05305 Alaska Department of Revenue Permanent Fund Dividend Form

What is the Alaska Department Of Revenue Permanent Fund Dividend?

The Alaska Department of Revenue Permanent Fund Dividend (PFD) is a program that distributes a portion of the state's oil revenues to eligible residents. This annual payment is designed to share the wealth generated from Alaska's natural resources with its citizens. The amount of the dividend varies each year based on the earnings of the Permanent Fund, which is invested in various assets. Residents must meet specific eligibility criteria to qualify for the PFD, which includes being a resident of Alaska for at least one calendar year and not being convicted of certain felonies.

How to obtain the Alaska Department Of Revenue Permanent Fund Dividend

To obtain the Alaska PFD, residents must complete an application process through the Alaska Department of Revenue. Applications can be submitted online, by mail, or in person. It is essential to provide accurate information, including your Social Security number and proof of residency. The application period typically opens on January 1 and closes on March 31 each year. Residents are encouraged to apply early to ensure they meet the deadline and receive their dividend in a timely manner.

Steps to complete the Alaska Department Of Revenue Permanent Fund Dividend

Completing the Alaska PFD application involves several key steps:

- Gather required documents, such as your Social Security number and proof of residency.

- Visit the Alaska Department of Revenue website or designated application centers.

- Fill out the application form accurately, ensuring all information is correct.

- Submit your application by the deadline, either online or by mail.

- Monitor your application status through the Alaska Department of Revenue portal.

Eligibility Criteria for the Alaska Department Of Revenue Permanent Fund Dividend

To be eligible for the Alaska PFD, applicants must meet specific criteria, including:

- Being a resident of Alaska for at least one full calendar year.

- Being a U.S. citizen or a qualified alien.

- Not having been convicted of a felony involving moral turpitude, unless you have completed your sentence.

- Providing accurate information on the application, including Social Security number.

Filing Deadlines / Important Dates for the Alaska Department Of Revenue Permanent Fund Dividend

Key dates for the Alaska PFD application process include:

- Application period opens: January 1

- Application period closes: March 31

- Dividend payments typically issued: Early October

IRS Guidelines for the Alaska Department Of Revenue Permanent Fund Dividend

The IRS considers the Alaska PFD as taxable income for federal tax purposes. Recipients must report the amount received on their federal tax returns. It is advisable to keep a record of the PFD amount, as it will be reported on the Form 1099-MISC, which is issued by the Alaska Department of Revenue. Understanding how the PFD affects your tax situation is essential for accurate filing and compliance with IRS regulations.

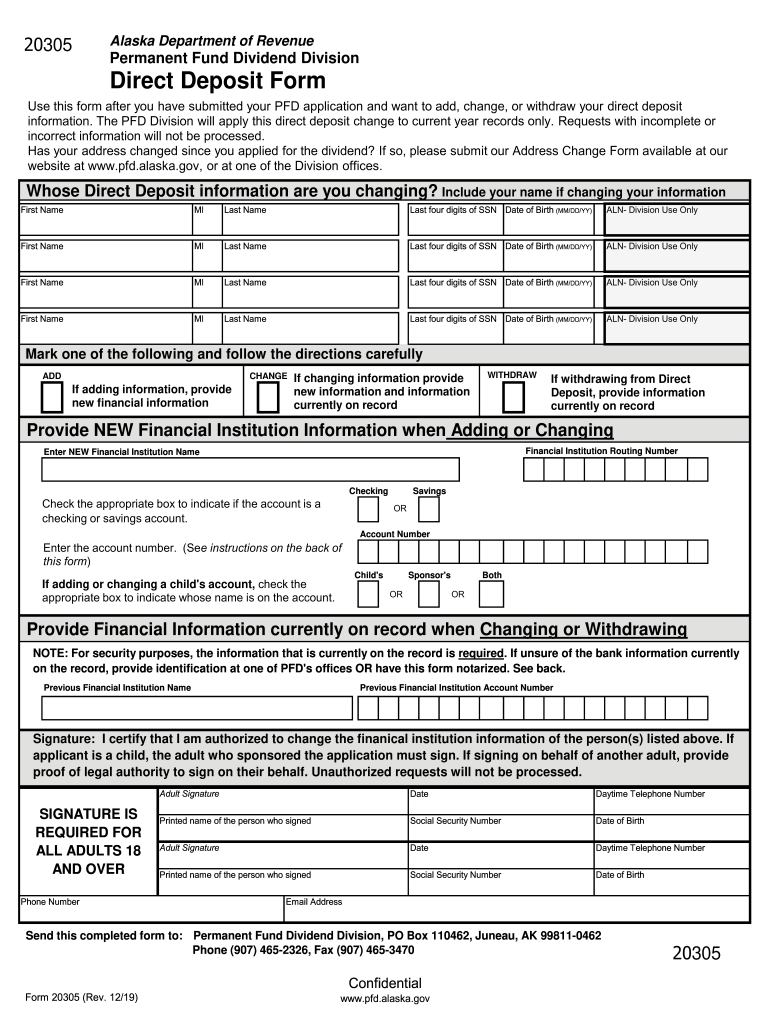

Quick guide on how to complete 05305 alaska department of revenue permanent fund dividend

Prepare 05305 Alaska Department Of Revenue Permanent Fund Dividend seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage 05305 Alaska Department Of Revenue Permanent Fund Dividend on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The easiest way to edit and electronically sign 05305 Alaska Department Of Revenue Permanent Fund Dividend effortlessly

- Find 05305 Alaska Department Of Revenue Permanent Fund Dividend and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign 05305 Alaska Department Of Revenue Permanent Fund Dividend and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Alaska PFD 1099?

An Alaska PFD 1099 is a tax form issued to residents of Alaska that records the annual Permanent Fund Dividend issued by the state. This form is important for reporting the dividend income on your tax returns. It is essential for understanding how this income impacts your overall financial situation.

-

How do I obtain my Alaska PFD 1099?

You can obtain your Alaska PFD 1099 through the Alaska Department of Revenue's website or by contacting their office directly. The form is usually available online after the dividends are distributed each year, making it convenient for residents to access their tax documents.

-

Is the Alaska PFD 1099 taxable?

Yes, the Alaska PFD 1099 amount is considered taxable income at the federal level. However, it is not taxed by the state of Alaska, which can benefit residents financially. It’s important to report this income when filing your federal taxes to avoid any discrepancies.

-

How does airSlate SignNow assist with Alaska PFD 1099 documents?

airSlate SignNow streamlines the process of managing and eSigning documents related to your Alaska PFD 1099. With our platform, you can easily send, receive, and store important financial documents securely. This simplifies not only your tax documentation but also ensures compliance and peace of mind.

-

What features does airSlate SignNow offer for eSigning Alaska PFD 1099 forms?

airSlate SignNow provides features like customizable templates, real-time notifications, and secure cloud storage for easy management of your Alaska PFD 1099 forms. These tools enhance collaboration and ensure your documents are signed by the right people without delays or complications.

-

Can I integrate airSlate SignNow with other software for managing Alaska PFD 1099?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as cloud storage solutions and accounting software. This allows you to manage your Alaska PFD 1099 alongside other financial documents efficiently, optimizing your workflow and organization.

-

What are the benefits of using airSlate SignNow for my Alaska PFD 1099?

Using airSlate SignNow for your Alaska PFD 1099 provides enhanced security, convenience, and compliance. It helps you save time by reducing the need for physical paperwork, making document management and tax preparation more efficient. You can also track the status of your eSigned documents in real time.

Get more for 05305 Alaska Department Of Revenue Permanent Fund Dividend

- Certificate of completion of limited appearance connecticut judicial form

- Interstate compact for juvenilestake into custody application and orderdelinquent child form

- Eeoc sues ccc group for racial harassmentus equal form

- Aoc int 6 form

- Code pj or form

- Self help forms kentucky justice online

- Form aoc jv 29 download fillable pdf or fill online order

- Aoc jv 1 doc type pj juvenile id kycourtsgov form

Find out other 05305 Alaska Department Of Revenue Permanent Fund Dividend

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template