Nebraska Tax Form 14n

What is the Nebraska Tax Form 14n

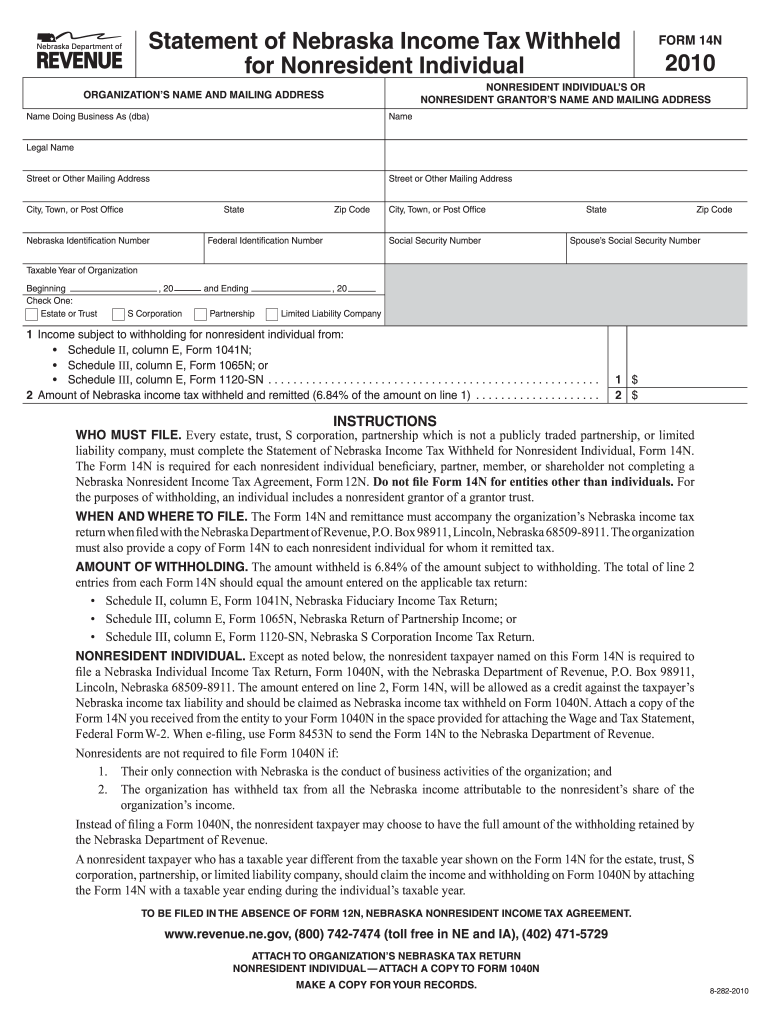

The Nebraska Tax Form 14n is a specific tax form used by individuals and businesses in Nebraska to report income and calculate tax liabilities. This form is essential for ensuring compliance with state tax regulations. It provides a structured way for taxpayers to disclose their financial information to the Nebraska Department of Revenue. Understanding the purpose of this form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Nebraska Tax Form 14n

Using the Nebraska Tax Form 14n involves several steps to ensure that all necessary information is accurately reported. Taxpayers should begin by gathering all relevant financial documents, such as W-2s, 1099s, and any other income statements. Once the required information is collected, individuals can fill out the form, ensuring that each section is completed accurately. After filling out the form, it can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Nebraska Tax Form 14n

Completing the Nebraska Tax Form 14n requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary financial documents, including income statements and deductions.

- Fill out the form with accurate personal and financial information.

- Review the completed form for any errors or omissions.

- Submit the form electronically through approved channels or mail it to the Nebraska Department of Revenue.

Following these steps can help ensure that the form is completed correctly and submitted on time.

Legal use of the Nebraska Tax Form 14n

The legal use of the Nebraska Tax Form 14n is governed by state tax laws. This form must be completed and submitted in accordance with the guidelines set forth by the Nebraska Department of Revenue. To be legally binding, the form must include accurate information and be signed by the taxpayer. Electronic submissions are accepted, provided they comply with eSignature laws, ensuring that the form is valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska Tax Form 14n are critical for compliance. Typically, the form must be filed by April fifteenth of each year for individual taxpayers. Businesses may have different deadlines depending on their fiscal year. It is important to stay informed about these dates to avoid late fees or penalties. Taxpayers should mark their calendars and prepare their documents well in advance of these deadlines.

Who Issues the Form

The Nebraska Tax Form 14n is issued by the Nebraska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance for individuals and businesses to help them understand their tax obligations and complete the necessary forms accurately.

Quick guide on how to complete nebraska tax form 14n

Effortlessly Prepare Nebraska Tax Form 14n on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the proper form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Nebraska Tax Form 14n on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Nebraska Tax Form 14n with Ease

- Find Nebraska Tax Form 14n and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your preference. Modify and eSign Nebraska Tax Form 14n and guarantee effective communication at every stage of the form completion process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Tax Form 14n?

The Nebraska Tax Form 14n is a crucial document used for reporting specific tax information to the Nebraska Department of Revenue. It is essential for businesses and individuals for accurate tax compliance. Understanding how to properly fill out and submit this form can simplify the tax filing process.

-

How can airSlate SignNow assist with the Nebraska Tax Form 14n?

airSlate SignNow makes it easy to send, receive, and eSign the Nebraska Tax Form 14n electronically. Our platform streamlines the document process, ensuring you can manage tax forms efficiently and securely. This helps you stay organized and simplifies your filing tasks.

-

What are the pricing options available for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different needs, including a plan specifically designed for businesses that handle Nebraska Tax Form 14n and similar documents. Each plan provides a mix of features, so customers can choose one that best fits their budget and requirements.

-

What features does airSlate SignNow provide for managing the Nebraska Tax Form 14n?

With airSlate SignNow, you can easily create, customize, and eSign the Nebraska Tax Form 14n. Our platform includes built-in templates, automated workflows, and advanced security features that empower you to manage your tax documents efficiently. These capabilities ensure a seamless experience.

-

Is airSlate SignNow secure for handling sensitive documents like the Nebraska Tax Form 14n?

Yes, airSlate SignNow prioritizes security by utilizing encryption and robust authentication measures to protect your sensitive documents, including the Nebraska Tax Form 14n. You can trust that your data is safe and secure, allowing you to focus on completing your tax forms.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow offers integration with various accounting and tax preparation software, enhancing the usability of the Nebraska Tax Form 14n. This allows for seamless data transfer and better workflow management, making tax preparation more efficient.

-

What are the benefits of using airSlate SignNow for the Nebraska Tax Form 14n?

Using airSlate SignNow for the Nebraska Tax Form 14n provides several benefits, including time-saving electronic signing, easy document sharing, and improved organization. It allows you to manage your tax documents from anywhere, ensuring that you never miss a deadline.

Get more for Nebraska Tax Form 14n

- Non directory form

- Current students winona state university form

- I wish to declare a form

- Classactivity form

- Special events food service application form

- Student life travel liability waiverstudent life travel liability waiver form

- Lutgert college of business application for 5 year msaampampt form

- Mga internship form

Find out other Nebraska Tax Form 14n

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding