Ir372 Form

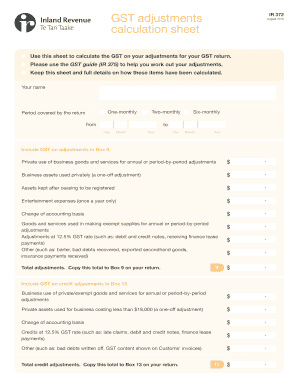

What is the IR-372?

The IR-372 is a form used for reporting specific tax-related information to the Inland Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with tax regulations. It serves as a means to document income, deductions, and other pertinent financial details that may affect tax obligations. Understanding the purpose and requirements of the IR-372 is crucial for accurate tax reporting and avoiding potential penalties.

How to Use the IR-372

Using the IR-372 involves several key steps to ensure that the form is completed accurately. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form by entering the required information in the designated fields. Be sure to review the instructions carefully to ensure compliance with IRS guidelines. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferred submission method.

Steps to Complete the IR-372

Completing the IR-372 requires attention to detail and adherence to specific guidelines. Follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts.

- Access the IR-372 form online or obtain a physical copy.

- Fill in personal information, including your name, address, and Social Security number.

- Input financial data accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS submission guidelines.

Legal Use of the IR-372

The IR-372 must be completed and submitted in accordance with IRS regulations to be considered legally valid. This includes ensuring that all information provided is accurate and truthful. Failure to comply with legal requirements can result in penalties, including fines or audits. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the IR-372 can vary based on individual circumstances, such as whether you are self-employed or filing jointly. Generally, the IRS requires that the form be submitted by April 15 of the tax year. It is essential to stay informed about any changes to deadlines or extensions that may apply. Marking important dates on a calendar can help ensure timely submission and avoid penalties.

Required Documents

To complete the IR-372 accurately, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents readily available will streamline the process of filling out the form and ensure that all necessary information is included.

Quick guide on how to complete ir372

Complete Ir372 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It provides an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the instruments required to create, modify, and eSign your documents swiftly without delays. Manage Ir372 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ir372 without any hassle

- Obtain Ir372 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Ir372 and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow, and how does it relate to inland revenue?

airSlate SignNow is an easy-to-use platform that enables businesses to send and eSign documents efficiently. It simplifies the process of managing contracts and agreements, which is essential for ensuring compliance with inland revenue regulations. By streamlining these workflows, you can save time and reduce the risk of errors.

-

How does airSlate SignNow help with inland revenue compliance?

With airSlate SignNow, businesses can maintain organized digital records of all signed documents, which is crucial for inland revenue compliance. The platform ensures that all signatures are legally binding and securely stored, helping you meet all documentary requirements set by inland revenue authorities. This minimizes the risk of audits and penalties.

-

What features of airSlate SignNow support inland revenue documentation?

airSlate SignNow offers features such as document templates, customizable workflows, and integration with cloud storage, which are essential for managing inland revenue documentation. These tools facilitate quick preparation and signing of documents, ensuring that you can swiftly respond to any requests from inland revenue authorities. Additionally, real-time tracking allows you to monitor document status efficiently.

-

Is airSlate SignNow cost-effective for small businesses dealing with inland revenue?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises navigating inland revenue requirements. With a flexible pricing structure, you can choose a plan that fits your budget while still gaining access to powerful features that enhance your document management processes. This allows small businesses to remain compliant without overspending.

-

Can airSlate SignNow integrate with existing accounting software for inland revenue purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, making it easier to manage documents related to inland revenue. This integration helps streamline your workflows by allowing you to send, sign, and store documents directly from your existing accounting system, reducing the chances of errors and ensuring compliance.

-

What are the benefits of using airSlate SignNow for inland revenue documentation?

Using airSlate SignNow for inland revenue documentation offers numerous benefits, including reduced paper usage, enhanced workflow automation, and faster turnaround times for signed documents. The platform also provides security features that protect sensitive data, ensuring you are always compliant with inland revenue standards. This ultimately leads to increased efficiency and productivity in your business.

-

How does airSlate SignNow ensure the security of documents required by inland revenue?

airSlate SignNow takes document security seriously, employing advanced encryption methods to protect all files. This is vital for documents that need to be submitted to inland revenue to prevent unauthorized access. Additionally, the platform offers access controls and audit trails, ensuring compliance and enhancing the security of your critical information.

Get more for Ir372

- Dhs wisconsin form

- Demographic data patient information

- Dph 4151 form

- Fillable online policy name fees policy department finance form

- Wisconsin blood lead registry organization security and confidentiality agreement form

- Lyme disease case worksheet form

- Release of confidential information authorization for wisconsin medicaid badgercare plus foodshare family planning only

- The wir user agreement f 42008a form

Find out other Ir372

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself