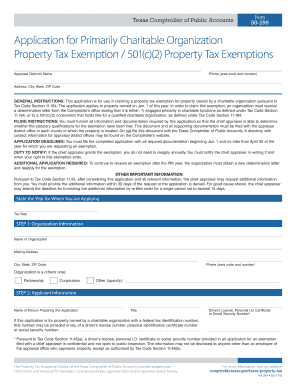

Property Tax Exemption 501c2 Property Tax Exemptions Form

Understanding the tx 50 exemption

The tx 50 exemption, also known as the 50-299 exemption, is a property tax exemption available in Texas for specific charitable organizations. This exemption is designed to reduce the financial burden on qualifying entities by exempting them from certain property taxes. To be eligible, organizations must meet specific criteria set forth by the Texas Comptroller's office, which includes being recognized as a 501(c)(3) or 501(c)(2) organization under the Internal Revenue Code. This exemption is crucial for non-profits, as it allows them to allocate more resources toward their charitable missions rather than tax liabilities.

Eligibility criteria for the tx 50 exemption

To qualify for the tx 50 exemption, organizations must adhere to several eligibility criteria. These include:

- Being a non-profit organization recognized under Section 501(c)(3) or 501(c)(2) of the Internal Revenue Code.

- Utilizing the property exclusively for charitable purposes.

- Meeting any additional state-specific requirements as outlined by the Texas Comptroller.

Organizations should ensure they maintain compliance with these criteria to avoid any potential penalties or loss of exemption status.

Steps to complete the tx 50 exemption application

Completing the tx 50 exemption application involves several key steps:

- Gather necessary documentation, including proof of 501(c)(3) or 501(c)(2) status.

- Complete the appropriate application form, usually the 50-299 form, ensuring all information is accurate and complete.

- Submit the application to the local appraisal district by the specified deadline, which varies by jurisdiction.

- Respond to any follow-up requests from the appraisal district to provide additional information or clarification.

Following these steps carefully can help ensure a smooth application process and successful exemption approval.

Required documents for the tx 50 exemption

When applying for the tx 50 exemption, organizations must prepare and submit specific documents, including:

- A completed 50-299 application form.

- Proof of 501(c)(3) or 501(c)(2) status, such as a determination letter from the IRS.

- Documentation demonstrating the use of the property for charitable purposes.

Having these documents ready can expedite the application process and help ensure compliance with all requirements.

Legal use of the tx 50 exemption

The legal use of the tx 50 exemption is governed by Texas state law and IRS regulations. Organizations must use the exempt property solely for charitable purposes to maintain their exemption status. Misuse of the property, such as renting it for non-charitable activities, can result in penalties, including the loss of the exemption and potential back taxes owed. It is essential for organizations to understand these legal obligations to safeguard their tax-exempt status.

Filing deadlines for the tx 50 exemption

Filing deadlines for the tx 50 exemption vary by local jurisdiction but generally fall within specific timeframes each year. Organizations should be aware of these deadlines to ensure timely submission of their applications. Typically, applications must be submitted by the first day of the year in which the exemption is sought. Failure to meet these deadlines can result in the denial of the exemption for that tax year.

Quick guide on how to complete property tax exemption 501c2 property tax exemptions

Effortlessly Prepare Property Tax Exemption 501c2 Property Tax Exemptions on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed forms, as you can easily locate the correct document and securely keep it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents quickly and without delays. Handle Property Tax Exemption 501c2 Property Tax Exemptions on any device using the airSlate SignNow apps for Android or iOS and simplify any paperwork process today.

The simplest way to modify and eSign Property Tax Exemption 501c2 Property Tax Exemptions effortlessly

- Obtain Property Tax Exemption 501c2 Property Tax Exemptions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Property Tax Exemption 501c2 Property Tax Exemptions to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the tx 50 exemption in relation to airSlate SignNow?

The tx 50 exemption refers to a feature within airSlate SignNow that allows businesses to streamline their document signing processes. This exemption can help organizations simplify compliance and enhance efficiency when managing eSignatures. Understanding how to leverage the tx 50 exemption will enable you to optimize your document workflows.

-

How can the tx 50 exemption benefit my business?

Utilizing the tx 50 exemption can signNowly reduce paperwork, save time, and increase overall productivity for your business. With airSlate SignNow's capabilities, you can handle eSignatures easily while ensuring compliance with legal standards. This allows for faster transactions and improved customer satisfaction.

-

Is there a cost associated with the tx 50 exemption feature?

The tx 50 exemption feature is included in the standard pricing plans of airSlate SignNow, making it cost-effective for businesses of all sizes. By investing in airSlate SignNow, you gain access to essential features, like the tx 50 exemption, without additional fees. This ensures you get exceptional value in managing your eSigning requirements.

-

Are there specific documents that qualify under the tx 50 exemption?

Yes, various types of documents can qualify under the tx 50 exemption when using airSlate SignNow. Typically, these include legal documents, contracts, and other agreements that require signatures. It's important to review the specific criteria for your documents to ensure compliance with the tx 50 exemption.

-

How does airSlate SignNow integrate with other tools regarding the tx 50 exemption?

airSlate SignNow seamlessly integrates with various business applications, enhancing the functionality of the tx 50 exemption. Whether you use CRM systems, cloud storage solutions, or project management tools, airSlate SignNow can connect easily, allowing for efficient document management. This integration streamlines workflows, making the tx 50 exemption even more effective.

-

Can I track the status of documents with the tx 50 exemption?

Absolutely! airSlate SignNow provides robust tracking features that allow you to monitor the status of documents associated with the tx 50 exemption. You'll receive real-time notifications when documents are viewed, signed, or completed, enabling you to stay informed throughout the signing process.

-

What security measures are in place for documents under the tx 50 exemption?

Security is paramount at airSlate SignNow, especially for documents related to the tx 50 exemption. Our platform employs encryption, two-factor authentication, and secure servers to protect your sensitive information. You can trust that your documents and signatures are kept safe and compliant with industry standards.

Get more for Property Tax Exemption 501c2 Property Tax Exemptions

- Fillable online jis code dbp dbo fax email print pdffiller form

- Form pc 552 safe deposit box certificate and receipt

- State of michigan probate court county of pc form

- 1 decedent last resided at and died 2 i demand mailed form

- Notice of intent to request informal appointment of personal

- Fillable online pc558 application for informal probate and

- Fillable online european community connecticut workers form

- Fillable online expxi 96 ea p 1 external application form

Find out other Property Tax Exemption 501c2 Property Tax Exemptions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors