1098 T Uvu Form

What is the uvu 1098 T?

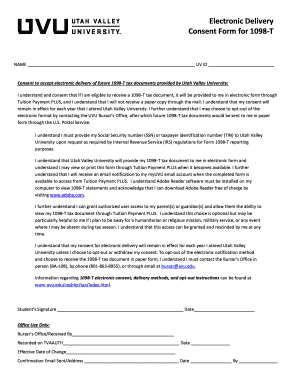

The uvu 1098 T is a tax form issued by Utah Valley University that reports qualified tuition and related expenses. This form is essential for students who want to claim educational tax credits on their federal tax returns. It provides information on the amount of tuition paid, scholarships received, and other financial aid that may affect a student's tax situation. Understanding this form is crucial for maximizing potential tax benefits related to education costs.

How to obtain the uvu 1098 T

To obtain the uvu 1098 T form, students can access it through the Utah Valley University student portal. Typically, the form becomes available in January, reflecting the previous tax year’s tuition payments. Students should log in to their accounts, navigate to the financial section, and locate the 1098 T form. If there are any issues accessing the form, students can contact the university's financial aid office for assistance.

Steps to complete the uvu 1098 T

Completing the uvu 1098 T involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including tuition payments and any scholarships received. Next, accurately fill out the form with the required details, ensuring that all amounts are correctly reported. After completing the form, review it for any errors before submission. Depending on individual circumstances, students may need to consult with a tax professional for guidance on how to use the information provided on the form.

Legal use of the uvu 1098 T

The uvu 1098 T is legally recognized as a valid document for reporting educational expenses to the IRS. To ensure its legal use, the form must be filled out accurately and submitted by the appropriate deadlines. Students should retain a copy of the form for their records, as it may be required for future tax filings or audits. Compliance with IRS guidelines regarding educational tax credits is essential to avoid penalties and ensure eligibility for potential refunds.

Key elements of the uvu 1098 T

Key elements of the uvu 1098 T include the student's identification information, the total amount of qualified tuition and related expenses, and any scholarships or grants received during the tax year. Additionally, the form will indicate whether the student was enrolled for at least half-time, which can affect eligibility for certain tax credits. Understanding these elements helps students accurately report their educational expenses and maximize their tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the uvu 1098 T are aligned with the IRS tax filing schedule. Typically, the form is made available by January thirty-first of each year, allowing students to prepare their tax returns. The deadline for filing federal tax returns is usually April fifteenth. Students should be aware of these dates to ensure timely filing and avoid any potential penalties for late submission.

Quick guide on how to complete 1098 t uvu

Prepare 1098 T Uvu effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and without interruptions. Manage 1098 T Uvu on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign 1098 T Uvu with ease

- Locate 1098 T Uvu and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1098 T Uvu and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is uvu 1098 t and how does it work?

The uvu 1098 t is a tax form used to report tuition and related expenses paid by students at Utah Valley University. It provides essential information for tax filings, and using airSlate SignNow makes it easy to electronically sign and send the uvu 1098 t securely. Our platform streamlines the process, so you can focus on what matters most—your education.

-

How can airSlate SignNow help with the uvu 1098 t process?

airSlate SignNow simplifies the uvu 1098 t process by offering an efficient eSigning solution. You can quickly upload, sign, and share the form with necessary parties directly from the platform. This not only saves time but also ensures that your uvu 1098 t is processed correctly and promptly.

-

Is there a cost associated with using airSlate SignNow for uvu 1098 t?

Yes, while airSlate SignNow offers a cost-effective solution for document management, specific pricing depends on the plan you choose. We provide various subscription options tailored for individuals and businesses, ensuring you can efficiently manage your uvu 1098 t and other documents without breaking the bank.

-

What features does airSlate SignNow offer to assist with uvu 1098 t e-signing?

airSlate SignNow includes robust features such as customizable templates, document tracking, and secure storage to enhance your uvu 1098 t signing experience. With an intuitive interface, users can easily navigate the eSigning process while ensuring compliance and security for sensitive information.

-

Can I integrate airSlate SignNow with other applications for my uvu 1098 t needs?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to work with your uvu 1098 t alongside tools you already use. Whether you need to upload the form from cloud storage or send it through email, our integrations ensure flexibility and convenience.

-

How secure is my uvu 1098 t information when using airSlate SignNow?

Your security is our priority. When using airSlate SignNow for the uvu 1098 t, all data is encrypted, and we comply with industry standards to protect your personal information. We take extra measures to ensure your documents are secure during transmission and storage.

-

What are the benefits of using airSlate SignNow for managing uvu 1098 t forms?

The main benefits of using airSlate SignNow for your uvu 1098 t forms include time savings, increased efficiency, and enhanced document security. By digitizing the signing process, you eliminate delays and paperwork hassles, streamlining your workflow and giving you peace of mind.

Get more for 1098 T Uvu

- Medication form to accompany camp 60s registration form

- Ceu tracker template form

- After school registration form

- Jdf 1000 case information sheetdoc

- Credit card authorization form 59102069

- Form 0060 fall protection equipment inspection employers report of injury or occupational disease

- Test correction template form

- Statutory declaration of payment distribution form albertaparksca

Find out other 1098 T Uvu

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template