mahindra bank challan 280 pdf, users typically need a Kotak Mahindra Bank account and basic details like account number and payment information. It is advisable to have a printer available if you prefer to submit the challan physically at the bank. Ensure all details are accurate to avoid issues.

Get more for Kotak Tds Challan 280

- Mc1054 form

- Criminal record statement california department of social services cdss ca form

- Lab 183 form

- Medicinal marijuana certification forms ny

- Cdph8679 form

- Los angeles county confidential morbidity report of tuberculosis suspects and cases form

- Retirement allowance estimate request calpers cagov form

- Cal pers pers bsd 470 form

Find out other Kotak Tds Challan 280

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF