MC 52, Request and Writ for Garnishment Income Tax Refund Form

What is the MC 52, Request and Writ for Garnishment Income Tax Refund

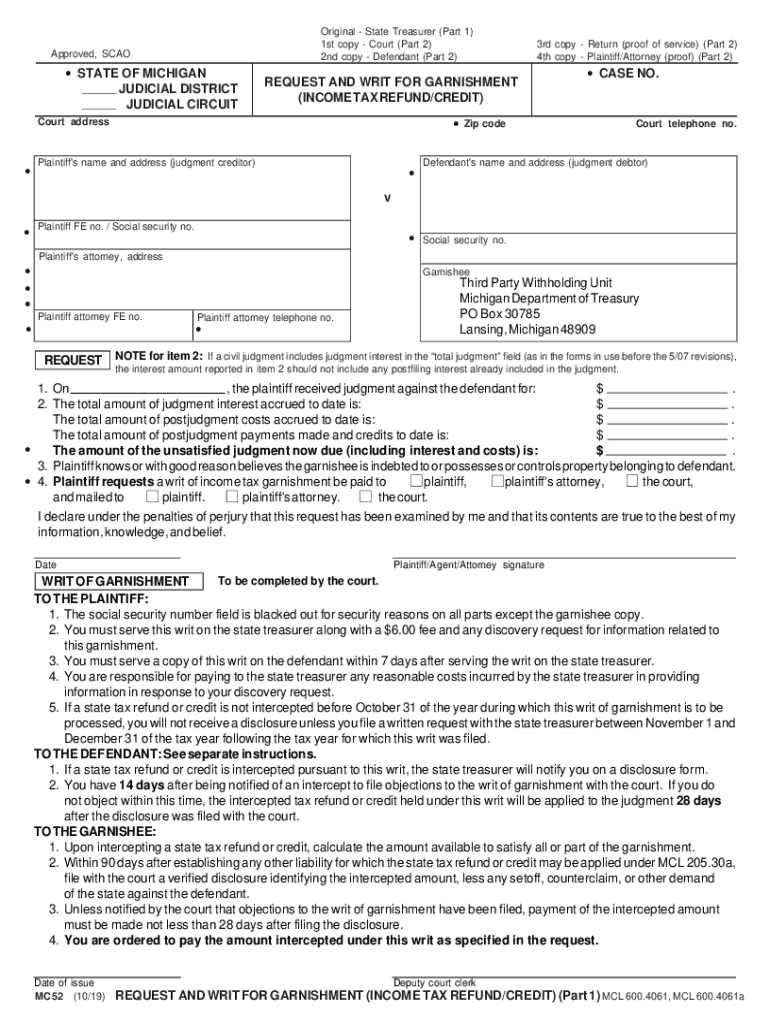

The MC 52, also known as the Request and Writ for Garnishment Income Tax Refund, is a legal document used in Michigan to initiate the garnishment of an individual's income tax refund. This form is typically utilized by creditors seeking to collect debts owed by the taxpayer. The MC 52 outlines the necessary information regarding the creditor, the debtor, and the amount owed, allowing the court to process the garnishment request effectively. Understanding this form is essential for both creditors and debtors to navigate the garnishment process legally and efficiently.

How to use the MC 52, Request and Writ for Garnishment Income Tax Refund

Using the MC 52 involves several steps to ensure proper completion and submission. First, gather all relevant information about the debtor, including their name, address, and the amount owed. Next, fill out the form accurately, ensuring that all details are correct to avoid delays. After completing the form, it must be filed with the appropriate court. It's important to follow up with the court to confirm that the garnishment has been processed. Utilizing a digital solution like signNow can simplify this process by allowing for electronic signatures and secure document storage.

Steps to complete the MC 52, Request and Writ for Garnishment Income Tax Refund

Completing the MC 52 requires careful attention to detail. Follow these steps:

- Obtain the MC 52 form, which can be downloaded from official court websites or legal resources.

- Provide your information as the creditor, including your name, address, and contact details.

- Enter the debtor's information accurately, including their full name and address.

- Specify the amount owed and any relevant case numbers.

- Sign the form to certify that the information provided is true and accurate.

- Submit the completed form to the appropriate court for processing.

Legal use of the MC 52, Request and Writ for Garnishment Income Tax Refund

The legal use of the MC 52 is governed by Michigan law, which outlines the circumstances under which garnishment can be pursued. Creditors must ensure that they are compliant with all legal requirements when filing this form. This includes providing accurate information and following proper procedures to avoid potential legal repercussions. The court will review the request to determine if it meets the necessary criteria for garnishment, ensuring that the rights of the debtor are also considered.

Key elements of the MC 52, Request and Writ for Garnishment Income Tax Refund

Several key elements must be included in the MC 52 for it to be valid:

- Creditor Information: Details about the creditor, including name and contact information.

- Debtor Information: Full name and address of the debtor.

- Amount Owed: The total amount that is being claimed through garnishment.

- Case Number: Any relevant case numbers associated with the debt.

- Signature: The creditor's signature to affirm the accuracy of the information.

Eligibility Criteria for the MC 52, Request and Writ for Garnishment Income Tax Refund

To utilize the MC 52, certain eligibility criteria must be met. The creditor must have a valid judgment against the debtor, confirming that the debtor owes a specific amount. Additionally, the debtor must be eligible for a tax refund that can be garnished. It is essential for creditors to verify these criteria before submitting the MC 52 to ensure compliance with legal standards and to facilitate a smoother garnishment process.

Quick guide on how to complete mc 52 request and writ for garnishment income tax refund

Effortlessly Prepare MC 52, Request And Writ For Garnishment Income Tax Refund on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and seamlessly. Manage MC 52, Request And Writ For Garnishment Income Tax Refund on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to Modify and eSign MC 52, Request And Writ For Garnishment Income Tax Refund with Ease

- Locate MC 52, Request And Writ For Garnishment Income Tax Refund and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to store your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign MC 52, Request And Writ For Garnishment Income Tax Refund to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mc 52 request and writ for garnishment income tax refund

The best way to create an e-signature for a PDF in the online mode

The best way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a mi request garnishment?

A mi request garnishment is a legal document used to collect debts by garnishing an individual's wages or bank accounts. Understanding this process is crucial, and with tools like airSlate SignNow, you can easily create, sign, and manage these documents securely.

-

How can airSlate SignNow assist with mi request garnishment?

airSlate SignNow offers a streamlined process for preparing and signing mi request garnishment documents. Our platform simplifies electronic signatures, making it faster and more efficient for businesses to handle garnishments and other legal paperwork.

-

What are the pricing options for airSlate SignNow?

Our pricing for airSlate SignNow is competitive and tailored to fit various business sizes and needs. We offer flexible plans that allow organizations to manage their mi request garnishment processes without breaking the bank, ensuring cost-effectiveness.

-

Are there any specific features for handling mi request garnishment?

Yes, airSlate SignNow includes features like customizable templates for mi request garnishment documents, secure storage, and tracking capabilities. These features ensure that you can handle garnishments efficiently while maintaining compliance with legal standards.

-

Can airSlate SignNow integrate with other systems for mi request garnishment?

Absolutely! airSlate SignNow supports integrations with various software platforms, enhancing your workflow for managing mi request garnishment. This functionality allows for seamless data transfer and improves overall efficiency in document handling.

-

What benefits does airSlate SignNow provide for mi request garnishment processes?

Using airSlate SignNow for mi request garnishment processes offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our solution empowers businesses to manage their garnishment tasks effortlessly while ensuring compliance and prompt action.

-

Is airSlate SignNow secure for handling legal documents like mi request garnishment?

Yes, security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and complies with legal standards to ensure that your mi request garnishment documents remain secure and confidential throughout the entire process.

Get more for MC 52, Request And Writ For Garnishment Income Tax Refund

- Establishing paternity custody parenting time and child support form

- Instructions for your hearing on the complaint for modification form

- Instructions for your modification of custody or parenting plan form

- Intrastate transfer form

- 6 144302 intrastate transfer of guardianship and conservatorship form

- Cc 613 revised 0115 form

- This worksheet is to assist you in gathering information needed to

- Master forms list page 2 nebraska judicial branch nebraskagov

Find out other MC 52, Request And Writ For Garnishment Income Tax Refund

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast