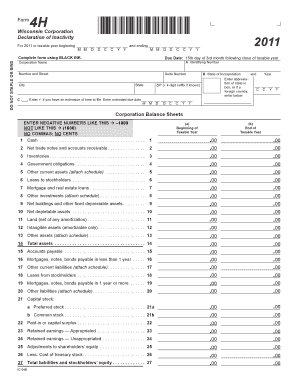

Wisconsin Department of Revenue Form 4h

What is the Wisconsin Department of Revenue Form 4h

The Wisconsin Department of Revenue Form 4h is a specific tax form used by individuals and businesses in Wisconsin to report certain tax-related information. This form is primarily associated with the state's income tax system and is essential for ensuring compliance with state tax regulations. It is designed to collect data necessary for calculating tax liabilities and ensuring proper tax administration. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the Wisconsin Department of Revenue Form 4h

To effectively use the Wisconsin Department of Revenue Form 4h, individuals must first obtain the form from the appropriate state resources. Once acquired, users should carefully read the instructions provided with the form to understand the necessary information required for completion. It is important to gather all relevant financial documents, such as income statements and deductions, before filling out the form. After completing the form, it should be submitted according to the specified guidelines, ensuring that all information is accurate and complete to avoid any potential issues with the state tax authorities.

Steps to complete the Wisconsin Department of Revenue Form 4h

Completing the Wisconsin Department of Revenue Form 4h involves several key steps:

- Obtain the form from the Wisconsin Department of Revenue website or local offices.

- Read the instructions thoroughly to understand the requirements.

- Gather necessary documentation, including income records and any applicable deductions.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, either online, by mail, or in person.

Legal use of the Wisconsin Department of Revenue Form 4h

The legal use of the Wisconsin Department of Revenue Form 4h is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Additionally, electronic submissions must comply with the relevant eSignature laws to be considered valid. It is important for users to be aware of their rights and responsibilities when using this form, as any inaccuracies or failures to comply can lead to penalties or legal repercussions.

Form Submission Methods

The Wisconsin Department of Revenue Form 4h can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission via the Wisconsin Department of Revenue's electronic filing system.

- Mailing the completed form to the appropriate state tax office.

- In-person delivery at designated state offices for immediate processing.

Eligibility Criteria

Eligibility to use the Wisconsin Department of Revenue Form 4h typically depends on the individual's or business's income level and tax situation. Generally, residents of Wisconsin who have taxable income or specific tax obligations are required to complete this form. It is essential to review the eligibility criteria outlined by the Wisconsin Department of Revenue to determine if this form applies to your specific circumstances.

Quick guide on how to complete wisconsin department of revenue form 4h

Complete Wisconsin Department Of Revenue Form 4h effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your files quickly without delays. Handle Wisconsin Department Of Revenue Form 4h using the airSlate SignNow apps on Android or iOS and enhance any document-related process today.

The simplest way to modify and eSign Wisconsin Department Of Revenue Form 4h with ease

- Find Wisconsin Department Of Revenue Form 4h and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Department Of Revenue Form 4h and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Wisconsin form 4H?

The Wisconsin form 4H is a vital document used by youth to report their participation in 4-H projects and activities. This form is essential for 4-H members in Wisconsin to showcase their skills and accomplishments. By utilizing airSlate SignNow, you can easily create and eSign the Wisconsin form 4H, streamlining the submission process.

-

How can airSlate SignNow help me with the Wisconsin form 4H?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Wisconsin form 4H. With its user-friendly interface, you can quickly fill out the form, ensuring that all necessary information is accurately captured. This makes it simple to stay organized and submit your 4-H projects on time.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin form 4H?

Yes, there are various pricing plans available for airSlate SignNow, catering to different budget needs. The platform is known for its cost-effective solutions, making it accessible for individuals and organizations looking to manage the Wisconsin form 4H efficiently. Check the pricing page for more details.

-

Can I integrate airSlate SignNow with other applications while using the Wisconsin form 4H?

Absolutely! airSlate SignNow offers various integrations with popular applications that can enhance your experience with the Wisconsin form 4H. This allows you to streamline workflows and manage documents seamlessly, ensuring that all your tools work together effectively.

-

What are the benefits of using airSlate SignNow for the Wisconsin form 4H?

Using airSlate SignNow for the Wisconsin form 4H comes with several benefits, including increased efficiency and reduced paperwork. The platform enables you to eSign documents, which saves time and ensures secure transmission. Additionally, you can access your forms from anywhere, making it convenient for busy 4-H members.

-

How secure is airSlate SignNow when handling the Wisconsin form 4H?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents, including the Wisconsin form 4H. All data is securely stored and transmitted, ensuring that your information remains confidential. You can trust airSlate SignNow to handle your 4-H documentation safely.

-

Can I access my Wisconsin form 4H documents on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access your Wisconsin form 4H on-the-go. Whether you’re using a smartphone or tablet, you can fill out, eSign, and manage your documents with ease. This mobile compatibility adds convenience for busy 4-H members.

Get more for Wisconsin Department Of Revenue Form 4h

Find out other Wisconsin Department Of Revenue Form 4h

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will