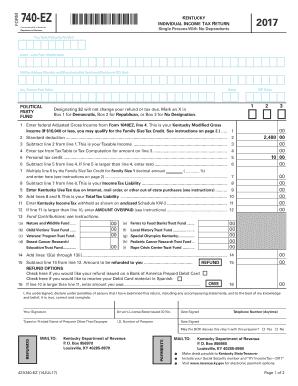

Kentucky 740 Tax Form

What is the Kentucky 740 Tax Form

The Kentucky 740 tax form is a state income tax return used by residents of Kentucky to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state, as it determines how much tax they owe to the state government. The Kentucky 740 is designed for taxpayers who have a more complex tax situation, including those with various sources of income, deductions, and credits. It is important to understand the purpose of this form to ensure accurate reporting and compliance with state tax laws.

How to use the Kentucky 740 Tax Form

Using the Kentucky 740 tax form involves several steps to ensure that all income and deductions are reported accurately. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. After collecting these documents, individuals can fill out the form by entering their income, calculating deductions, and determining their tax liability. It is crucial to follow the instructions provided with the form to ensure correct completion. Additionally, taxpayers may benefit from using electronic tools for filling out and eSigning the form to streamline the process.

Steps to complete the Kentucky 740 Tax Form

Completing the Kentucky 740 tax form requires careful attention to detail. Here are the steps to follow:

- Gather all income documents, including W-2s and 1099s.

- Review the instructions for the Kentucky 740 to understand the required sections.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income in the appropriate sections of the form.

- Calculate any deductions you are eligible for, such as standard or itemized deductions.

- Determine your tax liability based on the income reported and deductions taken.

- Sign and date the form, ensuring all information is accurate before submission.

Legal use of the Kentucky 740 Tax Form

The Kentucky 740 tax form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Utilizing a reliable eSignature platform can help maintain compliance and enhance the security of the document during submission.

Required Documents

When completing the Kentucky 740 tax form, certain documents are required to support the information reported. These documents typically include:

- W-2 forms from employers that detail annual earnings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expense receipts.

- Any previous year tax returns, if applicable, for reference.

Form Submission Methods

The Kentucky 740 tax form can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online submission via the Kentucky Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete kentucky 740 tax form

Effortlessly Prepare Kentucky 740 Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Kentucky 740 Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Most Efficient Way to Edit and eSign Kentucky 740 Tax Form with Ease

- Find Kentucky 740 Tax Form and click on Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to preserve your changes.

- Choose your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Kentucky 740 Tax Form to achieve seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kentucky Form 740 and why is it important?

The Kentucky Form 740 is the state income tax form required for individuals to report their taxable income in Kentucky. It is essential for ensuring compliance with state tax laws and allows residents to accurately calculate their tax liabilities or refunds. Using airSlate SignNow, you can easily eSign and submit your Kentucky Form 740 without hassle.

-

How can airSlate SignNow help me with the Kentucky Form 740?

airSlate SignNow provides a user-friendly platform for electronically signing and sending your Kentucky Form 740. With our tool, you can ensure secure document handling and eliminate the need for printing and mailing. This streamlines the filing process, making it straightforward and efficient for tax season.

-

Is there a cost associated with using airSlate SignNow for the Kentucky Form 740?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including costs for eSigning documents like the Kentucky Form 740. Our solutions are cost-effective, ensuring you receive value for the features that facilitate seamless document management. Check out our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for managing the Kentucky Form 740?

airSlate SignNow includes several features such as electronic signatures, document templates, and secure cloud storage for managing your Kentucky Form 740. Our platform also supports real-time collaboration with team members, making it easy to complete and review tax forms efficiently. Additionally, document tracking helps you stay updated on the status of your submissions.

-

Can I integrate airSlate SignNow with other software for filing Kentucky Form 740?

Yes, airSlate SignNow easily integrates with numerous third-party applications, enhancing your workflow when completing the Kentucky Form 740. Our integrations facilitate seamless data transfer between your existing tools and our platform. This allows for an optimized filing experience, saving you time and reducing errors.

-

What benefits can I expect from using airSlate SignNow for my Kentucky Form 740?

Using airSlate SignNow for your Kentucky Form 740 offers numerous benefits, including enhanced efficiency, security, and cost savings. Our platform enables you to sign and send your documents from anywhere, which is ideal for busy tax seasons. Additionally, our secure storage ensures that your sensitive information is well-protected.

-

Is it safe to eSign the Kentucky Form 740 with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption protocols to ensure the safety of your Kentucky Form 740 and other sensitive documents. Our platform is compliant with legal requirements for eSignature acceptance, giving you peace of mind when signing tax forms online.

Get more for Kentucky 740 Tax Form

- Vodafone net iptal formu

- Ems grade 9 exam papers form

- Hojas pentagramadas para imprimir word form

- Fiche de renseignement visa etudiant form

- Pdf to word converter online tool convert pdf to doc form

- Food fishery disability application form 2021

- Louisiana power of attorney form

- Third and final call mendocino county civil grand jury form

Find out other Kentucky 740 Tax Form

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed