Enrollment Form USAble Mutual Insurance Company

What is the enrollment form for a usable mutual insurance company?

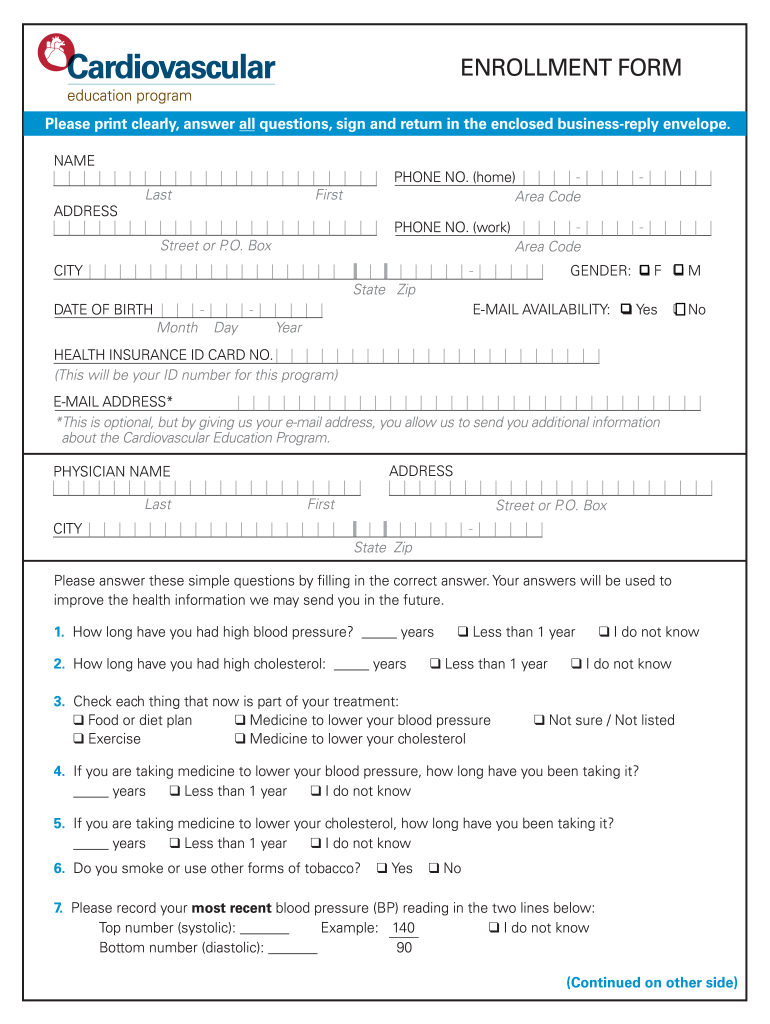

The enrollment form for a usable mutual insurance company is a crucial document that allows individuals to apply for insurance coverage. This form typically collects essential personal information, including the applicant's name, contact details, and any relevant health history. It serves as the official request for coverage and initiates the relationship between the applicant and the insurance provider. Understanding the purpose and components of this form is vital for ensuring a smooth application process.

Steps to complete the enrollment form for a usable mutual insurance company

Completing the enrollment form for a usable mutual insurance company involves several key steps:

- Gather necessary information: Collect all required personal and health information before starting the form.

- Fill out the form: Enter your details accurately, ensuring that all sections are completed as required.

- Review the form: Double-check all entries for accuracy and completeness to avoid delays.

- Sign the form: Provide your signature, either digitally or physically, to validate your application.

- Submit the form: Send the completed form to the insurance company through the designated submission method.

Key elements of the enrollment form for a usable mutual insurance company

The enrollment form for a usable mutual insurance company typically includes several key elements:

- Personal Information: Name, address, date of birth, and contact details.

- Health History: Questions regarding medical conditions, medications, and previous insurance coverage.

- Coverage Selection: Options for the types of coverage desired, including any additional riders or benefits.

- Payment Information: Details on how premiums will be paid, including payment methods and frequency.

- Signature Section: A space for the applicant's signature, which may also include a date and witness signature if required.

Legal use of the enrollment form for a usable mutual insurance company

The enrollment form for a usable mutual insurance company must comply with legal standards to be considered valid. This includes adherence to regulations such as the ESIGN Act and UETA, which govern the use of electronic signatures. Additionally, the form should clearly outline the terms and conditions of the insurance coverage being applied for. Ensuring that all legal requirements are met is essential for the form to be enforceable in a court of law.

How to obtain the enrollment form for a usable mutual insurance company

Obtaining the enrollment form for a usable mutual insurance company can be done through several methods:

- Company Website: Most insurance companies provide downloadable forms on their official websites.

- Customer Service: Contacting the insurance company's customer service can provide access to the form via email or postal service.

- Local Offices: Visiting a local branch or office of the insurance company can allow for in-person acquisition of the form.

Form submission methods for a usable mutual insurance company

Submitting the enrollment form for a usable mutual insurance company can typically be done through various methods:

- Online Submission: Many companies offer a secure portal for submitting forms electronically.

- Mail: Completed forms can often be sent via postal service to the designated address of the insurance company.

- In-Person: Applicants may choose to submit the form directly at a local office for immediate processing.

Quick guide on how to complete enrollment form usable mutual insurance company

Effortlessly Prepare Enrollment Form USAble Mutual Insurance Company on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Enrollment Form USAble Mutual Insurance Company on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Steps to Edit and eSign Enrollment Form USAble Mutual Insurance Company with Ease

- Find Enrollment Form USAble Mutual Insurance Company and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for such tasks.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your updates.

- Choose how you prefer to send your form—via email, text message (SMS), invitation link, or download it on your PC.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Modify and eSign Enrollment Form USAble Mutual Insurance Company to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a usable mutual insurance company?

A usable mutual insurance company is a type of insurer that is owned by its policyholders, providing them with a democratic stake in the company. This model often results in lower premiums and higher customer satisfaction, as profits are returned to policyholders rather than distributed to shareholders. Understanding this term can help you evaluate your insurance options more effectively.

-

How do I choose a usable mutual insurance company?

When selecting a usable mutual insurance company, consider factors such as financial stability, customer reviews, and the range of coverage options offered. Researching the company's history and how they handle claims can also provide insight into their reliability. Comprehensive comparisons can lead you to the best choice for your insurance needs.

-

What are the benefits of using a usable mutual insurance company?

The benefits of using a usable mutual insurance company include potential cost savings, as profits are shared among policyholders, and personalized customer care since the focus is on member needs. Additionally, these companies typically have a strong commitment to community and customer engagement, contributing to a sense of trust and satisfaction among clients.

-

Are premiums different at a usable mutual insurance company compared to traditional insurers?

Yes, premiums at a usable mutual insurance company can differ from those of traditional insurers. Generally, they tend to be lower since mutual companies do not have to pay dividends to shareholders, allowing them to return savings to members. Comparing quotes can help you find the most cost-effective option for your coverage needs.

-

What features should I look for in a usable mutual insurance company?

Key features to look for in a usable mutual insurance company include flexible policy options, robust claims support, and a transparent approach to handling member inquiries and claims. Additionally, consider how user-friendly their online platforms are for managing your policies and accessing account information. These features can enhance your overall experience.

-

Can I integrate digital signature solutions with a usable mutual insurance company?

Yes, many usable mutual insurance companies now offer integrations with digital signature solutions like airSlate SignNow. This functionality can streamline the process of signing documents securely and efficiently, which is particularly beneficial for busy professionals. Digital integrations enhance your overall user experience and accessibility.

-

How does a usable mutual insurance company support customer claims?

Customer claims support at a usable mutual insurance company typically includes dedicated assistance and thorough guidance throughout the claim process. Many companies prioritize timely responses and transparent communication to ensure a smooth experience. Accessing customer support through multiple channels, including chat and phone, can further enhance assistance.

Get more for Enrollment Form USAble Mutual Insurance Company

- However with divorce on the rise form

- Type names of designated persons form

- Missouri last will and testament make a last will in missouri form

- Missouri passed away on form

- Stock certificates form

- With the terms of the will and laws of the state of missouri in reference to the procedures and form

- Tc memo 2017 62 united states tax court vincent j form

- In the municipal court of name of city form

Find out other Enrollment Form USAble Mutual Insurance Company

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit