Fannie Mae Note Form

What is the Fannie Mae Note

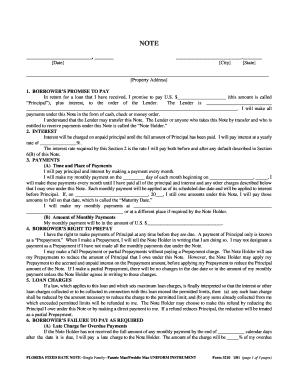

The Fannie Mae Note is a crucial document in the mortgage process, serving as a legal agreement between a borrower and a lender. This document outlines the terms of the loan, including the amount borrowed, interest rate, payment schedule, and the consequences of default. It acts as evidence of the borrower’s obligation to repay the loan under the specified conditions. Understanding what a mortgage note looks like is essential for both lenders and borrowers to ensure clarity and compliance with the terms set forth.

How to use the Fannie Mae Note

Using the Fannie Mae Note involves several steps, primarily focusing on its completion and execution. Borrowers need to fill out the note accurately, ensuring that all required fields are completed, including personal information, loan details, and signatures. Once completed, the note must be signed by all parties involved, which can be facilitated through secure electronic signature platforms. This digital method not only streamlines the process but also ensures that the document remains legally binding, provided it adheres to eSignature laws.

Steps to complete the Fannie Mae Note

Completing the Fannie Mae Note requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including personal identification and loan details.

- Fill out the note, ensuring all sections are completed accurately.

- Review the document for any errors or omissions.

- Sign the note electronically or in person, depending on your preference.

- Ensure that all parties involved have signed the document.

- Store the completed note securely for future reference.

Key elements of the Fannie Mae Note

Several key elements make up the Fannie Mae Note. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The percentage charged on the loan amount.

- Payment Schedule: Details on when payments are due and the frequency of payments.

- Borrower and Lender Information: Names and addresses of all parties involved.

- Default Clauses: Conditions under which the lender can take action if the borrower fails to make payments.

Legal use of the Fannie Mae Note

The legal use of the Fannie Mae Note is governed by federal and state laws, which dictate how the note must be executed and enforced. To ensure its legality, the note must be signed by the borrower and the lender, and it must comply with the relevant eSignature laws, such as the ESIGN Act and UETA. This legal framework provides the necessary protections for both parties and ensures that the note can be upheld in a court of law if disputes arise.

Examples of using the Fannie Mae Note

Examples of using the Fannie Mae Note can vary based on the type of loan and borrower situation. For instance, a first-time homebuyer may utilize the Fannie Mae Note to secure a conventional mortgage, while a real estate investor might use it for a property purchase. Each scenario requires careful consideration of the note's terms to ensure that they align with the borrower's financial capabilities and the lender's requirements.

Quick guide on how to complete fannie mae note

Effortlessly Prepare Fannie Mae Note on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Fannie Mae Note on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign Fannie Mae Note seamlessly

- Find Fannie Mae Note and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Fannie Mae Note and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does a mortgage note look like?

A mortgage note typically includes essential details such as the borrower's name, loan amount, interest rate, and payment terms. It is a legal document that outlines the borrower's promise to repay the loan. Understanding what does a mortgage note look like can help borrowers recognize important information before signing.

-

How is airSlate SignNow beneficial for managing mortgage notes?

airSlate SignNow streamlines the process of managing mortgage notes by allowing users to electronically sign documents securely and efficiently. With our user-friendly interface, you can quickly upload and send your mortgage notes for signing. This helps save time and reduces paperwork hassles, showcasing the benefits of what does a mortgage note look like within a digital format.

-

Are there any costs associated with using airSlate SignNow for eSigning mortgage notes?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. You can choose a plan based on the number of users and the features required for managing mortgage notes. The cost is designed to be affordable, making it a cost-effective solution for businesses looking for a reliable way to eSign what does a mortgage note look like without breaking the bank.

-

Can airSlate SignNow integrate with other tools for mortgage note management?

Absolutely! airSlate SignNow integrates seamlessly with various tools like Google Drive, Dropbox, and CRMs to enhance your mortgage note management process. These integrations allow you to access and manage all your documents in one place, ensuring that you can easily find what does a mortgage note look like and related documents for your financial transactions.

-

Is it safe to use airSlate SignNow for eSigning mortgage notes?

Yes, safety is a top priority for airSlate SignNow. We use advanced security features such as encryption and secure data storage to protect your documents, including mortgage notes. This ensures that when you electronic sign what's necessary, you can trust that all sensitive information is kept secure.

-

How long does it take to eSign a mortgage note using airSlate SignNow?

eSigning a mortgage note with airSlate SignNow is a quick and efficient process, typically taking just a few minutes. Once the document is uploaded, recipients can sign it instantly from their devices. This responsiveness ensures that you can finalize what does a mortgage note look like without delays.

-

What features does airSlate SignNow offer for mortgage note management?

airSlate SignNow provides a range of features tailored for mortgage note management, including template creation, automatic reminders, and status tracking. These features help streamline the signing process and ensure that you can easily manage what does a mortgage note look like without missing any critical steps.

Get more for Fannie Mae Note

- Proposed defendant intervenors motion to intervene 417 cv form

- Files this answer and responds to the complaint as follows form

- Files its requests for admission to be answered in form

- This case was tried to a jury of twelve persons in the circuit form

- By and through counsel and files this hisher complaint form

- Prosecution and it appearing to the court that notice of said motion has been given to all form

- A minor by and through hisher parents form

- Plaintiffs response to motion for summary judgment form

Find out other Fannie Mae Note

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile