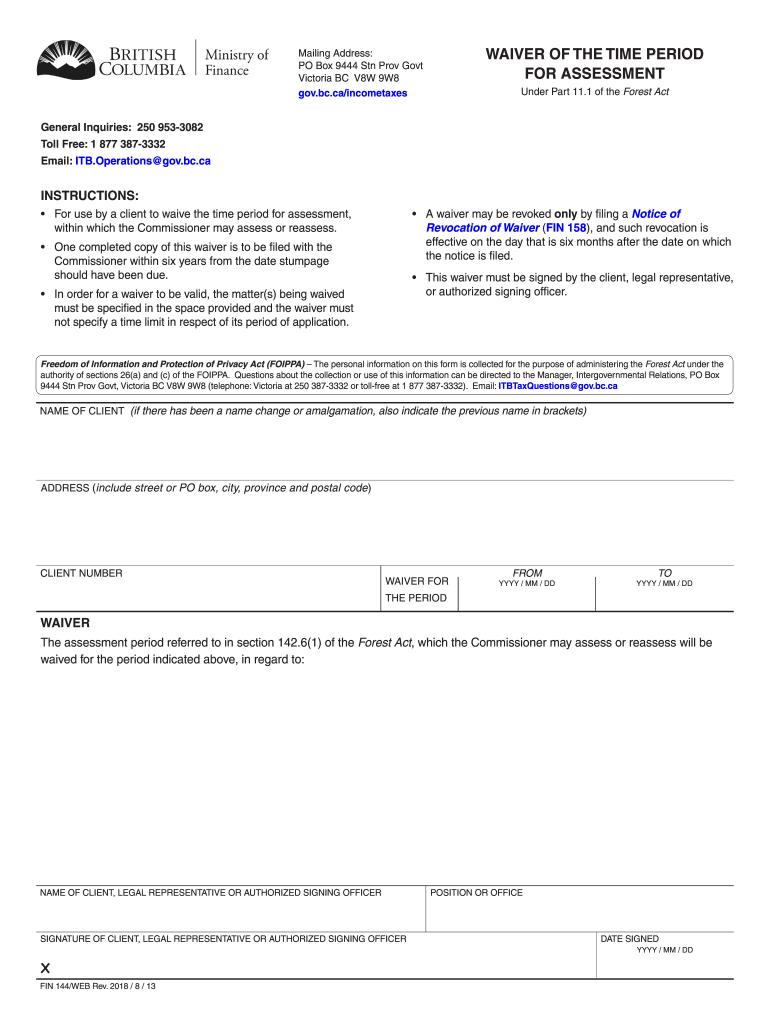

Form 144 This Form is Completed by a Taxpayer to Waive the Time Period for Assessment, as Described in Section 142 61, within Wh

Understanding Indiana Oversize Permits

Indiana oversize permits are essential for vehicles that exceed the standard size and weight limits set by the state. These permits ensure that oversized loads can travel safely on public roads while complying with local regulations. Obtaining an oversize permit is crucial for businesses and individuals who need to transport large equipment or materials across Indiana. The process is designed to minimize road damage and enhance safety for all road users.

Steps to Obtain Indiana Oversize Permits Online

To obtain an Indiana oversize permit online, follow these steps:

- Visit the official Indiana Department of Transportation (INDOT) website.

- Navigate to the oversize/overweight permits section.

- Fill out the online application form with accurate vehicle and load details.

- Submit the application along with any necessary documentation, such as proof of insurance.

- Pay the required fee using a secure online payment method.

- Receive your permit via email or download it directly from the website.

Key Information Required for the Application

When applying for an Indiana oversize permit online, certain information is required:

- Vehicle identification details, including make, model, and license plate number.

- Dimensions of the load, including height, width, and length.

- Weight of the load, as well as axle configurations.

- Route details, including starting and ending points.

- Contact information for the applicant or company.

Legal Considerations for Indiana Oversize Permits

It is important to understand the legal implications of operating an oversize vehicle in Indiana. Without the appropriate permit, operators may face fines, penalties, or even legal action. The permit serves as a legal authorization to transport oversized loads, ensuring compliance with state laws. Additionally, operators must adhere to specific routing requirements and travel restrictions, especially during certain hours or in adverse weather conditions.

Penalties for Non-Compliance

Failing to obtain an Indiana oversize permit can result in significant penalties. These may include:

- Fines that vary based on the severity of the violation.

- Impoundment of the vehicle until compliance is achieved.

- Increased insurance premiums due to non-compliance incidents.

Ensuring that all necessary permits are secured before transport is essential to avoid these consequences.

Benefits of Using Digital Solutions for Permit Applications

Utilizing digital solutions for applying for Indiana oversize permits offers several advantages:

- Convenience of applying from anywhere at any time.

- Faster processing times compared to traditional methods.

- Reduced paperwork and storage needs.

- Immediate access to permits upon approval.

These benefits streamline the process for businesses and individuals, making compliance easier and more efficient.

Quick guide on how to complete form 144 this form is completed by a taxpayer to waive the time period for assessment as described in section 14261 within

Effortlessly Prepare Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without any delays. Manage Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh with ease

- Acquire Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 144 this form is completed by a taxpayer to waive the time period for assessment as described in section 14261 within

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What are Indiana oversize permits online, and why are they necessary?

Indiana oversize permits online are essential documents required for vehicles that exceed standard size limits while traveling on public roads. These permits ensure that oversized loads comply with state regulations to avoid fines and ensure road safety. Obtaining them online simplifies the process, making it quicker and more efficient.

-

How do I apply for Indiana oversize permits online?

To apply for Indiana oversize permits online, you need to visit the official airSlate SignNow platform and follow the guided application process. You'll be required to provide information about your vehicle and the dimensions of your load. The online application is designed to be user-friendly, allowing for fast submissions.

-

What is the cost of Indiana oversize permits online?

The cost of Indiana oversize permits online varies based on the size and type of the vehicle as well as the specific permit requirements. Typically, airSlate SignNow offers competitive pricing that can help keep your expenses in check. Make sure to check the pricing details during your application process.

-

What features does airSlate SignNow offer for obtaining Indiana oversize permits online?

airSlate SignNow provides a seamless interface for obtaining Indiana oversize permits online, including instant access to templates, e-signature capabilities, and tracking options. These features streamline the process, allowing for efficient management of your permits and associated documents all in one place.

-

Are there any benefits to using airSlate SignNow for Indiana oversize permits online?

Using airSlate SignNow for Indiana oversize permits online offers numerous benefits, such as time savings and a simplified process. The ability to manage your documents digitally reduces paperwork and increases efficiency in obtaining the necessary permits. Additionally, you can access your permits anytime, ensuring you're always compliant.

-

Can I renew my Indiana oversize permits online through airSlate SignNow?

Yes, airSlate SignNow allows users to easily renew their Indiana oversize permits online. The platform provides reminders and a straightforward process for renewals, helping you stay compliant without unnecessary delays. Simply log in to your account and follow the renewal steps to ensure you are always up to date.

-

Is there customer support available for Indiana oversize permits online?

Absolutely! airSlate SignNow offers dedicated customer support for any queries related to Indiana oversize permits online. You can signNow out to our support team through chat, email, or phone. We're here to assist you with any challenges you might face during the permitting process.

Get more for Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh

- Insurance contractor shall maintain general liability and workers compensation as well as form

- Kitchen vent form

- Made without breach of the contract pending payment or resolution of any dispute form

- Progress payments form

- Water drainage form

- Owner agrees form

- To pay a late charge of 1 of all payments that are more than ten 10 days late plus interest at the form

- Subfloor material form

Find out other Form 144 This Form Is Completed By A Taxpayer To Waive The Time Period For Assessment, As Described In Section 142 61, Within Wh

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF