Use This Form to Request a Rollover from Another 529 Plan, a Coverdell Education Savings Account, or a Qualified U

Purpose of the Fidelity 529 Rollover Form

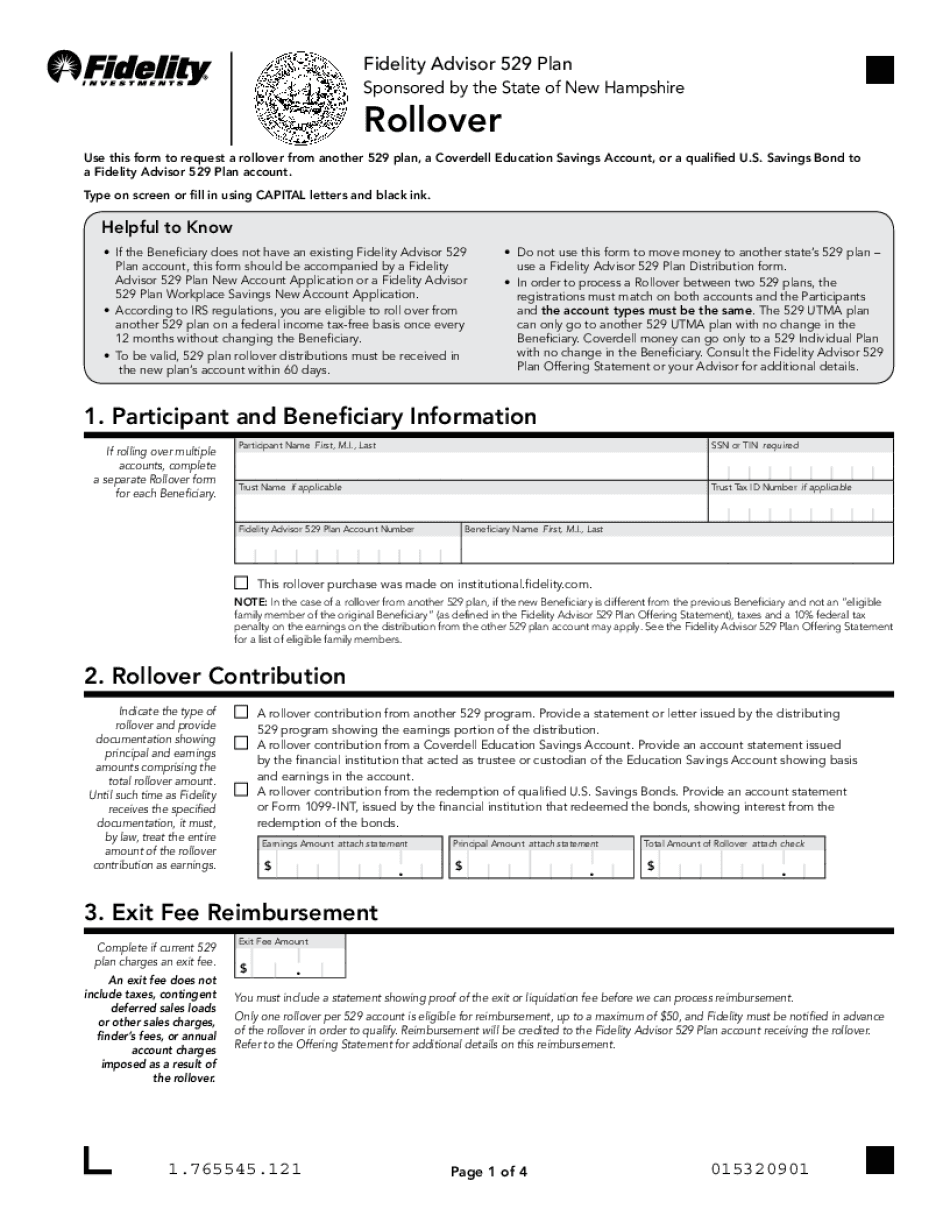

The Fidelity 529 rollover form is designed to facilitate the transfer of funds from another 529 plan, a Coverdell Education Savings Account, or a qualified U.S. savings plan. This form allows account holders to consolidate their education savings into a single account, making it easier to manage investments and ensure that funds are used for qualified education expenses. Utilizing this form helps streamline the process of moving assets while maintaining the tax advantages associated with 529 plans.

Steps to Complete the Fidelity 529 Rollover Form

Completing the Fidelity 529 rollover form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including details of the existing account from which you are rolling over funds. Fill out the form with accurate personal information, including your name, address, and Social Security number. Specify the amount you wish to roll over and provide the details of the current plan. Review the completed form for accuracy before submission to avoid delays.

Required Documents for the Fidelity 529 Rollover

To successfully complete the Fidelity 529 rollover process, certain documents are necessary. These typically include:

- A copy of the statement from the existing 529 plan or Coverdell Education Savings Account.

- Your Fidelity 529 account information.

- Any additional forms required by the existing plan for processing rollovers.

Having these documents ready will expedite the rollover process and help ensure compliance with all applicable regulations.

IRS Guidelines for 529 Rollovers

The Internal Revenue Service (IRS) has established guidelines governing 529 plan rollovers. According to IRS regulations, you can roll over funds from one 529 plan to another without incurring taxes, provided the rollover is completed within sixty days. Additionally, each beneficiary can only receive one rollover per twelve-month period. Understanding these guidelines is crucial to avoid any potential tax penalties and to ensure that the rollover maintains its tax-advantaged status.

Form Submission Methods

The Fidelity 529 rollover form can be submitted through various methods, providing flexibility for account holders. Options typically include:

- Online submission through Fidelity’s secure portal, allowing for quick processing.

- Mailing the completed form to Fidelity’s designated address for processing.

- In-person submission at a Fidelity branch location, where assistance may be available.

Choosing the appropriate submission method can help facilitate a smooth and efficient rollover process.

Legal Considerations for Fidelity 529 Rollovers

When executing a Fidelity 529 rollover, it is essential to be aware of the legal considerations involved. The rollover must comply with federal and state laws governing 529 plans. This includes understanding the specific rules regarding contributions, withdrawals, and the treatment of funds. Utilizing a reliable electronic signature solution, such as airSlate SignNow, can enhance the legal validity of your documents, ensuring compliance with the ESIGN Act and UETA. This is particularly important for maintaining the integrity of the rollover process.

Quick guide on how to complete use this form to request a rollover from another 529 plan a coverdell education savings account or a qualified u

Effortlessly prepare Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents promptly without interruptions. Manage Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U with no hassle

- Obtain Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the use this form to request a rollover from another 529 plan a coverdell education savings account or a qualified u

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is a Fidelity 529 rollover?

A Fidelity 529 rollover involves transferring funds from one 529 college savings plan to another to achieve better returns or benefits. This process is generally tax-free and allows you to take advantage of different investment options offered by Fidelity. By executing a Fidelity 529 rollover, you can optimize your college savings strategy.

-

What are the benefits of a Fidelity 529 rollover?

The main benefits of a Fidelity 529 rollover include greater investment flexibility, potentially better fees, and the opportunity to choose a plan that aligns with your financial goals. Additionally, a Fidelity 529 rollover allows you to consolidate your accounts, making it easier to manage your college savings. This enables you to maximize the growth potential of your investments.

-

Are there any fees associated with a Fidelity 529 rollover?

While the Fidelity 529 rollover itself is typically tax-free, there may be fees charged by the original plan or the receiving plan. It's essential to review both plans for any associated costs prior to initiating a rollover. Understanding these fees can help you make informed decisions about your college savings.

-

How can I initiate a Fidelity 529 rollover?

To initiate a Fidelity 529 rollover, you’ll need to contact both the current and the new plan provider. They will provide you with the necessary forms and instructions to complete the rollover process. It's advisable to gather all required information and consult with a financial advisor to ensure a smooth transition.

-

Can I perform a Fidelity 529 rollover multiple times?

Yes, you can perform a Fidelity 529 rollover multiple times; however, the IRS allows only one rollover per beneficiary per 12-month period. This means that careful planning is required to optimize your investments while adhering to IRS regulations. Consulting with a financial advisor can help you navigate these limits effectively.

-

What features should I look for in a Fidelity 529 plan?

When considering a Fidelity 529 plan, look for features such as low fees, a variety of investment options, and tax advantages. Additionally, consider whether the plan allows for easy management and transactions online. Understanding these features can help you choose the right plan for your rollover.

-

How does a Fidelity 529 rollover affect my tax situation?

A Fidelity 529 rollover is generally tax-free, provided that the funds are transferred directly between qualified plans. This means you won't incur taxes or penalties as long as you adhere to the 12-month rule and other IRS guidelines. Always consult a tax professional to understand your specific situation before proceeding.

Get more for Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U

- Chancery court forms hamilton county tennessee

- In the circuit court ofcounty mississippi form

- To any lawful officer of form

- In the united states district court district of govinfo form

- Guide to becoming a guardian without a lawyer cuny school of form

- Come now form

- Rule 10 counterclaims cross claims and third party claims form

- Come now plaintiffs form

Find out other Use This Form To Request A Rollover From Another 529 Plan, A Coverdell Education Savings Account, Or A Qualified U

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement