Income Documentation Form

What is the Income Documentation

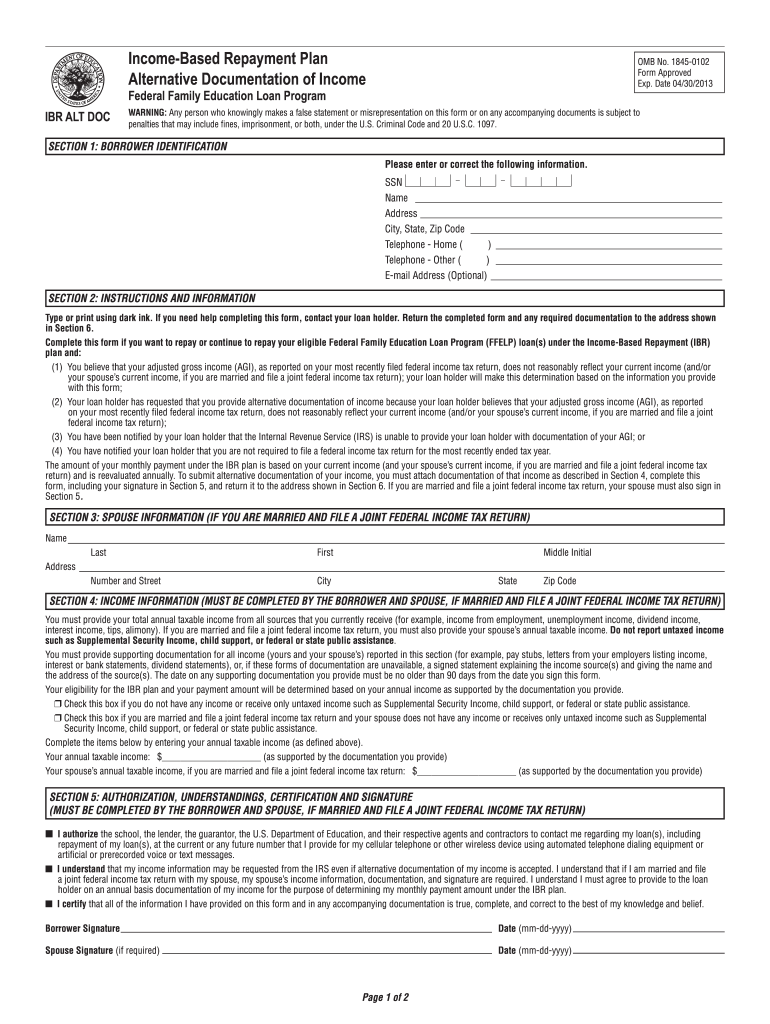

The income documentation is a formal record that verifies an individual's or entity's income for various purposes, including loan applications, tax filings, and financial assessments. This documentation can include pay stubs, tax returns, bank statements, and other relevant financial records. It is essential for proving financial stability and eligibility for various programs, including income repayment alternatives.

How to Use the Income Documentation

Using income documentation effectively involves gathering all necessary financial records and ensuring they are current and accurate. Individuals should compile documents such as W-2 forms, 1099s, and recent pay stubs. Once collected, these documents can be used to complete forms for loan applications, financial aid, or other purposes requiring proof of income. It is crucial to follow specific guidelines provided by the requesting institution to ensure compliance.

Steps to Complete the Income Documentation

Completing income documentation requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including pay stubs, tax returns, and bank statements.

- Review each document to ensure all information is accurate and up-to-date.

- Fill out any required forms, making sure to include all necessary details.

- Double-check for completeness, ensuring no fields are left blank.

- Submit the documentation as required, either online or via mail, depending on the institution's guidelines.

Legal Use of the Income Documentation

Income documentation must be used in compliance with relevant laws and regulations. Each institution may have specific requirements regarding what constitutes acceptable income verification. It is essential to ensure that all documents submitted are legitimate and accurately reflect the individual's financial situation. Misrepresentation of income can lead to serious legal consequences, including penalties or denial of applications.

Required Documents

When preparing income documentation, certain documents are typically required. These may include:

- Recent pay stubs or salary statements

- Tax returns for the previous year

- Bank statements showing regular deposits

- Proof of additional income sources, such as rental income or dividends

Gathering these documents in advance can streamline the process and ensure a smooth submission.

Form Submission Methods (Online / Mail / In-Person)

Submitting income documentation can be done through various methods, depending on the institution's requirements. Common submission methods include:

- Online: Many institutions allow for electronic submission through secure portals, which can expedite processing times.

- Mail: Physical copies can be sent via postal service, but this method may take longer for processing.

- In-Person: Some institutions may allow for direct submission at their offices, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete income documentation form

Discover the Easiest Method to Complete and Sign Your Income Documentation

Are you still spending time preparing your official paperwork on paper instead of doing it digitally? airSlate SignNow provides a superior way to fill out and sign your Income Documentation and associated forms for public services. Our advanced electronic signature solution equips you with everything required to handle paperwork swiftly and in compliance with official standards - comprehensive PDF editing, management, security, signing, and sharing tools all readily available in a user-friendly interface.

Only a few steps are needed to complete filling out and signing your Income Documentation:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to input in your Income Documentation.

- Move between the sections with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the fields with your information.

- Modify the content using Text boxes or Images from the toolbar above.

- Emphasize what is essential or Redact sections that are no longer relevant.

- Select Sign to create a legally valid electronic signature using any method of your choice.

- Add the Date next to your signature and conclude your task by clicking the Done button.

Store your completed Income Documentation in the Documents section of your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides versatile form sharing options. There’s no need to print out your forms when you are required to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How do I apply for a PAN card online if I do not have Aadhaar attached to my mobile number?

PAN card applications have been made easier when the Indian Government introduced an online application portal. You will either have to fill out Form 49A or Form 49AA. Persons holding an Indian Citizenship need to fill out Form 49A. If you hold a foreign passport, you will have to fill out Form 49AA. Thus, OCI Cardholders, PIO cardholders are all eligible to fill out Form 49AA, while NRIs holding an Indian passport can fill out Form 49A.Here are 12 simple steps for you to apply for an Indian PAN Card from abroadLog in to the PAN Card Website online here nsdl.comScroll down the page and click on the link that says “Apply for a new PAN card”Depending on your status, fill out either Form 49A or Form 49AARead the guidelines carefully before filling in your details. Make sure that your overseas address matches the one in your proof of address document.Remember do not fill in an Indian address if you are an NRI, PIO or OCI cardholder.Once the form is filled, cross-check all your information and verify that it is correct before clicking the “Submit” button.If your form was filled out correctly, an acknowledgement page should appear on your screen.Print out a minimum of two copies of this acknowledgement slip. Ensure that you keep one with yourself for future reference.Paste your photos wherever it is required. You will need to place your signature wherever required in black ink only.Self-attest all copies you have made of your passport and the document proving your residential address.You will need to send these documents by mail to NSDL, PAN Unit. The address is as follows:NSDL at 'Income Tax PAN Services Unit, National Securities Depository Limited, 3rd floor, Sapphire Chambers, Near Baner Telephone Exchange, Baner, Pune – 411045On the envelope, you will need to mention that it is a PAN card application, and also mention your acknowledgement number. Write this in the format “PAN Card Application – Your Acknowledgement Number”Once you have mailed your documents within 15 days of completing your on-line application form, then you can track your application using your acknowledgement number.

-

How can I obtain Japanese citizenship?

Great answers by Dick Karp and David LaSpina.I can only add my two cents of knowledge to their insights.The first thing: citizenship and naturalization are two different matters.You can only get citizenship if you were born from Japanese parents, AND being registered within 3 months with your local Japanese consulate.AND when you signNow 20 years old, it's mandatory you choose whether lose your local citizenship or your Japanese citizenship.Should you not make a move, you lose your Japanese one by default.On the other hand, you might be naturalised Japanese (i.e.: become a non-born Japanese with a permanent visa) if all these criteria are met:- you're living for at least 5 years in Japan- you're at least 20 years old- you can read, write and speak Japanese fluently- you are willing to go through writing exams and interview processes- you have professional skills and $ to support yourselfEvery case is examined and weighed individually. Say, if one of your parents is Japanese (Japanese-born), the Ministry of Justice may wave the age and residence requirements. But again: it is a case-by-case process.Sources:Japanese nationality lawI want to become a Japanese nationalMany angles to acquiring Japanese citizenship | The Japan TimesAlso, I went myself to my local Japan consulate and talked with them.

-

How do illegal immigrants live in the US successfully for 20 years, including getting a driving license, get a job, pay taxes, and buy a house?

I live in Arizona and have seen a lot of this go down over the last couple decades. It boils down to numerous businesses, both small and large who are willing to capitalize on a cheap, extremely hard working labor force (legal status be damned). There are very few white people in this state who work as laborers in landscaping, roofing, concrete, tree trimming, house painting, dish washing, car washing, house cleaning, and crop harvesting. The white people run the companies. Or are the foremen or managers. But almost every person busting thier ass at the physical work is from Mexico and many speak little if any English.They are getting paid under the table, or they are using stolen identites for tax purposes (a decade ago a friend of mine's brother was sent a letter from the IRS claiming he was several years and thousands of dollars behind on taxes, his brother was 13 at the time). These immigrant workers are also doing the job for less than a legal citizen would take, sometimes less than minimum wage. This saves the companies money, and law enforcement did little to crack down on the employers. And since the businesses were making money on the cheap labor, they didn't want the cops to end the gravy train either.A cottage industry of slum lords were more than willing to take rent money from these immigrants for houses and apartments, and if you sell a car in a private transaction there is no legal requirement to verify the legal status of the buyer. Sure they are supposed to register and insure it, but that only matters if they get pulled over, and the smart ones register it under a family memeber who is a citizen or has a green card.Now that you have an immigrant population with money to spend, entrepreneurial people who speak the same language will start local businesses to cater to the needs of these folks who might be shy to spend their money in a store where they have trouble communicating. And all this feeds back into and perpetuates the cycle.So the short answer is: money!

-

Can a spouse of someone holding a Japanese working visa work in Japan? Does working online considered as working in Japan?

The spouse of a person that is holding a Japanese Working visa should possess a dependent visa.If that's the case, the spouse can go to the Immigration Bureau and carry along certain required documents, and fill out documentation to request permission to work in Japan. The spouse will get a stamp in the passport.This limits working hours to a maximum of 28 hours per week.As Chan Liyanage, the spouse will be required to fill out an annual Tax Declaration form in which he/she states the income for the previous year, and though the work is online, I would think you would have to declare it. I know someone that has an online blog and she pays taxes on her income, but her blog is about Japan, so I'm not sure if that's the difference and she gets lots of earnings through it. The form does ask for any earnings, and they even ask how much money you receive from home, family, etc.Also, there is no limit to what the spouse can do (except for anything in the sex industry or anything that is illegal, but I'm sure that's not an option for you, anyway). There are lots of English teaching jobs, she can teach online on Learn a language online. Etc. The government gives a little monthly stipend for your child, that can help cover some very basic necessities, it can be quite useful.Instead of using private nurseries, apply as soon as the child is born for government nurseries, you pay 3-4X less.Also, note that hospital fees are nearly free for pre-natal care, you only pay when there are complications and you go outside of the appointments. But pre-natal care is nearly free, and when you give birth, the government may assist with hospital fees. We didn't pay anything at all when I gave birth. I feel lucky in that sense. The most important thing is to make sure that you pay your taxes and declare everything (this will apply for both spouses), and also that you have insurance (we have the national health insurance).

-

Why would social security deny a disability claim that is a contagious flesh eating disease that affects all aspects of the person's life?

I was told by a Social Security agent that it’s really important to have proper documentation of the illness you are claiming as a disability. The doctors need to fill out the disability forms (which many hate doing) and they have to fill them out correctly, which many do not do. I got letters several times from Social Security pushing me to keep on my doctors to fill out and send in the forms. In my case my doctor made an appointment with me to fill out the form. She told me the forms are time consuming and that doctors want to be paid for their time. Then as she filled out the form she put me through a bunch of moves to see what I could and could not do and what my range of motion was. I have both RA and osteoarthritis which severely limits my mobility.The second thing one needs to know is that even if you have a disability, you will not be accepted as disabled enough unless you cannot work any job that can support you. So let’s say you have RA, but can still earn an income of say $800-$1000 or more a month, there is a good chance you will not get disability. I’m not sure of the amount, sorry, but I receive SSi and it’s below $800 a month.Before medication, my RA was so bad I could barely hold a pen or a mug. Then there were times I wasn’t too bad, but it would last only a couple of days, and then the RA would hit me hard and I was crippled for days. Medication has helped some, but my RA is aggressive and certain issues make it hard to treat. Plus I have a knee injury that severally affects my mobility, so much so that I have become basically homebound.Also a spouse cannot claim disability from their partners Social Security. let’s say the disabled person was a stay at home mom and as such has little to no Social Security funds in her name. Now when they retire she can make claims to her spouses social security and that’s normal and acceptable. But if she is disabled she cannot lay claim to her spouse’s Social Security for disability purposes.Even if your disability is painful or leaves you crippled, if you are able to find work, already have a job that is working around your disability, or have job training that allows you to possible get a job that the government believes will allow you to earn enough to live on, they will reject your claim. Social Security used to help with partial disabilities but they stopped that some time ago. Now a person must be declared permanently disabled, though I believe they also allow certain temporary, but full disabilities, not sure though. As long as it is coming from your own Social Security funds.I also read that most claims are rejected outright and that the government wants to see how many claimants are serious enough to appeal. More than half of all who do appeal end up winning their cases. Often people need to see a disability lawyer to help them win and while they don’t pay these lawyers directly, their fees are a percentage of the retroactive disability funds the disabled person ends up receiving. (retroactive payment is from the day you first apply)Unlike what some people believe it is not easy to be accepted as disabled. You often have to jump through hoops to get accepted and even when one is accepted often times the amount of money you get is hard to live on.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the income documentation form

How to make an electronic signature for your Income Documentation Form online

How to make an electronic signature for the Income Documentation Form in Chrome

How to create an electronic signature for signing the Income Documentation Form in Gmail

How to create an electronic signature for the Income Documentation Form right from your smart phone

How to generate an eSignature for the Income Documentation Form on iOS

How to create an electronic signature for the Income Documentation Form on Android

People also ask

-

What is Income Documentation in the context of airSlate SignNow?

Income Documentation refers to the necessary paperwork that verifies an individual's income for various purposes, such as loan applications or financial assessments. With airSlate SignNow, you can easily prepare, send, and electronically sign these important documents efficiently and securely.

-

How does airSlate SignNow help streamline the Income Documentation process?

airSlate SignNow streamlines the Income Documentation process by providing a user-friendly platform where you can create templates, fill out forms, and collect electronic signatures quickly. This reduces the time spent on administrative tasks, allowing you to focus on more critical business functions.

-

What are the pricing options for using airSlate SignNow for Income Documentation?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it easy to manage your Income Documentation requirements. You can choose from monthly or annual subscriptions, which provide access to all essential features for efficient document management.

-

Are there any integrations available for managing Income Documentation?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing the management of Income Documentation. You can connect with popular tools like Google Drive, Salesforce, and Dropbox to streamline your workflow and improve collaboration.

-

What security measures does airSlate SignNow implement for Income Documentation?

Security is a top priority at airSlate SignNow, especially when handling sensitive Income Documentation. The platform employs advanced encryption, secure cloud storage, and compliance with industry regulations to ensure that your documents are safe and confidential.

-

Can I customize my Income Documentation templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Income Documentation templates to meet your specific needs. You can add fields, logos, and branding, ensuring that your documents reflect your organization's identity while maintaining professionalism.

-

How quickly can I get started with airSlate SignNow for my Income Documentation needs?

Getting started with airSlate SignNow for your Income Documentation needs is quick and easy. You can sign up for a free trial, explore the features, and begin sending documents for eSigning within minutes, helping you streamline your processes right away.

Get more for Income Documentation

- Filing a complaint with feha form

- California jus form

- Resource card for victims of domestic violence and form

- Billing form for in home supportive services california victim vcgcb ca

- Std 71 records transfer list form

- California transcript form

- California reap form

- California los angeles effects permit form

Find out other Income Documentation

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself