IFTA Annual Tax Return LC 05 03 17 Calculated PDF Form

What is the IFTA Annual Tax Return LC 05 03 17 Calculated pdf

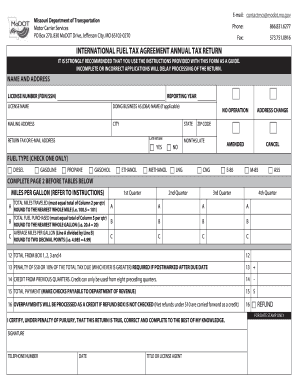

The IFTA Annual Tax Return LC 05 03 17 Calculated pdf is a crucial document for businesses operating in multiple jurisdictions that require compliance with the International Fuel Tax Agreement (IFTA). This form is specifically designed to report fuel usage and miles traveled in each member jurisdiction. The calculated version allows users to input data and automatically generate tax calculations, simplifying the process of filing. This form is essential for ensuring that fuel taxes are accurately reported and paid to the appropriate authorities, helping businesses avoid penalties and maintain compliance.

Steps to complete the IFTA Annual Tax Return LC 05 03 17 Calculated pdf

Completing the IFTA Annual Tax Return LC 05 03 17 Calculated pdf involves several key steps. First, gather all necessary data, including total miles driven and fuel purchased in each jurisdiction. Next, input this information into the designated fields of the form. The calculated pdf will automatically compute the tax owed based on the provided data. Review the calculations for accuracy before signing the document. Finally, ensure that the form is submitted by the appropriate deadline to avoid any penalties. Utilizing digital tools can streamline this process, making it more efficient and less prone to errors.

Legal use of the IFTA Annual Tax Return LC 05 03 17 Calculated pdf

The legal use of the IFTA Annual Tax Return LC 05 03 17 Calculated pdf hinges on compliance with various regulations governing eSignatures and digital documentation. To ensure the form is legally binding, it must be signed using a secure electronic signature solution that complies with the ESIGN Act and UETA. This means that the signature must meet specific criteria, such as verifying the signer's identity and maintaining a secure audit trail. By adhering to these legal standards, businesses can confidently submit their tax returns without concerns about validity.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Annual Tax Return LC 05 03 17 Calculated pdf are critical for compliance. Typically, the return is due on the last day of the month following the end of the reporting period, which is usually the end of the calendar year. It is essential for businesses to mark this date on their calendars to ensure timely submission. Late filings can result in penalties and interest charges, making adherence to these deadlines vital for maintaining good standing with tax authorities.

Required Documents

To complete the IFTA Annual Tax Return LC 05 03 17 Calculated pdf, several documents are necessary. Businesses should gather records of fuel purchases, mileage logs, and any previous IFTA returns. Additionally, documentation that verifies the business's operations in different jurisdictions may be required. Having these documents organized and accessible will facilitate the completion of the form and ensure accurate reporting of fuel usage and taxes owed.

Who Issues the Form

The IFTA Annual Tax Return LC 05 03 17 Calculated pdf is issued by the International Fuel Tax Agreement governing body, which consists of member jurisdictions across the United States and Canada. Each jurisdiction has its own regulations and requirements regarding the completion and submission of this form. Businesses must be familiar with the specific guidelines set forth by their home jurisdiction to ensure compliance when filing their returns.

Quick guide on how to complete ifta annual tax return lc 050317 calculatedpdf

Complete IFTA Annual Tax Return LC 05 03 17 Calculated pdf effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage IFTA Annual Tax Return LC 05 03 17 Calculated pdf on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest method to alter and eSign IFTA Annual Tax Return LC 05 03 17 Calculated pdf with ease

- Find IFTA Annual Tax Return LC 05 03 17 Calculated pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign IFTA Annual Tax Return LC 05 03 17 Calculated pdf and ensure smooth communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the IFTA Annual Tax Return LC 05 03 17 Calculated pdf?

The IFTA Annual Tax Return LC 05 03 17 Calculated pdf is a specific form used by trucking companies to report their interstate fuel taxes. This PDF form helps streamline the process of filing and ensures compliance with the International Fuel Tax Agreement (IFTA) regulations.

-

How can airSlate SignNow help me with the IFTA Annual Tax Return LC 05 03 17 Calculated pdf?

airSlate SignNow provides a simple platform to electronically sign and send your IFTA Annual Tax Return LC 05 03 17 Calculated pdf. This not only saves time but also reduces the hassle of dealing with paper documents and ensures that your filings are completed correctly and efficiently.

-

What are the pricing options for using airSlate SignNow for the IFTA Annual Tax Return LC 05 03 17 Calculated pdf?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. You can choose a plan that suits your usage of the IFTA Annual Tax Return LC 05 03 17 Calculated pdf, whether you require basic functionality or advanced features for larger teams.

-

Are there any key features that streamline my IFTA Annual Tax Return LC 05 03 17 Calculated pdf submissions?

Yes, airSlate SignNow includes features like document templates, automated workflows, and real-time collaboration, all of which make submitting your IFTA Annual Tax Return LC 05 03 17 Calculated pdf more efficient. These features allow you to easily manage your documents from any device.

-

What benefits does airSlate SignNow offer for submitting the IFTA Annual Tax Return LC 05 03 17 Calculated pdf?

Using airSlate SignNow to submit your IFTA Annual Tax Return LC 05 03 17 Calculated pdf offers several benefits, including faster processing times and enhanced security for your documents. Additionally, the platform’s user-friendly interface ensures that even those who are not tech-savvy can navigate the submission process easily.

-

Can I integrate airSlate SignNow with other software for my IFTA Annual Tax Return LC 05 03 17 Calculated pdf?

Yes, airSlate SignNow allows for seamless integration with various accounting and tax software, which can simplify your workflow when handling the IFTA Annual Tax Return LC 05 03 17 Calculated pdf. This integration helps you manage your documents more effectively and reduces the risk of errors.

-

Is there customer support available for assistance with IFTA Annual Tax Return LC 05 03 17 Calculated pdf?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any issues regarding the IFTA Annual Tax Return LC 05 03 17 Calculated pdf. Whether you need help understanding the features or troubleshooting, their support team is readily available to help you.

Get more for IFTA Annual Tax Return LC 05 03 17 Calculated pdf

- Bank certificate for confirmation of bank details form

- United states postal service retail quick tip sheet 2021 form

- Unisa past exam papers download pdf form

- Ipcr form 2020 download

- House ownership certificate telangana pdf form

- Stroke risk assessment form thompsonhealthcom

- Fiscal sponsorship agreement template form

- Online payment processed on date payment processed by form

Find out other IFTA Annual Tax Return LC 05 03 17 Calculated pdf

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now