REV185b, Authorization to Release Business Tax Information

What is the REV185b, Authorization To Release Business Tax Information

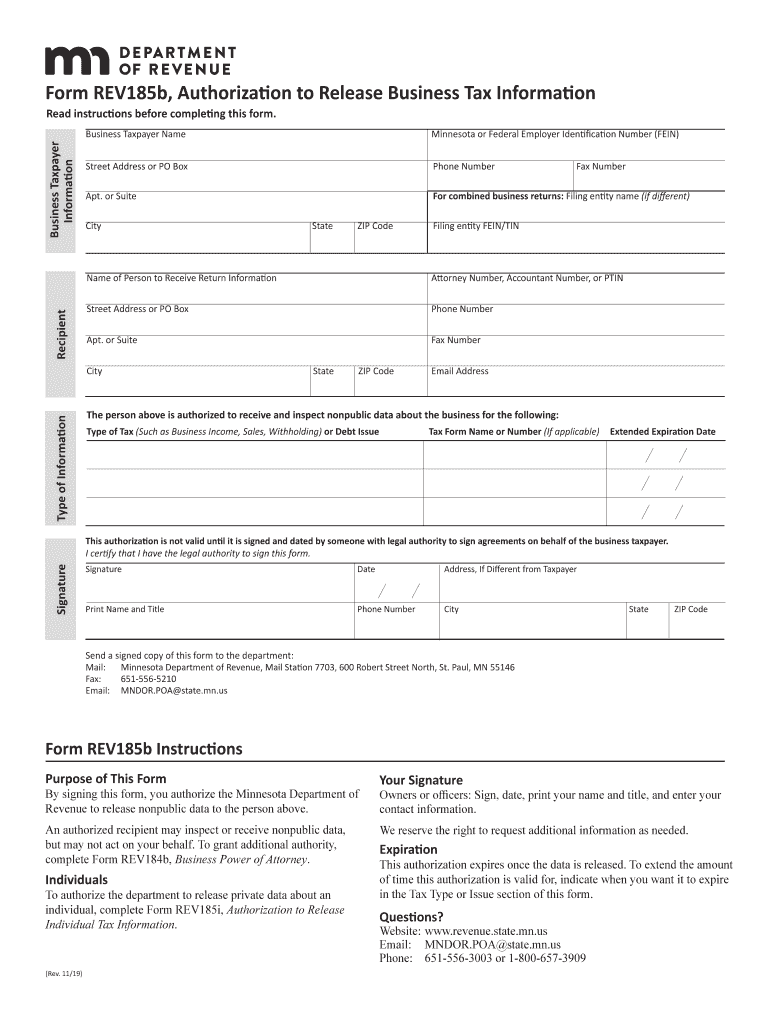

The REV185b form serves as an authorization document that allows businesses to release their tax information to designated third parties. This form is crucial for ensuring that sensitive tax data can be shared legally and securely. It is particularly important for businesses that require assistance from accountants, tax preparers, or other financial professionals. By completing the REV185b, businesses can facilitate the process of obtaining necessary tax documents while maintaining compliance with federal regulations.

How to use the REV185b, Authorization To Release Business Tax Information

Using the REV185b form involves several straightforward steps. First, ensure that you have the correct version of the form, as outdated forms may not be accepted. Next, fill out the required fields, including the business name, tax identification number, and the details of the third party receiving the information. It is essential to provide accurate information to avoid delays. Once completed, sign and date the form to validate the authorization. Finally, submit the form to the appropriate tax authority or the designated third party as instructed.

Steps to complete the REV185b, Authorization To Release Business Tax Information

Completing the REV185b involves a systematic approach:

- Obtain the latest version of the REV185b form from a reliable source.

- Fill in the business's name and tax identification number accurately.

- Provide the name and contact information of the third party authorized to receive the tax information.

- Specify the type of information being released, ensuring clarity on what data is included.

- Sign and date the form to confirm your authorization.

- Submit the completed form according to the instructions provided.

Legal use of the REV185b, Authorization To Release Business Tax Information

The REV185b form is legally binding when completed correctly and signed by the authorized representative of the business. It complies with various federal regulations governing the release of tax information. To ensure its legal validity, the form must be filled out with accurate details, and any required signatures must be obtained. Additionally, it is advisable to keep a copy of the completed form for your records, as this may be necessary for future reference or audits.

Key elements of the REV185b, Authorization To Release Business Tax Information

Several key elements define the REV185b form:

- Business Information: Includes the legal name and tax identification number of the business.

- Authorized Party Details: Information about the individual or organization authorized to receive the tax information.

- Scope of Authorization: Specifies what information is being released, ensuring clarity and compliance.

- Signatures: Required signatures from the business representative to validate the authorization.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the REV185b form. It is essential to follow these guidelines to ensure compliance and avoid potential penalties. The IRS emphasizes the importance of obtaining proper authorization before releasing sensitive tax information. Additionally, businesses should be aware of the specific circumstances under which the REV185b can be utilized, as outlined in IRS publications. Staying informed about these guidelines helps maintain compliance and protects both the business and the authorized recipient.

Quick guide on how to complete rev185b authorization to release business tax information

Effortlessly Prepare REV185b, Authorization To Release Business Tax Information on Any Device

Digital document management has gained considerable traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage REV185b, Authorization To Release Business Tax Information on any platform using airSlate SignNow’s Android or iOS applications, and simplify any document-related process today.

How to Edit and eSign REV185b, Authorization To Release Business Tax Information with Ease

- Obtain REV185b, Authorization To Release Business Tax Information and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Revise and electronically sign REV185b, Authorization To Release Business Tax Information while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is rev185b and how does it relate to airSlate SignNow?

Rev185b is a powerful feature within airSlate SignNow that streamlines the document signing process. It offers businesses a secure and efficient way to manage eSignatures, improving workflow and reducing turnaround time.

-

What are the pricing options for airSlate SignNow with rev185b?

AirSlate SignNow offers flexible pricing options for businesses looking to use rev185b. Depending on the size of your organization and the number of users, you can choose from several plans that fit your budget while providing full access to all features of rev185b.

-

What features does rev185b offer for document management?

Rev185b includes features such as customizable templates, automated workflows, and real-time tracking for document status. These features empower users to monitor progress and manage their documents efficiently through airSlate SignNow.

-

How does rev185b benefit businesses using airSlate SignNow?

Businesses can benefit from rev185b by enhancing productivity and reducing time spent on manual document handling. The ease of use and cost-effectiveness of airSlate SignNow with rev185b allows companies to focus on their core operations while ensuring compliance and security.

-

Can rev185b integrate with other tools and platforms?

Yes, rev185b can seamlessly integrate with various tools and platforms, enhancing your workflow. Integrations with CRM systems like Salesforce and document storage solutions such as Google Drive help businesses to maintain their preferred workflows within airSlate SignNow.

-

Is it easy to implement rev185b in my existing processes?

Implementing rev185b into your existing processes is straightforward with airSlate SignNow. The user-friendly interface and comprehensive support resources ensure that you can quickly adapt to this feature without major disruptions.

-

What types of businesses can benefit from rev185b?

Rev185b is designed to benefit a wide range of businesses, from startups to large enterprises. Any organization that requires efficient document management and eSignature solutions can leverage the capabilities of airSlate SignNow.

Get more for REV185b, Authorization To Release Business Tax Information

Find out other REV185b, Authorization To Release Business Tax Information

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors