Mf 001 Wisconsin Form

What is the MF 001 Wisconsin?

The MF 001 Wisconsin form is a document used by the Wisconsin Department of Revenue for various tax-related purposes. It is primarily utilized for reporting specific tax information, which may include income, deductions, and credits applicable to individuals or businesses operating within the state. Understanding the MF 001 is essential for ensuring compliance with state tax laws and accurately reporting financial information.

Steps to Complete the MF 001 Wisconsin

Completing the MF 001 Wisconsin involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions accompanying the form to understand the requirements. Fill out the form with accurate information, ensuring that all figures are correct. Double-check your entries for any errors before submitting the form. Finally, keep a copy of the completed MF 001 for your records.

Legal Use of the MF 001 Wisconsin

The MF 001 Wisconsin form is legally binding when completed and submitted according to state regulations. It is essential to provide truthful and accurate information, as any discrepancies could lead to penalties or legal issues. The form must be signed and dated, affirming that the information provided is correct to the best of the filer’s knowledge. Compliance with the legal requirements surrounding this form is crucial for maintaining good standing with the Wisconsin Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the MF 001 Wisconsin vary depending on the type of tax being reported. Typically, forms must be submitted by April fifteenth for individual income tax returns. It is important to stay informed about any changes to deadlines, as late submissions may incur penalties or interest. Marking important dates on a calendar can help ensure timely filing and compliance with state regulations.

Required Documents

To complete the MF 001 Wisconsin form, certain documents are required to support the information reported. These may include W-2 forms, 1099 forms, and other financial statements that detail income and deductions. It is advisable to have all relevant documentation organized and readily accessible to facilitate the completion of the form and ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The MF 001 Wisconsin can be submitted through various methods to accommodate different preferences. Filers have the option to submit the form online through the Wisconsin Department of Revenue's website, which may provide a faster processing time. Alternatively, the form can be mailed to the appropriate address listed on the instructions, or submitted in person at designated locations. Choosing the right submission method can help ensure that the form is processed efficiently.

Quick guide on how to complete mf 001 wisconsin

Prepare Mf 001 Wisconsin seamlessly on any device

Digital document management has become widespread among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed papers, as it allows access to the correct template and secure online storage. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Mf 001 Wisconsin on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The simplest method to modify and eSign Mf 001 Wisconsin effortlessly

- Locate Mf 001 Wisconsin and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your adjustments.

- Choose how you'd like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Modify and eSign Mf 001 Wisconsin to guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

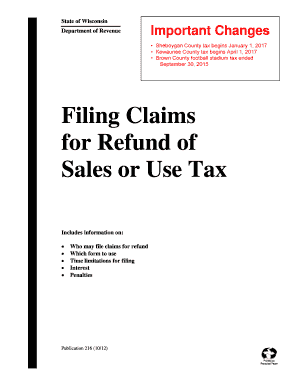

What is Publication 216?

Publication 216 is a comprehensive IRS guide that provides important information on tax compliance for organizations. For businesses utilizing airSlate SignNow, understanding Publication 216 helps ensure that electronic signatures on documents meet IRS standards and facilitate efficient tax document management.

-

How does airSlate SignNow support compliance with Publication 216?

AirSlate SignNow provides tools that ensure electronic signatures and document workflows are in full compliance with Publication 216. The platform’s features, such as audit trails and secure storage, help organizations maintain records that meet the guidelines set forth in the publication.

-

What are the benefits of using airSlate SignNow for tax-related documents under Publication 216?

Using airSlate SignNow for tax-related documents offers numerous benefits, including secure eSigning, a user-friendly interface, and audit capabilities. This empowers businesses to streamline their tax processes while adhering to the requirements of Publication 216 effectively.

-

Can I integrate airSlate SignNow with other tools while following Publication 216 guidelines?

Yes, airSlate SignNow seamlessly integrates with various tools such as Google Drive and Salesforce, allowing users to maintain compliance with Publication 216. This integration enhances workflow efficiency without sacrificing the integrity of your electronic documents.

-

What pricing options does airSlate SignNow offer for compliance with Publication 216?

AirSlate SignNow offers flexible pricing plans designed for businesses of all sizes. Each plan supports compliance with Publication 216, enabling organizations to choose a solution that fits their budget while ensuring secure and efficient eSigning processes.

-

Is airSlate SignNow user-friendly for understanding Publication 216 requirements?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for businesses to navigate and implement eSigning practices compliant with Publication 216. The intuitive interface ensures that users can easily understand and comply with the necessary IRS guidelines.

-

What features of airSlate SignNow are most beneficial for businesses dealing with Publication 216?

Key features of airSlate SignNow that benefit businesses dealing with Publication 216 include customizable templates, secure eSigning, and comprehensive tracking capabilities. These features collectively help organizations ensure they are meeting the requirements laid out in Publication 216 while enhancing their operational efficiency.

Get more for Mf 001 Wisconsin

- Dv lottery application form sample pdf

- Mr price account application form

- Ubi kyc form fill up online

- Akta pemberi pinjam wang 1951 pdf form

- Functional assessment tool pdf 213185274 form

- Trustee declaration form cac

- Jv 440 findings and orders after 18 month permanency hearing form

- Edd ca govsiteassetsfilespower of attorney declaration employment development department form

Find out other Mf 001 Wisconsin

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement