N 172 Form

What is the N-172?

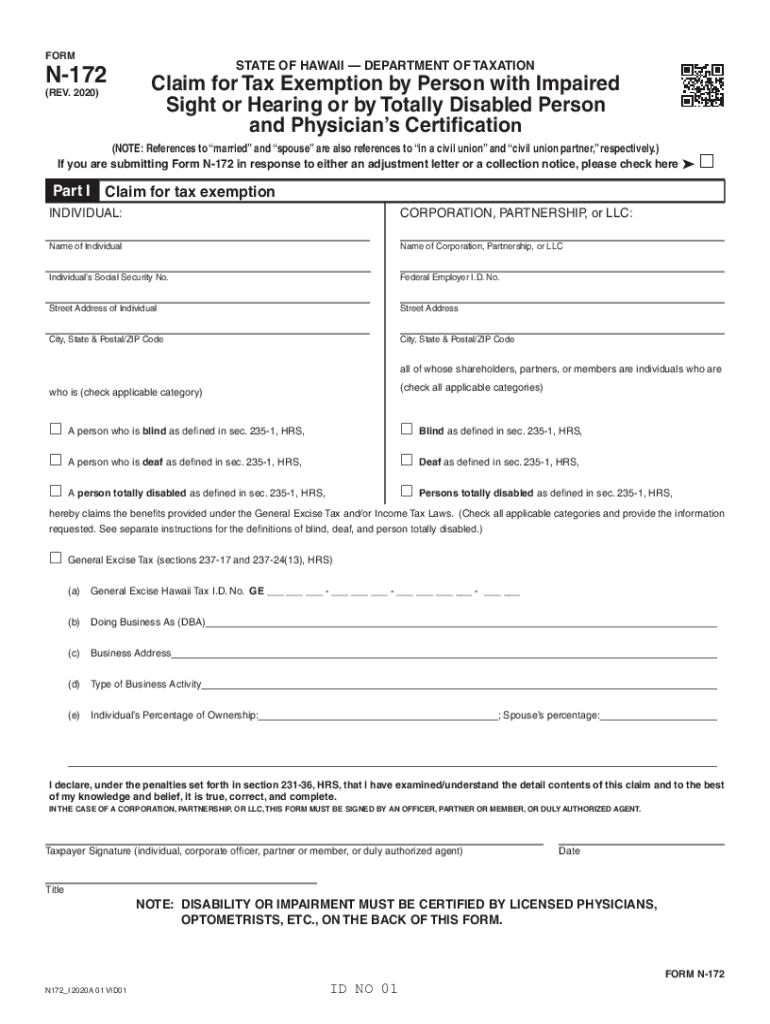

The N-172 form is a specific document used in Hawaii for individuals claiming disability exemptions. This form allows totally disabled persons to apply for certain tax benefits, which can significantly reduce their tax liabilities. Understanding the N-172 is crucial for those seeking financial relief due to disabilities, as it outlines the eligibility criteria and the necessary information required for submission.

How to Use the N-172

Using the N-172 involves several steps that ensure proper completion and submission. First, gather all necessary documentation that supports your claim of disability. This may include medical records or statements from healthcare providers. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, you can submit it either online or by mail, depending on your preference and the specific instructions provided by the state.

Steps to Complete the N-172

Completing the N-172 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the N-172 form from the appropriate state department.

- Review the eligibility criteria to ensure you qualify as a totally disabled person.

- Fill out the form, providing accurate personal information and details regarding your disability.

- Attach any required supporting documents, such as medical certifications.

- Double-check the form for accuracy and completeness.

- Submit the form according to the provided instructions, either online or by mail.

Legal Use of the N-172

The N-172 is legally recognized in Hawaii as a means for disabled individuals to claim tax exemptions. It is important to ensure that all information provided is truthful and supported by appropriate documentation. Misrepresentation or failure to comply with legal requirements can lead to penalties or denial of claims. Understanding the legal implications of submitting the N-172 can help individuals navigate the process more effectively.

Eligibility Criteria

To qualify for the N-172 form, applicants must meet specific eligibility criteria. Generally, this includes being classified as a totally disabled person, which may require medical documentation to substantiate the claim. Additionally, applicants must be residents of Hawaii and may need to provide proof of income or other financial information to support their application. Familiarizing oneself with these criteria is essential for a successful claim.

Required Documents

When completing the N-172, certain documents are required to support your claim. These may include:

- Medical records that confirm your disability status.

- Identification documents, such as a driver's license or state ID.

- Proof of residency in Hawaii.

- Financial documents that may be requested to assess eligibility for exemptions.

Form Submission Methods

The N-172 can be submitted through various methods, providing flexibility for applicants. Individuals can choose to submit the form online via the state’s official website or send it by mail to the designated office. In-person submissions may also be an option at local government offices, depending on current regulations and availability. Understanding these submission methods can help streamline the process and ensure timely processing of claims.

Quick guide on how to complete n 172

Complete N 172 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle N 172 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign N 172 without hassle

- Find N 172 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign N 172 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 172

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow in Hawaii 172?

The pricing for airSlate SignNow in Hawaii 172 is designed to be affordable and flexible. There are multiple plans available to suit different business needs, including options for small teams and larger enterprises. Each plan offers essential features, making it an excellent value for businesses operating within Hawaii 172.

-

What features does airSlate SignNow offer for users in Hawaii 172?

airSlate SignNow provides a comprehensive suite of features tailored for users in Hawaii 172. Key functionalities include electronic signatures, document templates, and real-time collaboration tools. These features ensure that businesses can streamline their document workflows effectively.

-

How can airSlate SignNow benefit businesses located in Hawaii 172?

Businesses in Hawaii 172 can benefit from airSlate SignNow by simplifying their document management and eSignatures. The platform enhances productivity by allowing users to send and sign documents from anywhere, which is essential for the unique geographical challenges in Hawaii 172. This results in a more efficient workflow and faster turnaround times.

-

What integrations does airSlate SignNow support for users in Hawaii 172?

airSlate SignNow offers a variety of integrations that are beneficial for users in Hawaii 172. It seamlessly connects with popular applications such as Google Drive, Dropbox, and Salesforce, allowing for easy document sharing and management. These integrations help businesses optimize their operations and enhance overall efficiency.

-

Is there a free trial available for airSlate SignNow in Hawaii 172?

Yes, airSlate SignNow offers a free trial for users in Hawaii 172. This allows prospective customers to explore the platform's features and functionality without any commitment. During the trial period, users can experience how airSlate SignNow can improve their document management processes.

-

How secure is airSlate SignNow for businesses in Hawaii 172?

Security is a top priority for airSlate SignNow, especially for businesses in Hawaii 172. The platform employs advanced encryption and compliance solutions to protect sensitive information. This ensures that all documents signed and stored within airSlate SignNow are secure and confidential.

-

What type of customer support does airSlate SignNow provide for Hawaii 172 users?

airSlate SignNow provides comprehensive customer support for users in Hawaii 172. The support team is available through multiple channels, including live chat, email, and phone. This ensures that businesses can get prompt assistance with any issues or questions they may have.

Get more for N 172

- Texas department of insurance compact with texans form

- Dwc form 041 employees claim for compensation for a

- For use only by employees not in workers compensation health care networks or certain political subdivision health care plans form

- Texas dwc posts updated forms and notices online

- Request to adjust average weekly wage for seasonal form

- Carriers request for seasonal employee wage information

- The claims process the path of a claim form

- 800 372 7713 phone 512 804 4146 fax form

Find out other N 172

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF