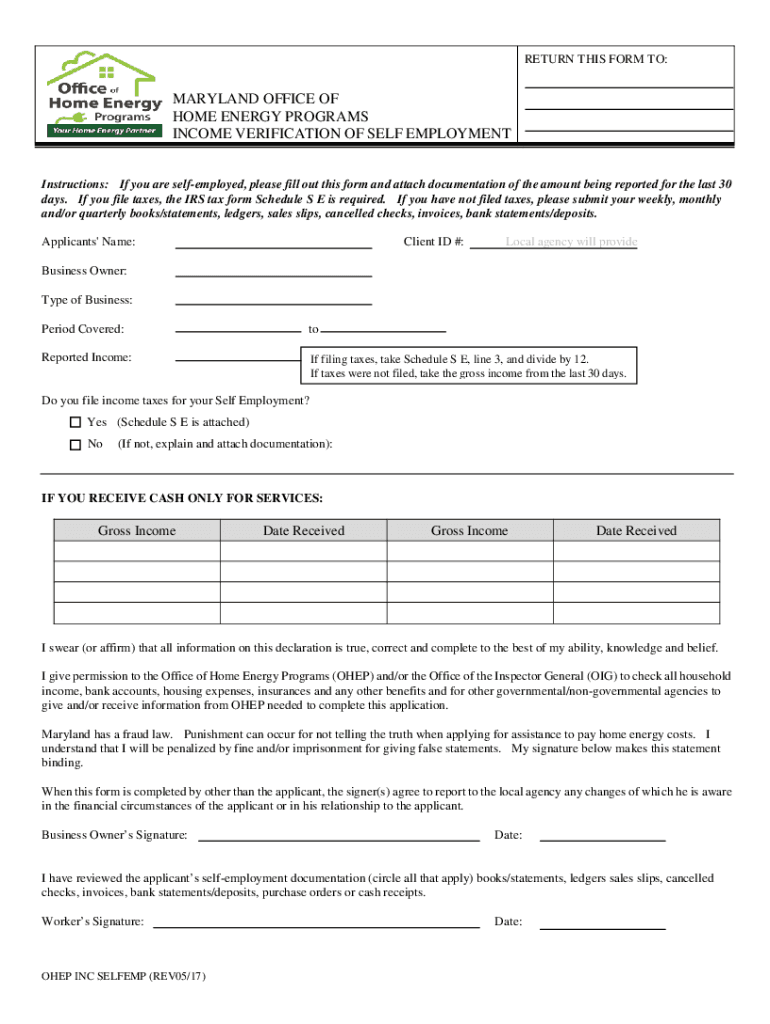

Income Verification of Self Employment Form

What is the proof of income letter for self-employed individuals?

A proof of income letter for self-employed individuals is a formal document that verifies an individual's income from self-employment. This letter is often required by lenders, landlords, or government agencies to assess financial stability. It typically includes details such as the nature of the business, the income earned over a specific period, and any relevant financial documentation that supports the income claims. This letter serves as a crucial tool for self-employed individuals to demonstrate their earning capacity when traditional pay stubs are not available.

How to obtain a proof of income letter for self-employment

To obtain a proof of income letter, self-employed individuals can follow these steps:

- Gather financial documents: Collect relevant documents such as tax returns, bank statements, and invoices that reflect income over the past year.

- Draft the letter: Include essential information such as your business name, contact details, and a clear statement of your income. Specify the time frame for the income being reported.

- Include supporting evidence: Attach copies of documents that substantiate your income claims, such as profit and loss statements or 1099 forms.

- Sign and date the letter: Ensure that the letter is signed and dated to validate its authenticity.

Key elements of a proof of income letter for self-employed individuals

A well-structured proof of income letter should contain several key elements to ensure clarity and effectiveness:

- Header: Include your name, business name, address, and contact information at the top.

- Date: Add the date when the letter is written.

- Recipient information: If applicable, include the name and address of the recipient.

- Income statement: Clearly state your total income for the specified period, along with a brief description of your business activities.

- Signature: Sign the letter to authenticate it.

Steps to complete a proof of income letter for self-employment

Completing a proof of income letter involves several straightforward steps:

- Identify the purpose of the letter and the required income details.

- Draft the letter using a clear and professional format.

- Review the letter for accuracy, ensuring all figures and details are correct.

- Attach any necessary supporting documents that verify your income.

- Finalize the letter by signing and dating it before submission.

Legal use of the proof of income letter for self-employed individuals

The proof of income letter holds legal significance, especially when used for financial transactions, loan applications, or rental agreements. For it to be considered valid, the letter must include accurate and truthful information. Misrepresentation of income can lead to legal consequences, including potential fraud charges. Therefore, it is essential to ensure that all claims made in the letter are supported by appropriate documentation and reflect actual earnings.

Examples of using a proof of income letter for self-employment

There are several scenarios where a proof of income letter may be required:

- When applying for a mortgage or personal loan, lenders often request proof of income to assess repayment ability.

- Landlords may require a proof of income letter to evaluate a prospective tenant's financial stability.

- Government assistance programs may ask for income verification to determine eligibility for benefits.

Quick guide on how to complete income verification of self employment

Complete Income Verification Of Self Employment with ease on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly substitution for traditional printed and signed paperwork, allowing you to obtain the necessary form and secure it online. airSlate SignNow equips you with all the features required to create, alter, and electronically sign your documents quickly and efficiently. Manage Income Verification Of Self Employment on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and electronically sign Income Verification Of Self Employment effortlessly

- Find Income Verification Of Self Employment and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize essential parts of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and electronically sign Income Verification Of Self Employment to ensure outstanding communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a proof of income letter for self employed individuals?

A proof of income letter for self employed individuals is a formal document that outlines your income details to verify your earnings to potential lenders, landlords, or other entities. This letter typically includes your income sources, average monthly earnings, and may also include additional supporting documents. Using airSlate SignNow, you can create and eSign this document quickly and conveniently.

-

How can airSlate SignNow help me create a proof of income letter for self employed?

With airSlate SignNow, you can easily customize templates for a proof of income letter for self employed individuals. Our platform offers a user-friendly interface that allows you to fill in your income details and eSign the document electronically. This streamlines the process, making it quicker and more efficient.

-

Is there a cost associated with generating a proof of income letter with airSlate SignNow?

Yes, there is a cost for using airSlate SignNow, but it remains an affordable solution for businesses looking to create essential documents like a proof of income letter for self employed individuals. We offer various pricing plans that accommodate different needs, ensuring you get the most value out of your investment.

-

What features does airSlate SignNow offer for eSigning a proof of income letter for self employed?

airSlate SignNow features include customizable templates, electronic signatures, and secure storage options. This ensures your proof of income letter for self employed is completed efficiently and safely. You can also track the status of your documents and receive real-time notifications.

-

Are there any integrations available with airSlate SignNow for creating proof of income letters?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Salesforce, and Dropbox, which can enhance your workflow. This allows you to easily access and manage your proof of income letter for self employed documents. Integrating these tools can signNowly improve your productivity.

-

What benefits do I gain from using airSlate SignNow for my proof of income letter?

Using airSlate SignNow benefits you by providing a streamlined process that saves time and enhances organization. With our eSigning capabilities, you can ensure that your proof of income letter for self employed is legally binding and easily shareable. This not only presents a professional image but also increases the likelihood of meeting deadlines.

-

How secure is airSlate SignNow when handling my proof of income letter?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure data storage procedures. Your proof of income letter for self employed, as well as all sensitive information, is safely protected. We comply with industry standards to ensure that your data remains confidential.

Get more for Income Verification Of Self Employment

- Blank form

- 2019 form irs instructions 8915 d fill online printable

- Form 8554 rev 2 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

- Low income taxpayer clinic list irs tax formslow income taxpayer clinicsinternal revenue serviceirs low income tax clinics can

- Wwwtdlrtexasgovelectriciansformsjourneyman sign electrician license application instructions

- I 129fpdf uscis form i 129f petition for alien fiance

- Pdf motor vehicle vessel and mobile home records request form

- Fillable site specific safety plan pdf form

Find out other Income Verification Of Self Employment

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement