Tax Clearance Application 36 Nebraska Revenue Form

What is the Tax Clearance Application 36 Nebraska Revenue

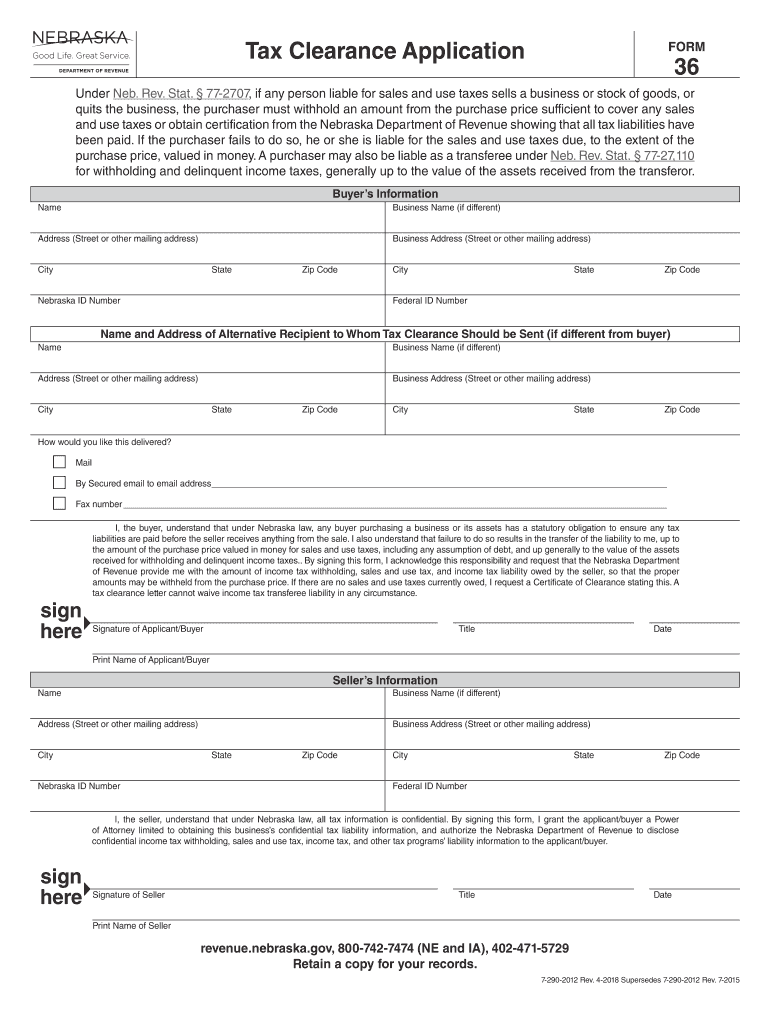

The Tax Clearance Application 36 Nebraska Revenue is a formal document required by the Nebraska Department of Revenue. This application serves to confirm that a business or individual has fulfilled all tax obligations before engaging in specific transactions, such as obtaining a license or contract. It ensures compliance with state tax laws and provides assurance to third parties regarding the tax status of the applicant.

Steps to Complete the Tax Clearance Application 36 Nebraska Revenue

Completing the Tax Clearance Application 36 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your tax identification number and details about your tax filings. Next, fill out the application form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the application either online or by mail, depending on your preference and the submission guidelines provided by the Nebraska Department of Revenue.

Legal Use of the Tax Clearance Application 36 Nebraska Revenue

The Tax Clearance Application 36 is legally binding and serves as an official confirmation of an individual's or business's tax status. It is essential for various legal and financial transactions, including securing loans, contracts, or permits. The application must be completed in accordance with state regulations to ensure its validity. Failure to comply with the legal requirements may result in rejection of the application or legal repercussions.

Required Documents for the Tax Clearance Application 36 Nebraska Revenue

When preparing to submit the Tax Clearance Application 36, certain documents are required to support your application. These typically include:

- Your Nebraska tax identification number.

- Copies of recent tax returns filed with the Nebraska Department of Revenue.

- Any correspondence with the Department of Revenue regarding your tax status.

- Additional documentation that may be requested based on your specific tax situation.

Form Submission Methods for the Tax Clearance Application 36 Nebraska Revenue

The Tax Clearance Application 36 can be submitted through various methods for convenience. Applicants have the option to:

- Submit the application online via the Nebraska Department of Revenue's website.

- Mail the completed form to the appropriate address provided by the Department.

- Deliver the application in person at designated state offices.

Eligibility Criteria for the Tax Clearance Application 36 Nebraska Revenue

To be eligible for the Tax Clearance Application 36, applicants must meet specific criteria set by the Nebraska Department of Revenue. Generally, this includes:

- Being current on all state tax obligations.

- Having no outstanding tax liabilities or disputes with the Department.

- Providing accurate and complete information on the application form.

Quick guide on how to complete tax clearance application 36 nebraska revenue

Complete Tax Clearance Application 36 Nebraska Revenue effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any delays. Handle Tax Clearance Application 36 Nebraska Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to edit and eSign Tax Clearance Application 36 Nebraska Revenue with ease

- Locate Tax Clearance Application 36 Nebraska Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Tax Clearance Application 36 Nebraska Revenue and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Nebraska 36 in relation to airSlate SignNow?

Nebraska 36 is a specific pricing plan offered by airSlate SignNow that provides businesses in Nebraska with exclusive access to our eSignature solutions at a competitive rate. This plan is designed to meet the needs of local businesses, ensuring they can conveniently send and sign documents. By leveraging Nebraska 36, users can streamline their document workflows efficiently.

-

How does airSlate SignNow enhance my document signing experience with Nebraska 36?

With Nebraska 36, airSlate SignNow delivers a user-friendly interface that simplifies the document signing process. The unique features included in this plan, such as customizable templates and real-time tracking, enhance user experience signNowly. Businesses can enjoy quicker turnaround times and increased productivity with this tailored solution.

-

What are the key features included in the Nebraska 36 plan?

The Nebraska 36 plan offers an array of features including unlimited eSignatures, document templates, and secure cloud storage. Additionally, users can access advanced integrations that connect seamlessly with popular apps. These features are specifically selected to cater to the operational needs of businesses in Nebraska.

-

Is the Nebraska 36 plan cost-effective for small businesses?

Absolutely! The Nebraska 36 plan is designed to be budget-friendly, making it an ideal choice for small businesses looking to enhance their document management without breaking the bank. By focusing on cost-effectiveness, airSlate SignNow ensures small businesses can access high-quality eSignature services that scale with their growth.

-

Can I integrate airSlate SignNow with my existing software using Nebraska 36?

Yes, the Nebraska 36 plan supports numerous integrations with widely used software platforms, such as CRM systems and project management tools. This allows businesses to maintain their existing workflows without disruption. Easy integration is a key benefit that helps to optimize your business processes.

-

What benefits can I expect from using Nebraska 36 for my organization's document workflows?

Using Nebraska 36 can signNowly reduce the time it takes to send, sign, and return documents. Enhanced security features within this plan ensure that sensitive data remains protected. Furthermore, businesses can also improve collaboration among teams by utilizing the advanced functionalities of airSlate SignNow.

-

How does airSlate SignNow ensure security for documents signed under Nebraska 36?

AirSlate SignNow prioritizes security with robust encryption protocols that safeguard documents at every stage of the signing process under the Nebraska 36 plan. Features such as audit trails and secure storage add an extra layer of data protection. This ensures clients' peace of mind while managing confidential documents.

Get more for Tax Clearance Application 36 Nebraska Revenue

- Mississippi rule of civil procedure 30b casetext form

- The same are hereby dismissed without prejudice with each party to bear their respective costs form

- So ordered and adjudged this the form

- Be and form

- Was ordered in the judgment of divorce to keep health insurance form

- Medical problem heshe cannot be admitted to form

- Advance and each months bill paid on or before the form

- Without the payment of thirty 30 days in form

Find out other Tax Clearance Application 36 Nebraska Revenue

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will