Personal Financial Statement First Trust & Savings Bank Form

What is the Personal Financial Statement First Trust & Savings Bank?

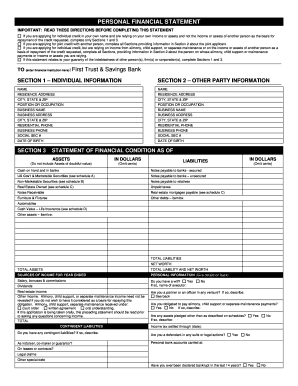

The Personal Financial Statement from First Trust & Savings Bank is a document that provides a comprehensive overview of an individual's financial situation. It typically includes details about assets, liabilities, income, and expenses. This form is essential for various financial transactions, such as applying for loans or mortgages, as it helps lenders assess the applicant's financial health and creditworthiness. By presenting a clear picture of one’s financial standing, the Personal Financial Statement facilitates informed decision-making for both the individual and the financial institution.

Steps to Complete the Personal Financial Statement First Trust & Savings Bank

Completing the Personal Financial Statement involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including bank statements, tax returns, and any other relevant financial records. Next, fill out the form by detailing your assets, such as real estate, savings accounts, and investments. Then, list your liabilities, including loans and credit card debts. It is important to provide accurate income and expense information to reflect your financial situation accurately. Finally, review the completed statement for any errors before submitting it to First Trust & Savings Bank.

Legal Use of the Personal Financial Statement First Trust & Savings Bank

The Personal Financial Statement is legally recognized as a binding document when completed accurately and submitted to financial institutions. It serves as a declaration of an individual's financial status and can be used in various legal contexts, such as loan applications and financial disclosures. To ensure its legal standing, it is crucial to comply with relevant laws and regulations, including providing truthful information. Misrepresentation or falsification of data may lead to legal repercussions, including denial of credit or other financial penalties.

Key Elements of the Personal Financial Statement First Trust & Savings Bank

Several key elements make up the Personal Financial Statement, each contributing to a holistic view of an individual's financial health. These elements include:

- Assets: This section lists all valuable possessions, including cash, real estate, vehicles, and investments.

- Liabilities: Here, individuals detail their debts, such as mortgages, loans, and credit card balances.

- Income: This part outlines all sources of income, including salaries, rental income, and dividends.

- Expenses: Individuals must provide a breakdown of monthly expenses, which can include housing costs, utilities, and discretionary spending.

These components are essential for lenders to evaluate the overall financial stability of the applicant.

How to Obtain the Personal Financial Statement First Trust & Savings Bank

Obtaining the Personal Financial Statement from First Trust & Savings Bank is a straightforward process. Individuals can request the form directly from the bank's website or visit a local branch to obtain a physical copy. Additionally, bank representatives can provide guidance on completing the form and answer any questions regarding specific requirements. It is advisable to ensure that you have all necessary financial information at hand before requesting the form to streamline the process.

Filing Deadlines / Important Dates

Filing deadlines for the Personal Financial Statement may vary depending on its intended use, such as loan applications or financial audits. It is essential to check with First Trust & Savings Bank for specific deadlines related to your application. Generally, timely submission of the Personal Financial Statement is crucial to avoid delays in processing loan applications or other financial requests. Keeping track of these important dates can help ensure that you meet all necessary requirements without complications.

Quick guide on how to complete personal financial statement first trust amp savings bank

Effortlessly Prepare Personal Financial Statement First Trust & Savings Bank on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and store it securely in the cloud. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Personal Financial Statement First Trust & Savings Bank on any device using the airSlate SignNow Android or iOS applications and simplify your document-centered workflows today.

How to Modify and eSign Personal Financial Statement First Trust & Savings Bank with Ease

- Locate Personal Financial Statement First Trust & Savings Bank and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select the method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Personal Financial Statement First Trust & Savings Bank to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal financial statement first trust amp savings bank

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the act April 2018 and how does it affect electronic signatures?

The act April 2018 refers to signNow legal changes that enhance the validity of electronic signatures in business transactions. This act ensures that electronic signatures, like those made with airSlate SignNow, hold the same legal weight as traditional handwritten signatures, making it crucial for businesses looking to streamline their processes.

-

How does airSlate SignNow comply with the act April 2018?

airSlate SignNow is fully compliant with the act April 2018, ensuring that all electronic signatures created on our platform are legally binding. By adhering to these regulations, we provide users with a secure and dependable solution for document management and electronic agreements.

-

What features does airSlate SignNow offer in relation to the act April 2018?

airSlate SignNow provides an array of features that align with the act April 2018, including secure signing, tracking, and storage of documents. Our platform also allows for customizable workflows, ensuring that users can manage their documents efficiently while maintaining compliance.

-

Is there a free trial available for airSlate SignNow to test its compliance with the act April 2018?

Yes, airSlate SignNow offers a free trial for new users to explore our platform and its capabilities. During this trial, you can evaluate how our features align with the act April 2018 and see how easy it is to manage your electronic signatures and documents.

-

What are the pricing plans for airSlate SignNow concerning the act April 2018 features?

Our pricing plans are designed to be cost-effective, offering various tiers that include features compliant with the act April 2018. Depending on your business needs, you can select a plan that provides the necessary tools for secure eSigning and document management at competitive rates.

-

Can airSlate SignNow integrate with other software in light of the act April 2018?

Absolutely! airSlate SignNow can seamlessly integrate with various software solutions while ensuring compliance with the act April 2018. This enables businesses to streamline their workflows and enhance productivity by linking our eSigning features with their existing systems.

-

What benefits does using airSlate SignNow offer in relation to the act April 2018?

Using airSlate SignNow offers numerous benefits, especially in light of the act April 2018. You can expedite the document signing process, reduce paperwork, and improve compliance, all while enjoying the peace of mind that comes from using a legally recognized electronic signature solution.

Get more for Personal Financial Statement First Trust & Savings Bank

- Type name or names of persons to receive form

- District of columbia quitclaim deed legal forms attorney

- 32483273 the complete book of latin phrases and scribd form

- Enter age at which property will be released from trust form

- The property at your death form

- Field 53 58 form

- Making a will in dcnolo form

- John schroeder pdf free download pdffoxcom form

Find out other Personal Financial Statement First Trust & Savings Bank

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure