40a102 2011-2026

What is the 40a102

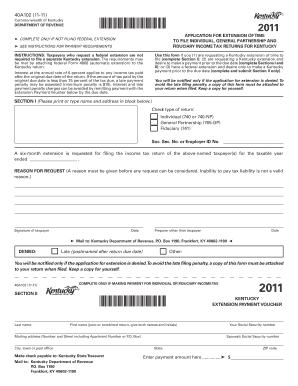

The 40a102 is a form used in Kentucky, primarily for tax-related purposes. It serves as an essential document for individuals and businesses to report specific financial information to the state. Understanding the purpose and requirements of the 40a102 is crucial for compliance with Kentucky tax laws. This form may be required for various tax filings, including income tax returns, and is a vital part of maintaining accurate financial records.

How to use the 40a102

Using the 40a102 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information required for the form. This may include income statements, deductions, and other relevant financial data. Next, fill out the form carefully, ensuring that all sections are completed accurately to avoid delays or penalties. Once completed, the form can be submitted to the appropriate state tax authority, either electronically or by mail.

Steps to complete the 40a102

Completing the 40a102 requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documentation, including income statements and deduction records.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, based on your preference and the requirements.

Legal use of the 40a102

The 40a102 must be used in accordance with Kentucky tax laws to ensure its legal validity. This means that all information provided must be truthful and accurate. Misrepresentation or errors can lead to legal penalties or issues with the state tax authority. It is important to keep a copy of the submitted form and any supporting documents for your records, as they may be required for future reference or audits.

Who Issues the Form

The 40a102 is issued by the Kentucky Department of Revenue. This state agency is responsible for managing tax-related forms and ensuring compliance with tax regulations. If you have questions about the form or need assistance, contacting the Kentucky Department of Revenue can provide you with the necessary guidance.

Form Submission Methods

The 40a102 can be submitted through various methods, providing flexibility for users. You can choose to file the form electronically via the Kentucky Department of Revenue's online portal, which may offer quicker processing times. Alternatively, you can print the completed form and mail it to the designated address provided in the instructions. In-person submissions may also be possible at local tax offices, depending on the specific guidelines set by the state.

Quick guide on how to complete 40a102

Complete 40a102 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to quickly create, modify, and eSign your documents without unnecessary delays. Handle 40a102 on any platform using airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

The easiest way to modify and eSign 40a102 effortlessly

- Obtain 40a102 and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize essential sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you want to share your form: via email, text message (SMS), an invite link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, the hassle of tedious form searching, or mistakes requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign 40a102 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ky 40a102 and how does it relate to airSlate SignNow?

Ky 40a102 is a crucial part of our document management system, enabling users to easily eSign documents and streamline their workflows. With this designation, airSlate SignNow enhances signature processes while ensuring compliance and security. Businesses leveraging ky 40a102 can benefit from improved efficiency in managing their paperwork.

-

What features does airSlate SignNow offer that utilize ky 40a102?

airSlate SignNow incorporates ky 40a102 to provide essential features such as customizable templates, advanced tracking, and secure cloud storage. This integration ensures that users can manage documents effortlessly while maintaining compliance with legal standards. Each feature linked to ky 40a102 is designed to streamline your document workflows.

-

How much does airSlate SignNow cost for users interested in ky 40a102?

Pricing for airSlate SignNow varies based on your specific needs, but it remains affordable and competitive for businesses looking to use ky 40a102. We offer different tiers to accommodate various user requirements, ensuring that you get the right plan to access the features associated with ky 40a102 without breaking the bank.

-

What are the benefits of using airSlate SignNow with ky 40a102?

Using airSlate SignNow with ky 40a102 allows businesses to enhance their document management processes by enabling easy electronic signatures. This can signNowly reduce turnaround times for approvals and improve organizational efficiency. Additionally, ky 40a102 ensures that your documents are handled securely and in compliance with relevant laws.

-

Can I integrate airSlate SignNow with other software while utilizing ky 40a102?

Yes, airSlate SignNow offers integrations with various third-party applications, which is optimized under the ky 40a102 framework. This means you can connect your existing systems seamlessly, allowing for a smoother workflow and enhanced productivity. Popular integrations include CRM systems, cloud storage solutions, and project management tools.

-

Is ky 40a102 compliant with legal e-signature laws?

Absolutely, ky 40a102 in airSlate SignNow is designed to comply with major legal e-signature acts, such as ESIGN and UETA. This compliance ensures that documents signed using ky 40a102 are legally binding and recognized by various jurisdictions. Users can confidently utilize airSlate SignNow for their electronic signature needs.

-

How secure is airSlate SignNow when using ky 40a102?

Security is a top priority at airSlate SignNow, especially when utilizing ky 40a102. The platform employs advanced encryption and security measures to protect sensitive information during document transmission and storage. Businesses can rely on ky 40a102 for a secure e-signature process that safeguards their data.

Get more for 40a102

- Through a third party form

- Agreement to furnish respite care form

- Request for verification of life insurance policy nd form

- Physician certification and recertificationampquot keyword found form

- Icfiid physician certification and recertification form

- Authorization to disclose information 5 ndgov

- Free through recovery ftr program provider application north dakota state government form

- Personalized recovery oriented services st marys healthcare form

Find out other 40a102

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed