Ma State Tax Form 2 Fillable

What is the Massachusetts State Tax Form 2 Fillable

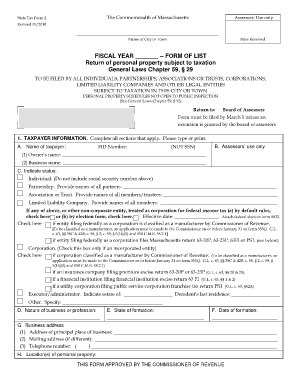

The Massachusetts State Tax Form 2 is designed for individuals who are required to file their state income taxes. This form is specifically used by residents and non-residents who have income sourced from Massachusetts. The form allows taxpayers to report their income, claim deductions, and calculate their tax liability. A fillable version of the form is available online, enabling users to complete it digitally, which can streamline the filing process.

How to Use the Massachusetts State Tax Form 2 Fillable

Using the fillable Massachusetts State Tax Form 2 is straightforward. First, access the form through a reliable source that offers it in a digital format. Once you have the form open, you can enter your information directly into the fields provided. This includes personal details, income information, and any deductions you wish to claim. After filling out the necessary sections, you can save the completed form for your records or proceed to submit it as required.

Steps to Complete the Massachusetts State Tax Form 2 Fillable

Completing the Massachusetts State Tax Form 2 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Open the fillable form and enter your personal information, such as your name, address, and Social Security number.

- Input your income details in the appropriate sections, ensuring accuracy to avoid issues.

- Claim any deductions or credits you are eligible for, which can reduce your overall tax liability.

- Review the completed form for any errors or omissions before finalizing it.

Legal Use of the Massachusetts State Tax Form 2 Fillable

The Massachusetts State Tax Form 2 is legally binding once it is properly completed and signed. To ensure its validity, you must adhere to the state’s regulations regarding eSignatures and electronic submissions. Using a secure platform that complies with legal standards, such as ESIGN and UETA, can help confirm that your electronic signature is recognized by the state. This is crucial for maintaining the integrity of your submission.

Key Elements of the Massachusetts State Tax Form 2 Fillable

Several key elements are essential when filling out the Massachusetts State Tax Form 2:

- Personal Information: This includes your name, address, and Social Security number.

- Income Reporting: You must accurately report all sources of income.

- Deductions and Credits: Identify any deductions or credits that apply to your situation.

- Signature: An electronic signature is required to validate the form.

Form Submission Methods

The completed Massachusetts State Tax Form 2 can be submitted in various ways. Taxpayers have the option to file online through the Massachusetts Department of Revenue website, which is often the quickest method. Alternatively, you can mail a printed copy of the form to the appropriate address or, in some cases, submit it in person at designated locations. Each method has its own processing times and requirements, so be sure to choose the one that best fits your needs.

Quick guide on how to complete ma state tax form 2 fillable

Easily prepare Ma State Tax Form 2 Fillable on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ma State Tax Form 2 Fillable on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Ma State Tax Form 2 Fillable effortlessly

- Find Ma State Tax Form 2 Fillable and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ma State Tax Form 2 Fillable to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Massachusetts State Tax Form 2?

The Massachusetts State Tax Form 2 is used by individual taxpayers to report their income and calculate their state tax liabilities. This form is crucial for accurately assessing your tax obligations in Massachusetts, ensuring compliance with state tax laws.

-

How can airSlate SignNow assist with the Massachusetts State Tax Form 2?

airSlate SignNow offers a streamlined process for completing and eSigning the Massachusetts State Tax Form 2 securely. Our user-friendly platform allows you to fill out the form digitally, saving time and reducing paper clutter while ensuring all your sensitive data is protected.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts State Tax Form 2?

Yes, there is a competitive pricing structure for using airSlate SignNow, which allows you to easily manage the Massachusetts State Tax Form 2 alongside other documents. Our plans cater to different business needs, ensuring you have access to an affordable yet effective solution for document signing and management.

-

What features does airSlate SignNow provide for the Massachusetts State Tax Form 2?

airSlate SignNow includes features such as electronic signatures, document templates, and secure data storage that simplify the handling of the Massachusetts State Tax Form 2. Additionally, our platform makes collaboration easy with real-time updates and notifications, streamlining the entire eSignature process.

-

Can I integrate airSlate SignNow with other software to handle the Massachusetts State Tax Form 2?

Absolutely! airSlate SignNow seamlessly integrates with many popular applications including CRM systems and cloud storage solutions. This integration capability enhances your workflow for managing the Massachusetts State Tax Form 2 and other documents, promoting efficiency across your operations.

-

Are the signatures on the Massachusetts State Tax Form 2 legally binding with airSlate SignNow?

Yes, signatures collected through airSlate SignNow are legally binding and compliant with state and federal regulations. Thus, when you use airSlate SignNow for the Massachusetts State Tax Form 2, you can be assured that your eSignatures hold legal weight just like traditional ink signatures.

-

How does airSlate SignNow enhance security for the Massachusetts State Tax Form 2?

airSlate SignNow prioritizes security with features like encryption and secure access controls to protect your Massachusetts State Tax Form 2 data. Our platform ensures that only authorized users can access documents, safeguarding sensitive tax information from unauthorized access.

Get more for Ma State Tax Form 2 Fillable

- Va form 24 0296 printable

- Image 162160402576012 999998868687012 httppbstwimgcom form

- Expiration date 05312021 form

- Request for determination of reasonable veterans affairs form

- Fillable online tax ohio it1040ez form 2014 fax email

- Certificate of affirmation of veterans affairs form

- Request for determination of loan veterans affairs form

- How to file a claim for survivor benefits under the eeoicpa form

Find out other Ma State Tax Form 2 Fillable

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament