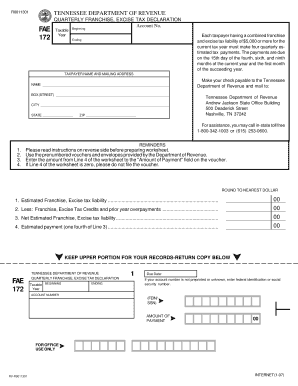

R0011301 TENNESSEE DEPARTMENT of REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn Form

Overview of the Tennessee FAE 172 Quarterly Franchise, Excise Tax Declaration

The Tennessee FAE 172 form, officially known as the R0011301, is a critical document for businesses operating in Tennessee. This form is used for reporting quarterly franchise and excise taxes to the Tennessee Department of Revenue. It is essential for maintaining compliance with state tax obligations. Understanding the purpose and requirements of this form helps ensure that businesses fulfill their tax responsibilities accurately and on time.

Steps to Complete the Tennessee FAE 172 Form

Completing the Tennessee FAE 172 form involves several key steps. First, gather all necessary financial information, including revenue and expenses for the reporting period. Next, accurately fill out each section of the form, ensuring that all figures are correct and supported by documentation. After completing the form, review it for accuracy before submission. Finally, submit the form either online or via mail, adhering to the specified deadlines to avoid penalties.

Filing Deadlines and Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Tennessee FAE 172 form. The quarterly filing deadlines typically fall on the last day of the month following the end of each quarter. For example, the deadlines for the first quarter are April 30, for the second quarter are July 31, for the third quarter are October 31, and for the fourth quarter are January 31 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents for Filing the Tennessee FAE 172

When preparing to file the Tennessee FAE 172 form, businesses should gather several key documents. These include financial statements, such as profit and loss statements, balance sheets, and any relevant tax records. Additionally, documentation supporting any deductions or credits claimed on the form should be organized and ready for submission. Having these documents on hand can streamline the filing process and ensure compliance with state requirements.

Legal Use of the Tennessee FAE 172 Form

The Tennessee FAE 172 form serves as a legally binding declaration of a business's tax obligations. It is essential for businesses to understand that submitting this form accurately and on time is not only a legal requirement but also a reflection of their financial integrity. Compliance with the filing and payment of franchise and excise taxes is enforced by the Tennessee Department of Revenue, and failure to comply can lead to legal repercussions.

Digital vs. Paper Version of the Tennessee FAE 172 Form

Businesses have the option to complete the Tennessee FAE 172 form digitally or using a paper version. The digital version offers several advantages, including ease of use, automated calculations, and quicker submission times. Additionally, electronic filing often provides immediate confirmation of submission, reducing the risk of lost documents. Conversely, some businesses may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensuring accuracy in the completion of the form remains paramount.

Quick guide on how to complete r0011301 tennessee department of revenue fae 172 quarterly franchise excise tax declaration account no tn

Complete R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents quickly without setbacks. Handle R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to edit and electronically sign R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn effortlessly

- Obtain R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that function.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn and ensure outstanding communication during every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of the Tennessee 172 RV?

The Tennessee 172 RV is designed with a compact yet functional layout, offering essential features such as a spacious living area, a fully equipped kitchen, and a comfortable sleeping arrangement. It is built with high-quality materials to ensure durability while providing comfort on the road. The intuitive design makes it an ideal choice for both solo travelers and families.

-

How much does the Tennessee 172 RV cost?

The price of the Tennessee 172 RV can vary based on additional features and options chosen. Generally, it is competitively priced within the RV market, offering great value for the features it provides. Potential buyers should check with local dealers for the most accurate pricing and available promotions.

-

What safety features are included in the Tennessee 172 RV?

Safety is a priority in the Tennessee 172 RV, which is equipped with advanced safety features such as anti-lock brakes, multiple airbags, and a robust frame structure. These features are designed to enhance the driving experience while ensuring the safety of all passengers. Additionally, it includes a comprehensive warranty for added peace of mind.

-

What are the benefits of using the Tennessee 172 RV for family trips?

The Tennessee 172 RV offers a comfortable and spacious environment perfect for family road trips. With its ample sleeping space and kitchen facilities, families can enjoy the convenience of home while on the go. This RV allows for flexibility in travel plans and creates memorable experiences for families traveling together.

-

Can I customize my Tennessee 172 RV?

Yes, the Tennessee 172 RV can be customized to fit your specific needs. Buyers have the option to choose from various upgrades such as enhanced entertainment systems, additional storage solutions, and premium furnishings. Customization allows owners to create a personalized travel experience tailored to their preferences.

-

Does the Tennessee 172 RV offer smart technology integrations?

Absolutely! The Tennessee 172 RV is compatible with various smart technology integrations, allowing you to enhance your travels. Features may include app-controlled heating and cooling systems, GPS tracking, and entertainment options that can be managed from your mobile device. Stay connected and comfortable wherever you go!

-

What is the fuel efficiency of the Tennessee 172 RV?

The Tennessee 172 RV is engineered to provide optimal fuel efficiency, balancing performance and economy. Depending on specific driving conditions and load, you can expect to achieve favorable miles per gallon compared to other models. This efficiency helps reduce travel costs and minimizes environmental impact.

Get more for R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn

- Public assistance connecticut judicial branch ctgov form

- Illinois secretary of state employeeattorney information

- Fl 141 declaration regarding service of california form

- Foc 23 form

- Rule 3007 1 objections to claimsnorthern district of form

- Wwwpdffillercom559705782 how to fillup email2020 form wi be 101 fill online printable fillable blank

- Wi be 004 2020 2021 fill and sign printable template form

- State bar exams questions and sample answers bing form

Find out other R0011301 TENNESSEE DEPARTMENT OF REVENUE FAE 172 QUARTERLY FRANCHISE, EXCISE TAX DECLARATION Account No Tn

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement