Vat 484 Form

What is the Vat 484

The Vat 484 form is a document used in the United States for reporting and managing value-added tax (VAT) details. This form is particularly relevant for businesses that engage in cross-border transactions or those that need to adjust their VAT registration. The Vat 484 allows entities to communicate changes in their VAT status to the appropriate authorities, ensuring compliance with tax regulations.

How to use the Vat 484

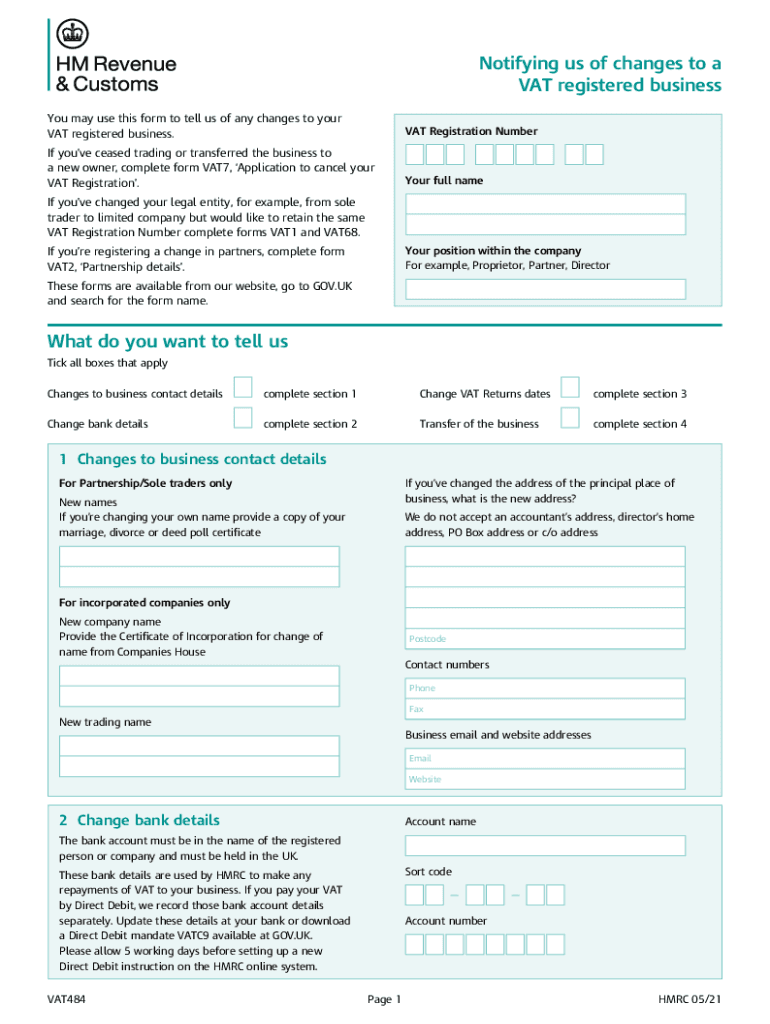

Using the Vat 484 form involves several steps to ensure accurate reporting. First, gather all necessary information regarding your business's VAT details. This includes your VAT registration number, business name, and any changes you are reporting. Once you have this information, you can fill out the form either digitally or by hand. Ensure that all sections are completed accurately to avoid delays in processing.

Steps to complete the Vat 484

Completing the Vat 484 form requires careful attention to detail. Follow these steps for a smooth process:

- Start by downloading the Vat 484 form in PDF format from an official source.

- Fill in your business information, including the name, address, and VAT registration number.

- Indicate the specific changes you are reporting, such as changes in business structure or VAT rates.

- Review the completed form for accuracy and completeness.

- Sign and date the form as required.

Legal use of the Vat 484

The legal use of the Vat 484 form is crucial for maintaining compliance with tax laws. This form serves as an official record of any changes to your VAT status, which can be important during audits or tax assessments. By properly completing and submitting the Vat 484, businesses can ensure that they are adhering to the regulations set forth by the Internal Revenue Service (IRS) and other governing bodies.

Required Documents

When submitting the Vat 484 form, certain documents may be required to support your changes. These may include:

- Proof of VAT registration.

- Documentation of any changes in business structure or ownership.

- Financial statements that may be relevant to the changes being reported.

Having these documents ready can facilitate a smoother submission process and help avoid potential issues with compliance.

Form Submission Methods

The Vat 484 can be submitted through various methods, depending on the requirements of the jurisdiction. Common submission methods include:

- Online submission through designated government portals.

- Mailing the completed form to the appropriate tax authority.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help ensure timely processing of your form.

Quick guide on how to complete vat 484

Accomplish Vat 484 seamlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents promptly without delays. Manage Vat 484 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Vat 484 effortlessly

- Locate Vat 484 and then click Obtain Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this task.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Completed button to save your modifications.

- Select how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Vat 484 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the VAT 484 form PDF used for?

The VAT 484 form PDF is used to report VAT adjustments for your business. It allows businesses to rectify any discrepancies in their VAT filings with the tax authorities, ensuring compliance and accuracy in tax reporting.

-

How can I obtain a VAT 484 form PDF?

You can download the VAT 484 form PDF directly from the official tax authority's website or through various online resources. Many document management platforms, like airSlate SignNow, also provide templates for easy access and usage.

-

Is airSlate SignNow suitable for managing VAT 484 form PDFs?

Yes, airSlate SignNow is ideal for managing VAT 484 form PDFs. With its user-friendly interface, you can easily upload, eSign, and share these documents securely, streamlining your VAT submission process.

-

What are the costs associated with using airSlate SignNow for VAT 484 form PDFs?

airSlate SignNow offers flexible pricing plans starting with a free trial to assess its features for handling VAT 484 form PDFs. Paid plans include additional features for businesses looking to optimize their document workflows while ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other software for VAT 484 form PDFs?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications, allowing you to easily import and export VAT 484 form PDFs. This enhances your workflow efficiency and centralizes your document management system.

-

What security measures does airSlate SignNow implement for VAT 484 form PDFs?

airSlate SignNow prioritizes your document security by employing industry-standard encryption protocols for all VAT 484 form PDFs. Additionally, features like two-factor authentication ensure that your sensitive documents remain protected at all times.

-

Can I track changes made to a VAT 484 form PDF in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tracking features for all changes made to your VAT 484 form PDFs. You can view document history and track signatures to maintain accountability and transparency during the signing process.

Get more for Vat 484

- How do i know if i have a valid slipping accident claim form

- T a r residential real estate listing agreement form

- Audit of landlords who provide the utility services to form

- Selling a rental propertytenancy services form

- Tag my18 best dating sites reviews ampampamp stats form

- In the future you may only enter my premises form

- I believe the above stated day and time is reasonable form

- Associated therewith form

Find out other Vat 484

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure