Lenders Application Paycheck Protection Program Loan Form

What is the Lenders Application Paycheck Protection Program Loan

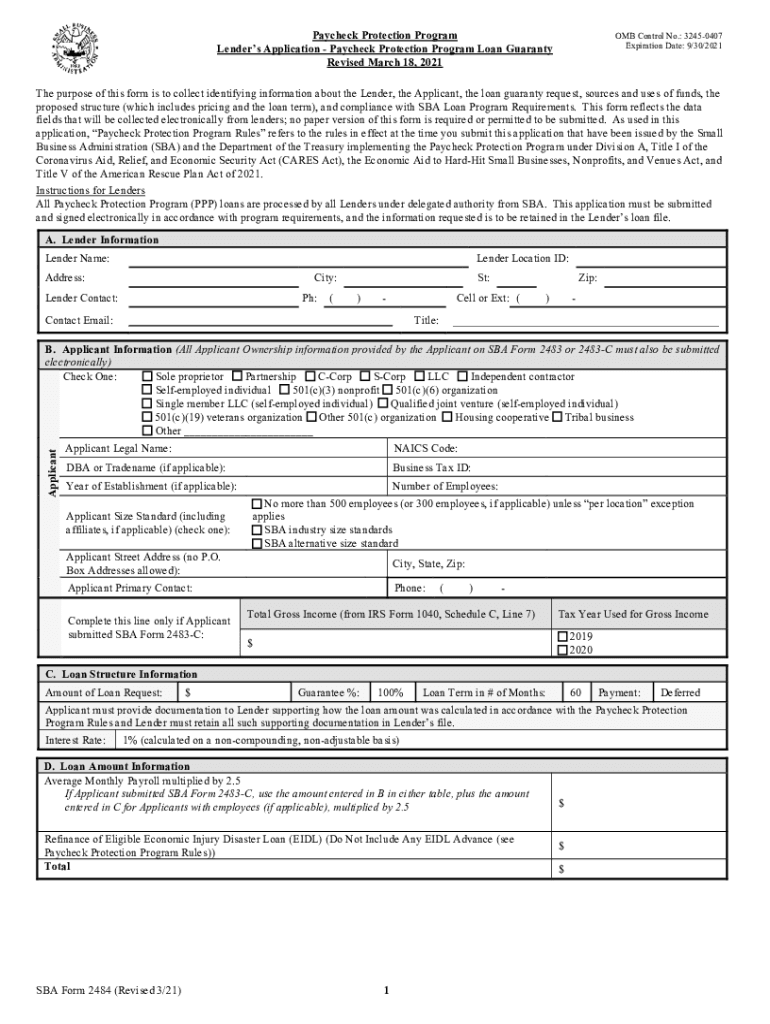

The Lenders Application Paycheck Protection Program Loan is a financial assistance initiative designed to help small businesses maintain their workforce during challenging economic times. This program, established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, provides loans that can be forgiven if certain criteria are met. The primary aim is to support businesses in covering payroll costs, rent, utilities, and other essential expenses. Understanding the specifics of this loan can empower business owners to make informed financial decisions.

Eligibility Criteria

To qualify for the Lenders Application Paycheck Protection Program Loan, businesses must meet specific eligibility requirements. Generally, eligible entities include small businesses, self-employed individuals, and certain non-profit organizations. Key criteria include:

- Having fewer than five hundred employees.

- Demonstrating the impact of economic uncertainty on operations.

- Using the loan proceeds for eligible expenses such as payroll, rent, and utilities.

It is essential for applicants to review these criteria thoroughly to ensure compliance and increase the chances of loan approval.

Steps to Complete the Lenders Application Paycheck Protection Program Loan

Completing the Lenders Application Paycheck Protection Program Loan involves a series of straightforward steps. These include:

- Gather necessary documentation, including payroll records and financial statements.

- Fill out the application form accurately, providing all required information.

- Submit the application to an approved lender, ensuring all documents are attached.

- Await feedback from the lender regarding the status of the application.

Following these steps can facilitate a smoother application process and enhance the likelihood of securing funding.

Required Documents

When applying for the Lenders Application Paycheck Protection Program Loan, specific documents are necessary to support the application. Commonly required documents include:

- Payroll documentation for all employees.

- Tax filings, including IRS Form 941.

- Financial statements, such as profit and loss statements.

- Business licenses and registrations.

Having these documents prepared in advance can expedite the application process and ensure compliance with lender requirements.

Form Submission Methods

The Lenders Application Paycheck Protection Program Loan can be submitted through various methods, depending on the lender's preferences. Common submission methods include:

- Online submission through the lender's portal.

- Mailing a hard copy of the application and supporting documents.

- In-person submission at the lender's office.

Choosing the most convenient submission method can help streamline the process and ensure timely consideration of the application.

Legal Use of the Lenders Application Paycheck Protection Program Loan

Understanding the legal aspects of the Lenders Application Paycheck Protection Program Loan is crucial for applicants. The loan must be used in accordance with federal guidelines to qualify for forgiveness. Acceptable uses include:

- Payroll costs, including salaries and wages.

- Rent or lease payments for business premises.

- Utilities, such as electricity and water.

Failure to adhere to these regulations can result in penalties, including the requirement to repay the loan in full.

Quick guide on how to complete lenders application paycheck protection program loan

Prepare Lenders Application Paycheck Protection Program Loan effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Lenders Application Paycheck Protection Program Loan on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The simplest way to edit and eSign Lenders Application Paycheck Protection Program Loan with ease

- Find Lenders Application Paycheck Protection Program Loan and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Lenders Application Paycheck Protection Program Loan and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Lenders Application Paycheck Protection Program Loan?

The Lenders Application Paycheck Protection Program Loan is a financial product designed to help small businesses secure funding during challenging economic times. This loan allows lenders to facilitate access to much-needed capital for businesses affected by the COVID-19 pandemic while ensuring compliance with government guidelines.

-

How can airSlate SignNow assist with the Lenders Application Paycheck Protection Program Loan?

airSlate SignNow offers an efficient platform for the electronic signing and management of documents related to the Lenders Application Paycheck Protection Program Loan. This solution helps streamline the application process, making it easier for lenders and borrowers to complete necessary paperwork quickly and securely.

-

What are the pricing options for airSlate SignNow related to the Lenders Application Paycheck Protection Program Loan?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs, including those looking to process Lenders Application Paycheck Protection Program Loans. Each plan includes essential features that simplify document management while ensuring secure eSignature capabilities.

-

What features does airSlate SignNow provide for the Lenders Application Paycheck Protection Program Loan?

airSlate SignNow provides features like customizable templates, document tracking, and reminder notifications, specifically for Lenders Application Paycheck Protection Program Loan processing. These features enhance efficiency, ensuring that all parties can focus on securing funding without delays.

-

What benefits can businesses expect from using airSlate SignNow for their Lenders Application Paycheck Protection Program Loan?

By using airSlate SignNow for the Lenders Application Paycheck Protection Program Loan, businesses can expect faster turnaround times, reduced paperwork errors, and improved communication between lenders and borrowers. These advantages translate into a smoother loan application process and quicker access to funds.

-

Is airSlate SignNow compliant with regulations for the Lenders Application Paycheck Protection Program Loan?

Yes, airSlate SignNow is designed to comply with the necessary regulations and guidelines outlined for the Lenders Application Paycheck Protection Program Loan. Our platform ensures that all document management processes meet security and legal standards, providing peace of mind to both lenders and borrowers.

-

Can airSlate SignNow integrate with other software for managing Lenders Application Paycheck Protection Program Loans?

Absolutely! airSlate SignNow offers seamless integrations with various business management tools, enhancing the document workflow for the Lenders Application Paycheck Protection Program Loan. This interoperability allows users to combine their existing systems with our platform for an optimized experience.

Get more for Lenders Application Paycheck Protection Program Loan

- Transport order form

- Unveiling ceremony the emanuel synagogue emanuelsynagogue form

- Bike rental contract form

- Pine knob rental agreement form pdf pine knob ski resort

- Private account information sheet labcorp

- Key requisition form

- Authorization form for direct deposit of your prs actra

- Termination notice form

Find out other Lenders Application Paycheck Protection Program Loan

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple