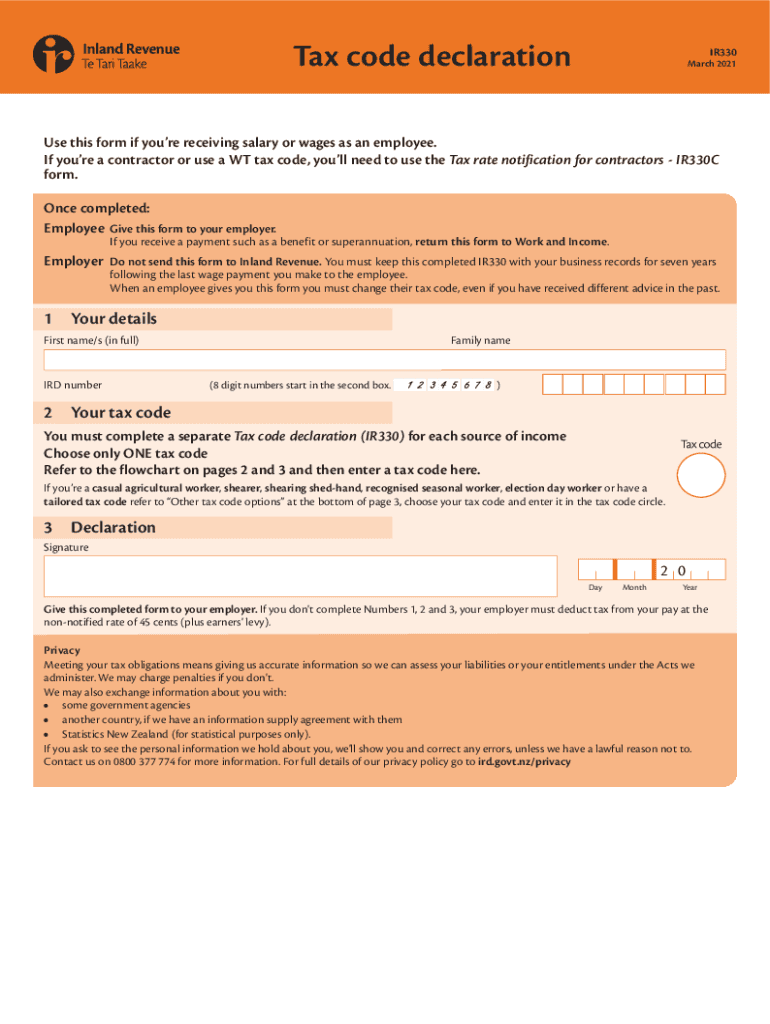

Tax Code Declaration IR330 IRD Form

Understanding the Tax Code Declaration IR330

The Tax Code Declaration IR330 is a crucial form used in the United States for tax purposes. It allows individuals to declare their tax code to their employer, ensuring that the correct amount of tax is withheld from their earnings. This form is essential for maintaining compliance with tax regulations and helps prevent underpayment or overpayment of taxes throughout the year.

Steps to Complete the Tax Code Declaration IR330

Completing the Tax Code Declaration IR330 involves several straightforward steps:

- Obtain the form: Download the IR330 form from a reliable source or request it from your employer.

- Fill in personal details: Provide your name, address, and Social Security number.

- Select your tax code: Choose the appropriate tax code based on your employment status and personal circumstances.

- Sign and date the form: Ensure that you sign and date the declaration to validate it.

- Submit the form: Return the completed form to your employer for processing.

Legal Use of the Tax Code Declaration IR330

The Tax Code Declaration IR330 is legally binding when completed correctly. It serves as an official document that employers must use to determine the correct tax withholding for their employees. Compliance with tax laws is essential, as inaccuracies can lead to penalties or legal issues.

Required Documents for the Tax Code Declaration IR330

When completing the Tax Code Declaration IR330, you may need to provide additional documentation to support your claims. This may include:

- Proof of identity: Such as a driver's license or passport.

- Social Security card: To verify your Social Security number.

- Previous tax returns: If applicable, to provide context for your tax situation.

Form Submission Methods

The Tax Code Declaration IR330 can be submitted through various methods, depending on your employer's preferences:

- Online: Many employers allow electronic submission through their payroll systems.

- Mail: You can send a physical copy of the completed form to your employer's HR department.

- In-person: Delivering the form directly to your employer can ensure immediate processing.

Examples of Using the Tax Code Declaration IR330

Understanding how to use the Tax Code Declaration IR330 can help clarify its importance:

- A new employee may need to submit the form to establish their tax code with their employer.

- An employee who experiences a change in personal circumstances, such as marriage or having a child, should update their tax code by submitting a new IR330.

Eligibility Criteria for the Tax Code Declaration IR330

To complete the Tax Code Declaration IR330, individuals must meet specific eligibility criteria:

- Must be employed in the United States.

- Must have a valid Social Security number.

- Must understand their tax obligations and select the appropriate tax code.

Quick guide on how to complete tax code declaration ir330 2021 ird

Complete Tax Code Declaration IR330 IRD effortlessly on any device

Online document administration has gained traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it digitally. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents quickly and efficiently. Handle Tax Code Declaration IR330 IRD on any platform using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

How to alter and eSign Tax Code Declaration IR330 IRD without breaking a sweat

- Find Tax Code Declaration IR330 IRD and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or mask sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Tax Code Declaration IR330 IRD and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax code declaration ir330 2021 ird

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the ir330 feature in airSlate SignNow?

The ir330 feature in airSlate SignNow refers to our advanced electronic signature capabilities. It allows users to securely sign documents online, ensuring compliance and efficiency. With ir330, businesses can streamline their workflows and reduce the time spent on document management.

-

How does pricing work for airSlate SignNow with ir330?

Pricing for airSlate SignNow with ir330 is competitive and designed to fit various business sizes. We offer flexible plans that can be tailored to your needs, ensuring you get the most value for your investment. Contact our sales team to learn more about specific pricing details and available promotions.

-

What are the key benefits of using ir330 in airSlate SignNow?

Using ir330 in airSlate SignNow provides numerous benefits, such as enhanced security, compliance with legal standards, and faster turnaround times for documents. It also improves collaboration among team members and clients by simplifying the signing process. Overall, ir330 ensures a seamless experience for all users.

-

Can I integrate airSlate SignNow's ir330 with other software?

Yes, airSlate SignNow's ir330 offers robust integration capabilities with various third-party applications. This allows businesses to connect their existing tools and streamline workflows effectively. From CRM systems to project management tools, ir330 integrates smoothly to enhance productivity.

-

Is there a mobile version for using the ir330 feature?

Absolutely! The ir330 feature in airSlate SignNow is fully accessible via our mobile app. This means you can sign documents and manage agreements from anywhere, at any time, ensuring flexibility for busy professionals on the go.

-

How secure is the ir330 electronic signature process?

The ir330 electronic signature process in airSlate SignNow is designed with security as a top priority. We use industry-standard encryption and comply with legal regulations to protect your documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What types of documents can be signed using ir330?

You can sign various types of documents using ir330 in airSlate SignNow, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. This flexibility allows organizations to digitize their document signing process efficiently.

Get more for Tax Code Declaration IR330 IRD

- Ccp prior authorization request form prior authorization request for ccp services

- New york commissioner health form

- Ireland health service executive 576625006 form

- Microchip registration form

- Islamic will template form

- Typeprint missouri department of health certificate of form

- Hurtigruten ship manifest information form

- Ford form permission slip girl scouts

Find out other Tax Code Declaration IR330 IRD

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed