Form 1020

What is the Form 1020

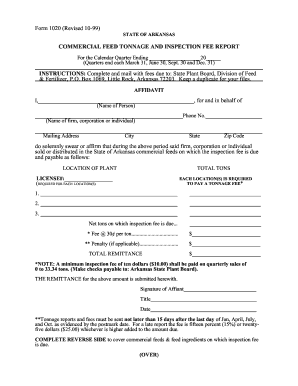

The Form 1020 is a tax document used primarily by businesses and individuals in the United States to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often associated with various tax obligations. Understanding the purpose and requirements of the Form 1020 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form 1020

Using the Form 1020 involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax records. Next, fill out the form accurately, ensuring that all information is complete and truthful. It is advisable to consult IRS guidelines or a tax professional to ensure compliance. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of filing.

Steps to complete the Form 1020

Completing the Form 1020 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary documents, such as financial statements and previous tax returns.

- Review the instructions provided by the IRS for the Form 1020 to understand each section.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check for any errors or omissions before submission.

- Submit the form electronically through a secure platform or mail it to the appropriate IRS address.

Legal use of the Form 1020

The legal use of the Form 1020 is governed by IRS regulations and federal tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted by the specified deadlines. Additionally, using a reliable electronic signature platform can enhance the form's legal standing, as it complies with the ESIGN Act and other relevant eSignature laws. This compliance is vital for ensuring that the submitted form is recognized by the IRS and holds up in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1020 are critical for compliance. Typically, the form must be submitted by the tax deadline, which is usually April fifteenth for most taxpayers. However, extensions may be available under certain circumstances. It is important to keep track of any changes to filing dates, especially for specific business types or circumstances that may alter the standard deadlines.

Required Documents

To successfully complete the Form 1020, certain documents are required. These may include:

- Income statements detailing revenue for the reporting period.

- Expense reports that outline all deductible costs incurred.

- Previous tax returns for reference and accuracy.

- Any additional documentation required by the IRS for specific deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

The Form 1020 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing the completed form to the designated IRS address, ensuring it is postmarked by the deadline.

- In-person submission at local IRS offices, though this may require an appointment.

Quick guide on how to complete form 1020

Complete Form 1020 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers a flawless environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Form 1020 on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The optimal method to modify and eSign Form 1020 with ease

- Locate Form 1020 and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1020 to guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 1020 and how can I use it with airSlate SignNow?

Form 1020 is a specific documentation template that can be used for various applications. With airSlate SignNow, you can easily manage, send, and eSign your form 1020, ensuring a smooth and compliant process. Our platform simplifies the process, making it user-friendly for both senders and signers.

-

What features does airSlate SignNow offer for managing form 1020?

airSlate SignNow provides several features that enhance the management of form 1020, such as customizable templates, secure eSignature options, and real-time tracking. These features help streamline workflow and ensure all parties are updated on the status of the document. You can also automate reminders to improve efficiency.

-

Is airSlate SignNow a cost-effective solution for handling form 1020?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents like form 1020. We offer competitive pricing plans tailored to businesses of all sizes, allowing you to choose a package that fits your needs without breaking the bank. Save on costs of printing and mailing by going digital.

-

Can I integrate airSlate SignNow with other software for form 1020 processing?

Absolutely! airSlate SignNow supports seamless integration with various software tools that can assist in the processing of form 1020. This includes popular CRM and project management systems, which enhance your workflow by allowing documents to flow effortlessly between platforms.

-

What are the security measures in place for handling form 1020 with airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement industry-standard encryption, secure cloud storage, and multi-factor authentication to protect your form 1020 and other sensitive documents. You can rest assured that your data is safe and compliant with legal regulations.

-

How does airSlate SignNow enhance collaboration when using form 1020?

airSlate SignNow enhances collaboration by enabling multiple users to access and sign form 1020 simultaneously. The platform offers features like comment threads and tagging, allowing all parties to communicate efficiently and ensure everyone is on the same page throughout the document's lifecycle.

-

What are the benefits of using airSlate SignNow to eSign form 1020?

Using airSlate SignNow to eSign form 1020 provides numerous benefits, including reduced turnaround time, increased accessibility, and improved tracking of document status. With our user-friendly interface, signers can quickly complete the signing process from anywhere, on any device, enhancing productivity.

Get more for Form 1020

- Please complete the back of this form north texas infectious

- Sobriety aa amends letter example form

- Credentialing application for hospitals and facilities form

- Cr e 03 1 010818 application practitionerdoc form

- Dma 5202 360617916 form

- Affidavit of declaration from authorized representative of qualified form

- Laguna beach unified school district lbhs chromebook loaner form

- Where to apply for weatherization department of energy form

Find out other Form 1020

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement