Ohio Taxation of Manufactured and Mobile Homes Tax Law Form

What is the Ohio Taxation Of Manufactured And Mobile Homes Tax Law

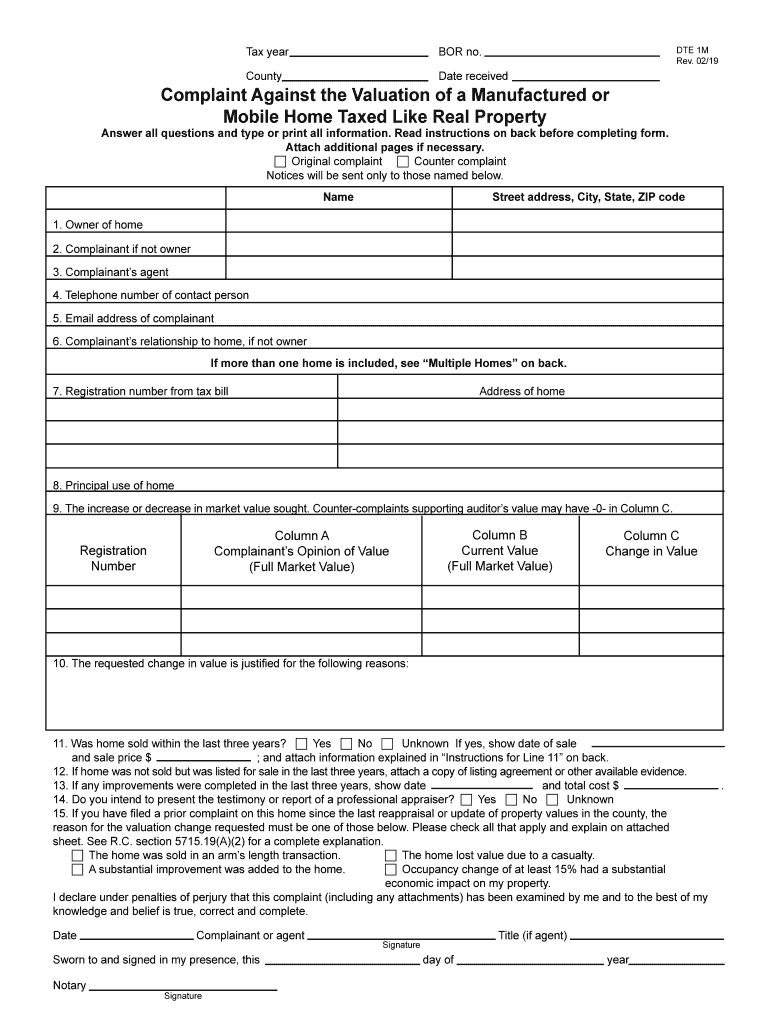

The Ohio Taxation of Manufactured and Mobile Homes Tax Law governs the taxation process specific to manufactured and mobile homes in the state of Ohio. This law establishes the framework for how these homes are assessed for tax purposes, including the determination of taxable value and applicable rates. It is essential for homeowners and potential buyers to understand this law to ensure compliance and to be aware of their tax obligations.

Steps to complete the Ohio Taxation Of Manufactured And Mobile Homes Tax Law

Completing the Ohio Taxation of Manufactured and Mobile Homes Tax Law involves several steps:

- Gather necessary documentation, including proof of ownership and any previous tax assessments.

- Determine the taxable value of the manufactured or mobile home based on state guidelines.

- Complete the required tax forms accurately, ensuring all information is current and correct.

- Submit the completed forms by the designated deadline to the appropriate local tax authority.

- Retain copies of all submitted documents for your records.

Key elements of the Ohio Taxation Of Manufactured And Mobile Homes Tax Law

Key elements of this tax law include:

- The definition of manufactured and mobile homes as taxable property.

- The assessment methods used to determine the value of these homes.

- Tax rates applicable to manufactured and mobile homes.

- Exemptions or reductions available for certain homeowners, such as those qualifying for senior citizen or disability benefits.

Legal use of the Ohio Taxation Of Manufactured And Mobile Homes Tax Law

The legal use of the Ohio Taxation of Manufactured and Mobile Homes Tax Law is crucial for ensuring compliance with state regulations. Homeowners must adhere to the guidelines set forth in the law to avoid penalties. Understanding the legal implications helps in navigating disputes or inquiries from tax authorities. It is advisable to consult with a tax professional if there are uncertainties regarding the law's application.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Taxation of Manufactured and Mobile Homes Tax Law are critical for compliance. Typically, tax forms must be submitted by a specific date each year, often aligned with local tax deadlines. It is important to stay informed about these dates to avoid late fees or penalties. Marking these deadlines on a calendar can help ensure timely submissions.

Who Issues the Form

The forms related to the Ohio Taxation of Manufactured and Mobile Homes Tax Law are typically issued by the Ohio Department of Taxation or local county auditors. These authorities provide the necessary documentation for homeowners to report their manufactured or mobile homes for tax purposes. It is essential to obtain the correct forms from the appropriate issuing body to ensure compliance with state regulations.

Quick guide on how to complete ohio taxation of manufactured and mobile homes tax law

Complete Ohio Taxation Of Manufactured And Mobile Homes Tax Law effortlessly on any device

Digital document management has become widely accepted among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any hold-ups. Manage Ohio Taxation Of Manufactured And Mobile Homes Tax Law on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to alter and eSign Ohio Taxation Of Manufactured And Mobile Homes Tax Law with minimal effort

- Locate Ohio Taxation Of Manufactured And Mobile Homes Tax Law and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Ohio Taxation Of Manufactured And Mobile Homes Tax Law while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Ohio Taxation Of Manufactured And Mobile Homes Tax Law?

The Ohio Taxation Of Manufactured And Mobile Homes Tax Law pertains to the specific tax obligations for owners of manufactured and mobile homes in Ohio. It includes details about assessment, tax rates, and exemptions that may apply. Understanding this law is essential for compliant ownership and financial planning.

-

How does airSlate SignNow help with Ohio Taxation Of Manufactured And Mobile Homes Tax Law documentation?

airSlate SignNow allows users to easily create, send, and eSign essential documents related to the Ohio Taxation Of Manufactured And Mobile Homes Tax Law. With its user-friendly interface, businesses can ensure they meet all legal requirements while streamlining their documentation processes. As a result, managing tax-related paperwork becomes efficient and stress-free.

-

What features does airSlate SignNow offer for tax-related document management?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning to facilitate compliance with Ohio Taxation Of Manufactured And Mobile Homes Tax Law. These features help ensure that all documents are completed accurately and in a timely manner, thus reducing the risk of tax issues. Additionally, users can track document status in real-time.

-

Are there any costs associated with using airSlate SignNow for Ohio Taxation Of Manufactured And Mobile Homes Tax Law forms?

Yes, airSlate SignNow offers various pricing plans suited for different business needs, enabling users to choose a package that fits their budget while accessing features for Ohio Taxation Of Manufactured And Mobile Homes Tax Law forms. The cost is reasonable given the time and resources saved by using an efficient eSigning solution. Businesses can also take advantage of free trials to assess the service.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax management software, enhancing your ability to comply with Ohio Taxation Of Manufactured And Mobile Homes Tax Law. This integration facilitates the import and export of data, making your workflow more efficient. By using it with familiar tools, businesses can streamline their tax preparation processes.

-

How secure is airSlate SignNow when managing Ohio Taxation Of Manufactured And Mobile Homes Tax Law documents?

airSlate SignNow prioritizes security, utilizing advanced encryption and authentication measures to protect sensitive information related to Ohio Taxation Of Manufactured And Mobile Homes Tax Law. Users can be assured that their tax documents are stored securely and can only be accessed by authorized individuals. This level of security helps maintain compliance and protect personal data.

-

Does airSlate SignNow provide customer support for users dealing with Ohio Taxation Of Manufactured And Mobile Homes Tax Law?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions related to Ohio Taxation Of Manufactured And Mobile Homes Tax Law. This support includes access to helpful resources, tutorials, and live assistance to ensure businesses can navigate their document management needs effectively. Having reliable support helps users stay informed about tax regulations.

Get more for Ohio Taxation Of Manufactured And Mobile Homes Tax Law

Find out other Ohio Taxation Of Manufactured And Mobile Homes Tax Law

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now