Property Assessment Complaint Form

What is the Property Assessment Complaint Form

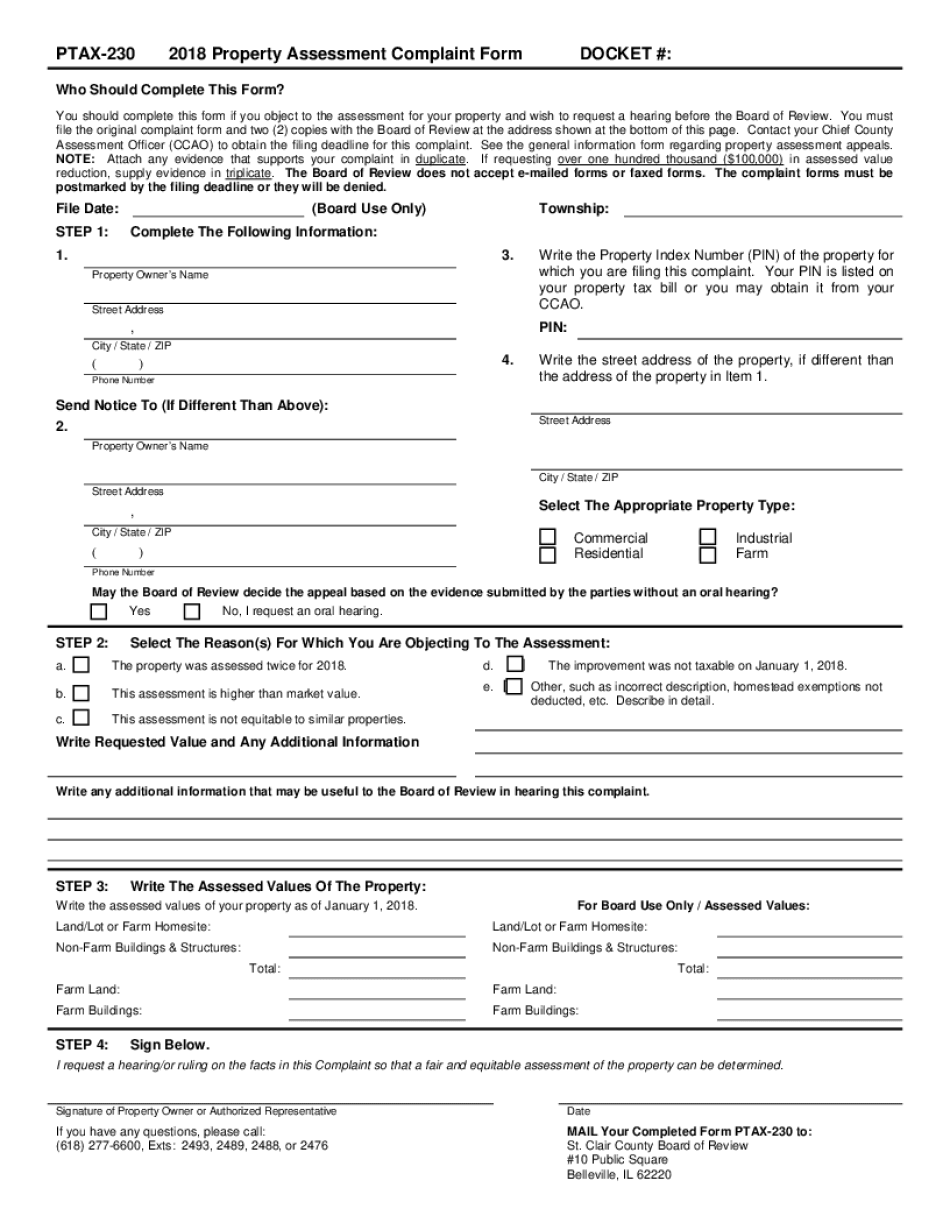

The ptax230 property, also known as the Property Assessment Complaint Form, is a legal document used by property owners to contest their property assessments. This form allows individuals to formally challenge the assessed value of their property, which can impact their property taxes. By filing this complaint, property owners seek to ensure that their property is assessed fairly based on its actual market value.

How to use the Property Assessment Complaint Form

Using the ptax230 property form involves several straightforward steps. First, property owners must gather relevant information regarding their property, including its assessed value and any comparable properties. Next, they should complete the form accurately, providing all required details, such as property identification and the reasons for the complaint. Once completed, the form should be submitted to the appropriate local assessment office, either online or by mail, depending on the jurisdiction's guidelines.

Steps to complete the Property Assessment Complaint Form

Completing the ptax230 property form requires careful attention to detail. Follow these steps for a successful submission:

- Gather documentation, including property tax bills and recent appraisals.

- Access the ptax230 property form through the local assessment office's website or request a physical copy.

- Fill out the form, ensuring all sections are completed, including personal information and property details.

- Clearly state the reasons for the complaint, supported by evidence such as comparable property assessments.

- Review the form for accuracy before submission.

- Submit the completed form by the specified deadline, ensuring it reaches the correct office.

Legal use of the Property Assessment Complaint Form

The ptax230 property form is legally recognized in the United States, provided it is filled out correctly and submitted within the designated timeframe. The legal framework surrounding property assessments allows homeowners to contest unfair valuations. It is essential for property owners to understand their rights and the legal implications of filing this complaint, as it can lead to adjustments in property taxes based on the outcome of the assessment review.

Required Documents

When filing the ptax230 property form, certain documents are typically required to support the complaint. These may include:

- Current property tax bill.

- Recent property appraisal or market analysis.

- Comparative sales data for similar properties in the area.

- Any previous correspondence with the local assessment office.

Having these documents ready can strengthen the case presented in the complaint.

Form Submission Methods

The ptax230 property form can be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission via the local assessment office's website.

- Mailing the completed form to the designated assessment office address.

- In-person submission at the local assessment office during business hours.

Property owners should verify the preferred submission method for their jurisdiction to ensure timely processing of their complaint.

Quick guide on how to complete 2018 property assessment complaint form

Complete Property Assessment Complaint Form effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents quickly without any delays. Manage Property Assessment Complaint Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-centered task today.

How to modify and eSign Property Assessment Complaint Form easily

- Find Property Assessment Complaint Form and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Property Assessment Complaint Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ptax230 property and how does it work?

The ptax230 property is a crucial component in document management, allowing users to define tax information within templates. It streamlines the process of managing tax-related documents by automatically populating necessary fields. By utilizing the ptax230 property, businesses can enhance accuracy and ensure compliance without the unnecessary hassle.

-

How can airSlate SignNow help manage ptax230 property documentation?

airSlate SignNow simplifies the management of ptax230 property documentation by providing customizable templates that meet your specific needs. With an intuitive interface, users can quickly create, send, and eSign documents, ensuring that all tax information is properly captured and utilized. This process ultimately saves time and reduces errors for your business.

-

What pricing plans are available for using the ptax230 property feature?

AirSlate SignNow offers various pricing plans that include the ptax230 property feature as part of its document management capabilities. These plans cater to businesses of all sizes and budgets, allowing you to choose an option that best suits your needs. Detailed pricing information can be found on our website to help you make an informed decision.

-

What are the benefits of using ptax230 property in my business?

Incorporating ptax230 property into your document workflows provides several benefits, such as enhanced accuracy and compliance in tax documentation. It minimizes the risk of human error by automating tax field entries, saving time and resources. Additionally, this feature aids in smoother audits and financial processes, ultimately improving overall operational efficiency.

-

Can I integrate other tools with airSlate SignNow for managing ptax230 property?

Yes, airSlate SignNow supports integrations with various third-party applications that allow for effective management of the ptax230 property. Whether you use CRM systems, cloud storage, or other software tools, our platform enables seamless connections. This capability enhances your workflow and ensures that information related to the ptax230 property is always up-to-date.

-

Is customer support available for questions about ptax230 property?

Absolutely! Our dedicated customer support team is available to assist you with any inquiries regarding the ptax230 property and how to utilize it within airSlate SignNow. We provide multiple channels for support, including live chat, email, and phone, ensuring that you have the help you need to optimize your document processes.

-

How secure is the information related to the ptax230 property on airSlate SignNow?

Security is a top priority at airSlate SignNow, especially concerning sensitive information like the ptax230 property. We employ advanced encryption protocols and comply with industry-standard security measures to protect your data. You can confidently manage your documents and tax information knowing that it is safeguarded against unauthorized access.

Get more for Property Assessment Complaint Form

- Vehicle dealer inventory loan notice michigan form

- Electron configuration worksheet high school pdf form

- Liquor liability for special events questionnaire nsq0006b0610doc form

- Schedule of real estate owned form

- For lab use only analytical request form

- Total nasal symptom score please answer all questions to form

- California certification trust form

- Employment application tvobgyncom form

Find out other Property Assessment Complaint Form

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast