Renter Refund Form Tc 40cb

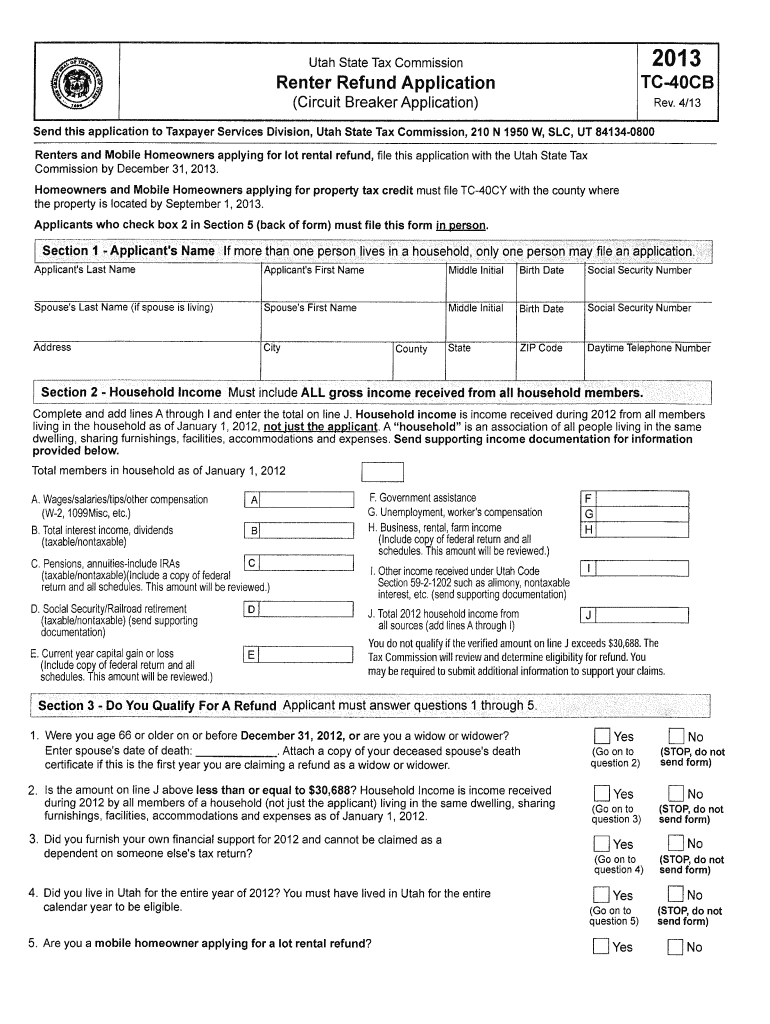

What is the Renter Refund Form TC-40?

The Renter Refund Form TC-40 is a specific document utilized in the state of Utah to apply for a refund of a portion of rent paid by eligible renters. This form is designed to assist individuals who meet certain criteria in claiming a refund based on their rental payments for the tax year. It is essential for renters to understand the purpose of this form, as it can provide significant financial relief for those who qualify.

How to use the Renter Refund Form TC-40

Using the Renter Refund Form TC-40 involves several straightforward steps. First, gather all necessary documentation, including proof of rent payments and any required identification. Next, fill out the form accurately, ensuring all information is complete and correct. After completing the form, submit it according to the specified submission methods, either online or by mail. Understanding the process thoroughly will help ensure a smooth experience when applying for a refund.

Steps to complete the Renter Refund Form TC-40

Completing the Renter Refund Form TC-40 requires attention to detail. Follow these steps:

- Obtain the form from the official state resources or download it online.

- Fill in personal information, including your name, address, and Social Security number.

- Document your rental payments, including the total amount paid during the tax year.

- Provide any additional information required, such as proof of income if applicable.

- Review the form for accuracy and completeness before submission.

Legal use of the Renter Refund Form TC-40

The Renter Refund Form TC-40 must be used in compliance with state laws and regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or denial of the refund. Understanding the legal implications of submitting this form can help renters avoid potential issues and ensure they receive the benefits they are entitled to.

Eligibility Criteria

To qualify for a refund using the Renter Refund Form TC-40, individuals must meet specific eligibility criteria set by the state of Utah. Generally, applicants must be renters who have paid rent in the previous tax year and meet certain income thresholds. Additionally, the property rented must be the applicant's primary residence. Familiarizing oneself with these criteria is essential for a successful application.

Filing Deadlines / Important Dates

Filing deadlines for the Renter Refund Form TC-40 are crucial for applicants to be aware of. Typically, the form must be submitted by a specific date each year, often aligning with state tax deadlines. Missing this deadline could result in the inability to claim a refund for that tax year. Keeping track of these important dates ensures that renters do not miss out on potential financial benefits.

Quick guide on how to complete renter refund form tc 40cb 2013

Effortlessly prepare Renter Refund Form Tc 40cb on any device

The management of online documents has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without complications. Manage Renter Refund Form Tc 40cb on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Renter Refund Form Tc 40cb with ease

- Obtain Renter Refund Form Tc 40cb and click Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Renter Refund Form Tc 40cb to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

What form does a J1 visa student who worked over the summer need to fill out to get a tax refund from the US government?

You need form 1040NR (or 1040NR-EZ) and form 8843.See Publication 519 (2014), U.S. Tax Guide for Aliens for some help as well as Page on irs.gov. You may have to file a nonresident state tax return as well but that depends on your state.Be careful when using web-based software (such as TurboTax) because not all of them support nonresident forms.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the renter refund form tc 40cb 2013

How to generate an electronic signature for your Renter Refund Form Tc 40cb 2013 online

How to generate an electronic signature for the Renter Refund Form Tc 40cb 2013 in Chrome

How to generate an eSignature for putting it on the Renter Refund Form Tc 40cb 2013 in Gmail

How to create an eSignature for the Renter Refund Form Tc 40cb 2013 from your smart phone

How to generate an electronic signature for the Renter Refund Form Tc 40cb 2013 on iOS

How to create an eSignature for the Renter Refund Form Tc 40cb 2013 on Android OS

People also ask

-

What is the Renter Refund Form Tc 40cb?

The Renter Refund Form Tc 40cb is a document used by tenants to apply for a refund of certain rental expenses. This form is essential for individuals looking to claim a refund based on their rental payments and associated costs, ensuring that you receive the financial benefits you are entitled to.

-

How can airSlate SignNow help with the Renter Refund Form Tc 40cb?

With airSlate SignNow, you can easily fill out and eSign the Renter Refund Form Tc 40cb, simplifying the submission process. Our platform allows for quick document management, ensuring that your form is completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing the Renter Refund Form Tc 40cb?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for documents like the Renter Refund Form Tc 40cb. These features enhance efficiency and ensure you can manage your refund application seamlessly.

-

Is there a cost associated with using airSlate SignNow for the Renter Refund Form Tc 40cb?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Our cost-effective solutions ensure that you can access powerful tools to manage your Renter Refund Form Tc 40cb without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for the Renter Refund Form Tc 40cb?

Absolutely! airSlate SignNow integrates with numerous applications, allowing you to streamline your workflow when handling the Renter Refund Form Tc 40cb. This means you can connect with popular tools for better document management and communication.

-

What are the benefits of using airSlate SignNow for the Renter Refund Form Tc 40cb?

Using airSlate SignNow for the Renter Refund Form Tc 40cb provides benefits such as increased efficiency, enhanced security, and ease of access. Our platform ensures your documents are handled securely while giving you the flexibility to sign from anywhere.

-

How does airSlate SignNow ensure the security of the Renter Refund Form Tc 40cb?

airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. This means that your Renter Refund Form Tc 40cb and all sensitive information are protected throughout the signing process.

Get more for Renter Refund Form Tc 40cb

Find out other Renter Refund Form Tc 40cb

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form