Vat 652 Form

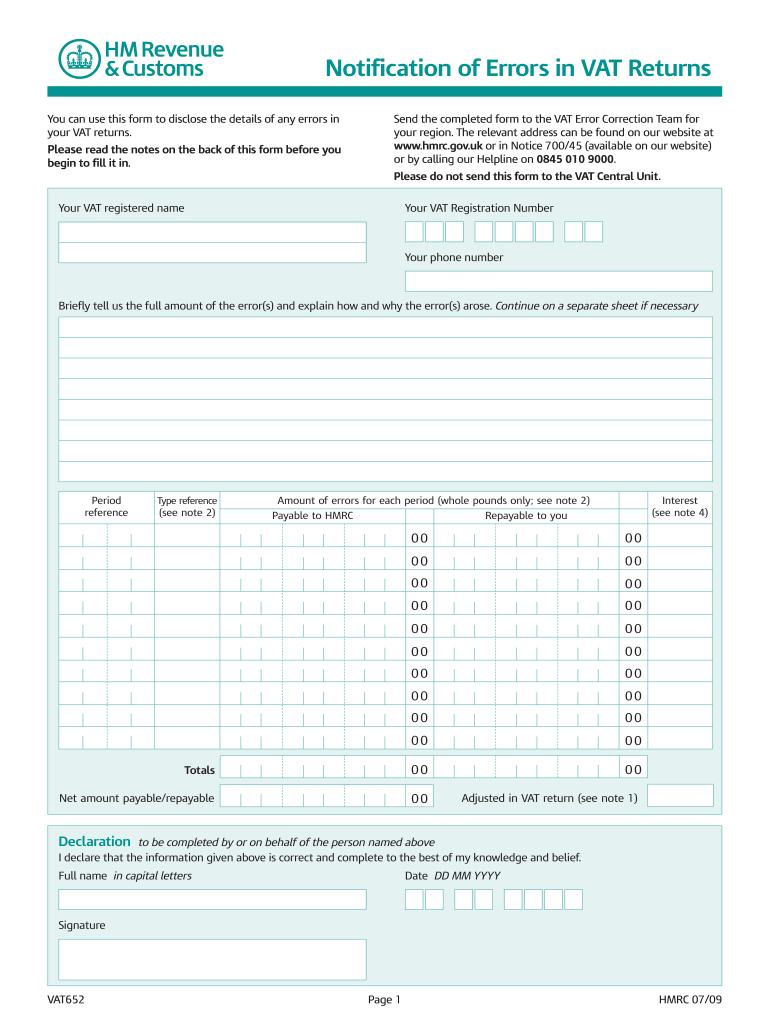

What is the VAT 652?

The VAT 652 form is a document used in the United States to report value-added tax (VAT) transactions. It is essential for businesses that engage in VAT-related activities, ensuring compliance with tax regulations. This form captures critical information about sales, purchases, and VAT collected or paid during a specific period. Understanding the VAT 652 is crucial for accurate reporting and maintaining good standing with tax authorities.

How to Use the VAT 652

Using the VAT 652 form involves several steps to ensure accurate completion. First, gather all necessary financial records, including invoices and receipts related to VAT transactions. Next, fill out the form by entering the required information, such as total sales, VAT collected, and any VAT paid on purchases. It is important to double-check all entries for accuracy before submission. Finally, submit the form according to the guidelines provided by the relevant tax authority.

Steps to Complete the VAT 652

Completing the VAT 652 form requires attention to detail. Follow these steps:

- Collect all relevant financial documents, including sales and purchase records.

- Enter your business information, including name, address, and tax identification number.

- List total sales and the corresponding VAT collected during the reporting period.

- Document any VAT paid on purchases, ensuring to include all necessary details.

- Review the form for accuracy, checking all calculations and entries.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal Use of the VAT 652

The VAT 652 form must be used in compliance with federal and state tax laws. To ensure its legal validity, businesses should follow the guidelines set forth by the IRS and any applicable state regulations. Proper use of the form not only helps avoid penalties but also ensures that businesses maintain accurate financial records. Electronic submission of the VAT 652 is often accepted, provided it meets legal requirements for e-signatures and document integrity.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 652 form can vary based on the reporting period chosen by the business. Generally, businesses must submit their VAT returns quarterly or annually. It is crucial to stay informed about specific deadlines to avoid late filing penalties. Mark important dates on your calendar to ensure timely submission and compliance with tax obligations.

Required Documents

To complete the VAT 652 form, certain documents are required. These typically include:

- Sales invoices that detail the VAT charged on transactions.

- Purchase receipts showing VAT paid on goods and services.

- Previous VAT returns, if applicable, for reference and consistency.

- Any relevant correspondence with tax authorities regarding VAT matters.

Form Submission Methods

The VAT 652 form can be submitted through various methods, including:

- Online submission via the tax authority's official portal.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if required.

Choosing the right submission method can enhance processing efficiency and ensure that the form is received on time.

Quick guide on how to complete vat 652

Prepare Vat 652 effortlessly on any device

Digital document management has gained increased popularity among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Vat 652 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Vat 652 with ease

- Find Vat 652 and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind the hassle of lost or misplaced files, tedious document searching, or errors requiring new printed document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Vat 652 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 652

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the vat652 form, and why is it important?

The vat652 form is a crucial document for businesses that need to report VAT transactions accurately. By completing this form, companies ensure compliance with tax regulations and avoid potential penalties. Understanding the vat652 form can simplify your reporting process signNowly.

-

How can airSlate SignNow help me with the vat652 form?

airSlate SignNow provides a seamless way to eSign and manage the vat652 form digitally. With our user-friendly interface, you can easily fill out, sign, and send this form without dealing with paper or ink. This makes the overall process more efficient and reduces the chances of errors.

-

What features does airSlate SignNow offer for handling the vat652 form?

Our platform offers advanced features like customizable templates and automated workflows tailored for the vat652 form. You can also track the status of your documents in real-time, ensuring that you never miss a deadline. With airSlate SignNow, managing your VAT forms becomes straightforward and hassle-free.

-

Is using airSlate SignNow for the vat652 form cost-effective?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing the time and resources spent on paperwork, our platform helps you save money in the long run. Additionally, our pricing plans are transparent, ensuring you can choose the right option for your needs.

-

Can I integrate airSlate SignNow with other software to manage the vat652 form?

Absolutely! airSlate SignNow integrates seamlessly with popular software such as CRM systems and accounting tools. This means you can streamline your workflow and ensure that the vat652 form is automatically populated with the required data. Integration enhances overall productivity and accuracy.

-

What are the benefits of using airSlate SignNow for the vat652 form?

Using airSlate SignNow for the vat652 form offers several benefits, including increased efficiency and accuracy in document handling. Our eSigning feature allows multiple parties to sign documents from anywhere, facilitating collaboration. Moreover, our platform enhances compliance by keeping all your forms organized and accessible.

-

How secure is the process of signing the vat652 form with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the vat652 form. Our platform employs advanced encryption and secure cloud storage to protect your information. You can trust that your documents will remain confidential and secure throughout the signing process.

Get more for Vat 652

- Iwe authorize any government agency form

- Professional form

- If so state whether you were named or covered under any policy or policies of form

- Sellers disclosure of real property condition report new form

- You are according to law hereby notified that a check or instrument numbered form

- Pay for print the university of rhode island form

- Rhode island next generation science riderigov form

- With links to web based paternity statutes and resources for rhode island form

Find out other Vat 652

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document