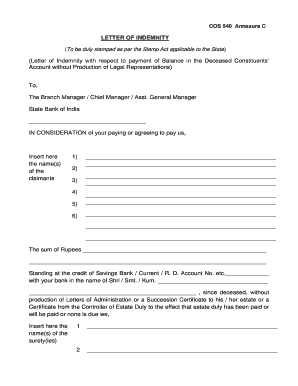

Sbi Letter of Indemnity Form

What is the SBI letter of indemnity?

The SBI letter of indemnity is a legal document that provides a guarantee to the State Bank of India, protecting it against potential losses or damages that may arise from specific transactions. This letter is often required in situations where the bank needs assurance that it will not face financial repercussions due to actions taken by the account holder. It serves as a safeguard for the bank, ensuring that any liabilities incurred during a transaction are covered by the account holder's commitment.

How to use the SBI letter of indemnity

Using the SBI letter of indemnity involves several steps. First, the account holder must identify the specific transaction or situation that requires the indemnity. Next, they should accurately fill out the letter, including all necessary details such as the transaction type, amount, and any relevant dates. After completing the document, the account holder must sign it and submit it to the bank. This process ensures that the bank has a formal record of the indemnity, which can be referenced if any issues arise.

Steps to complete the SBI letter of indemnity

To complete the SBI letter of indemnity, follow these steps:

- Gather necessary information, including account details and transaction specifics.

- Obtain the appropriate letter of indemnity format from the bank or online resources.

- Fill in the required fields accurately, ensuring that all information is correct.

- Review the document for any errors or omissions.

- Sign the letter, ensuring that the signature matches the one on file with the bank.

- Submit the completed letter to the bank, either in person or through an approved digital method.

Key elements of the SBI letter of indemnity

The key elements of the SBI letter of indemnity include:

- Account Holder Information: Name, address, and account number of the individual or entity providing the indemnity.

- Transaction Details: Description of the transaction for which the indemnity is being provided, including amounts and relevant dates.

- Indemnity Clause: A statement outlining the account holder's commitment to cover any losses or damages incurred by the bank.

- Signatures: Required signatures of the account holder and any witnesses, if applicable.

Legal use of the SBI letter of indemnity

The legal use of the SBI letter of indemnity is crucial for ensuring that both the bank and the account holder are protected during transactions. This document is recognized under U.S. law and can be enforced in a court of law if disputes arise. It is important for the account holder to understand that by signing the letter, they are legally binding themselves to cover any potential losses that may occur as a result of the specified transaction.

Examples of using the SBI letter of indemnity

Common examples of situations where the SBI letter of indemnity may be used include:

- When an account holder requests a duplicate of a lost bank document.

- During the transfer of funds where the original transaction details are disputed.

- In cases where a bank needs assurance against potential risks associated with international transactions.

Quick guide on how to complete sbi letter of indemnity

Effortlessly prepare Sbi Letter Of Indemnity on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly and without holdups. Manage Sbi Letter Of Indemnity on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sbi Letter Of Indemnity with ease

- Locate Sbi Letter Of Indemnity and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign Sbi Letter Of Indemnity and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi letter of indemnity

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is a letter of indemnity sample for bank?

A letter of indemnity sample for bank is a document used to protect a bank against potential losses or damages that may arise from a specific transaction. It outlines the responsibilities of the parties involved and serves as a guarantee that the bank will not incur any losses due to the actions associated with that transaction.

-

How can I create a letter of indemnity sample for bank using airSlate SignNow?

Creating a letter of indemnity sample for bank with airSlate SignNow is simple and efficient. You can use our templates to customize a letter to meet your specific needs, ensuring that all necessary details are included while maintaining legal credibility.

-

What features does airSlate SignNow offer for drafting a letter of indemnity sample for bank?

airSlate SignNow provides a variety of features for drafting a letter of indemnity sample for bank, including customizable templates, electronic signature options, and secure cloud storage. These features streamline the document preparation process, allowing you to send and eSign documents quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for a letter of indemnity sample for bank?

Yes, airSlate SignNow offers a cost-effective pricing structure that accommodates businesses of all sizes. You can choose between various plans based on your needs, ensuring that you get the best value for creating and managing documents like a letter of indemnity sample for bank.

-

What are the benefits of using airSlate SignNow for a letter of indemnity sample for bank?

Using airSlate SignNow to create a letter of indemnity sample for bank enhances efficiency, reduces turnaround time, and minimizes the risk of delays. The platform also provides a secure environment for document storage and signature collection, ensuring peace of mind throughout the process.

-

Can I integrate airSlate SignNow with other applications for managing a letter of indemnity sample for bank?

Absolutely! airSlate SignNow offers seamless integrations with various applications like Google Drive, Dropbox, and CRM systems. This connectivity allows you to manage your letter of indemnity sample for bank and other documents more effectively across different platforms.

-

How can airSlate SignNow help in compliance when creating a letter of indemnity sample for bank?

airSlate SignNow ensures compliance by providing legally binding electronic signatures and secure storage of your documents. This feature is critical when crafting a letter of indemnity sample for bank, as it helps you meet legal standards and protect against disputes.

Get more for Sbi Letter Of Indemnity

- Offer in compromiseinternal revenue service form

- I represent the heirs of name and in that regard i will be opening an estate on their behalf form

- In accordance with our telephone conversation today i am enclosing herewith a check in the form

- Enclosed is documentation which i will be filing to close the estate form

- In the matter of the estate of name cause no form

- Enclosed an original complaint to close estate which you will both need to execute before a form

- Enclosed please find a copy of the judgment closing estate which was entered with the form

- Sale of property located at form

Find out other Sbi Letter Of Indemnity

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF